Global Higher Education M-Learning Market - Key Trends & Drivers Summarized

Is Mobile Learning Redefining How Students Experience Higher Education Today?

Mobile learning, often referred to as m-learning, is radically transforming the higher education landscape by providing students with flexible, on-demand access to educational content through smartphones, tablets, and other portable devices. In an age where learners are increasingly digital-native and time-constrained, the appeal of accessing lectures, assignments, collaboration tools, and assessments anytime and anywhere is undeniable. This shift has effectively untethered education from traditional classrooms and rigid schedules, creating more inclusive and self-directed learning environments. M-learning caters to the growing demand for personalized education pathways, allowing students to progress at their own pace while choosing content formats that align with their learning styles, whether video, audio, text, or interactive simulations. The rise in bring-your-own-device policies across university campuses has made it easier for students to integrate learning into their daily lives, whether commuting, working part-time, or balancing other responsibilities. Furthermore, educators are increasingly incorporating mobile apps, gamification elements, and adaptive learning platforms to improve engagement and retention. As higher education institutions strive to enhance student satisfaction and outcomes, m-learning is emerging not just as a convenience but as a pedagogical strategy that bridges traditional instruction with real-world mobility. This evolution is especially relevant in a post-pandemic world where hybrid and blended models are replacing the conventional semester-based frameworks. In short, mobile learning is no longer supplementary; it is fast becoming a core element of the modern higher education experience.How Are Educational Institutions Leveraging Technology to Expand the Scope of M-Learning?

Universities and colleges across the globe are actively investing in digital infrastructure and learning management systems to support and expand the scope of mobile learning. From cloud-based platforms to AI-driven tutoring systems, higher education institutions are deploying a wide range of tools that make learning more accessible, collaborative, and data-informed. These platforms often include features such as mobile-accessible libraries, real-time notifications, push assignments, and asynchronous discussion boards, ensuring that students stay connected and engaged regardless of their location. Interactive assessments and multimedia-rich course materials are being optimized for mobile viewing, encouraging deeper cognitive engagement compared to static, desktop-bound formats. Faculty development programs are being restructured to help instructors create content specifically designed for mobile consumption, ensuring that course design aligns with best practices in usability and instructional effectiveness. Partnerships with edtech firms and platform providers are also fueling this transformation, offering white-label solutions and analytics tools that give institutions detailed insights into student behavior and performance. These analytics can then inform curriculum adjustments and personalized support interventions. Furthermore, cloud integration is enabling seamless synchronization between devices, allowing students to start a lesson on one device and complete it on another without losing progress. As cybersecurity and data privacy concerns grow, institutions are also adopting secure authentication systems and encrypted content delivery to protect users and maintain academic integrity. All these developments are converging to create a robust ecosystem where m-learning is not just an add-on but a foundational pillar of higher education delivery.What Role Are Students' Evolving Expectations Playing in Driving M-Learning Adoption?

The growing adoption of m-learning in higher education is strongly influenced by the changing expectations and learning behaviors of students. Today's students are tech-savvy, multitasking, and accustomed to accessing information instantly through mobile devices. They value autonomy, immediacy, and interactivity in their learning journeys, which traditional lecture-based methods often fail to provide. Mobile learning aligns perfectly with these preferences by allowing students to engage with course material on their own terms, at their convenience, and often in more digestible micro-learning formats. The modern student is no longer confined to lecture halls and textbooks but instead seeks an integrated experience that combines academic content, peer collaboration, and real-world applications. Social learning features embedded in mobile platforms, such as forums, group chats, and peer assessments, add an interactive layer that enhances motivation and knowledge sharing. Moreover, mobile learning tools support inclusive education by providing flexible access for students with disabilities, students from remote areas, and working adults pursuing higher education. The integration of career planning, internships, and industry certifications within mobile platforms is also gaining traction, as students look for education that directly translates into employability. Institutions that recognize and respond to these expectations are more likely to retain students and improve academic performance. The feedback loop is becoming more student-centric, with mobile platforms capturing real-time opinions, course ratings, and learning analytics that influence instructional design. These shifts underscore how student expectations are no longer passive but are now actively shaping the evolution of educational delivery through mobile-first strategies.What Factors Are Driving the Global Expansion of M-Learning in Higher Education?

The growth in the higher education m-learning market is driven by a combination of technological, economic, institutional, and societal factors that are reshaping how knowledge is delivered and consumed. One of the key drivers is the widespread penetration of smartphones and mobile internet across both developed and emerging markets, making mobile access to education more feasible and affordable than ever before. The cost efficiency and scalability of mobile learning solutions are particularly attractive to institutions looking to expand their reach without the need for massive infrastructure investments. Government initiatives aimed at digital literacy and inclusive education are further supporting the rollout of mobile learning platforms across universities and colleges. Additionally, the increasing demand for lifelong learning and upskilling is pushing adult learners and working professionals toward mobile-first programs that fit their busy schedules. The global shift toward competency-based education and outcome-oriented learning models also aligns well with m-learning, which allows for personalized tracking and continuous assessment. Industry demand for tech-savvy graduates is prompting higher education institutions to adopt mobile tools that help students build not only academic knowledge but also digital fluency and adaptability. Strategic collaborations between academia and technology providers are driving innovation, with custom apps, gamified content, and AI-powered tutors becoming commonplace. Furthermore, the experience of remote learning during the pandemic has validated the efficacy of mobile platforms, encouraging their long-term integration into academic frameworks. As mobile devices become more powerful and learning content more interactive, the momentum behind m-learning in higher education is expected to continue accelerating, making it a cornerstone of future academic ecosystems.Report Scope

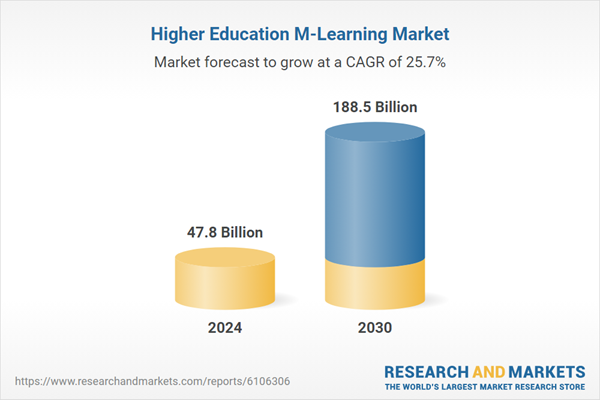

The report analyzes the Higher Education M-Learning market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Non-Learning Applications, Learning Applications); Course (Technical Courses, Non-Technical Courses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Non-Learning Application segment, which is expected to reach US$118.1 Billion by 2030 with a CAGR of a 23.4%. The Learning Application segment is also set to grow at 30.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $13 Billion in 2024, and China, forecasted to grow at an impressive 33.6% CAGR to reach $45.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Higher Education M-Learning Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Higher Education M-Learning Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Higher Education M-Learning Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Argon 18, Bianchi Bicycles, BMC Switzerland AG, Cannondale Bicycle Corporation, Colnago Ernesto & C. S.r.l. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Higher Education M-Learning market report include:

- 2U Inc.

- 360Learning

- Adobe Inc.

- Anthology (formerly Blackboard)

- Brightspace (D2L Corporation)

- Canvas (Instructure Inc.)

- Coursera, Inc.

- CYPHER Learning

- Docebo Inc.

- edX (2U Inc.)

- Ellucian Company L.P.

- Epignosis LLC (TalentLMS)

- iSpring Solutions, Inc.

- LinkedIn Learning (Microsoft)

- Microsoft Corporation

- Moodle Pty Ltd

- Oracle Corporation

- Paradiso Solutions

- Pearson plc

- PowerSchool Holdings, Inc.

- SAP SE (SAP Litmos)

- Simplilearn Solutions Pvt Ltd

- Thinkific Labs Inc.

- Udemy, Inc.

- Xylem Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 2U Inc.

- 360Learning

- Adobe Inc.

- Anthology (formerly Blackboard)

- Brightspace (D2L Corporation)

- Canvas (Instructure Inc.)

- Coursera, Inc.

- CYPHER Learning

- Docebo Inc.

- edX (2U Inc.)

- Ellucian Company L.P.

- Epignosis LLC (TalentLMS)

- iSpring Solutions, Inc.

- LinkedIn Learning (Microsoft)

- Microsoft Corporation

- Moodle Pty Ltd

- Oracle Corporation

- Paradiso Solutions

- Pearson plc

- PowerSchool Holdings, Inc.

- SAP SE (SAP Litmos)

- Simplilearn Solutions Pvt Ltd

- Thinkific Labs Inc.

- Udemy, Inc.

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 47.8 Billion |

| Forecasted Market Value ( USD | $ 188.5 Billion |

| Compound Annual Growth Rate | 25.7% |

| Regions Covered | Global |