Global Hospital Daily Cash Benefit Insurance Market - Key Trends & Drivers Summarized

How Is Hospital Daily Cash Benefit Insurance Evolving to Address Modern Healthcare Costs?

Hospital daily cash benefit insurance is undergoing significant transformation as healthcare costs continue to rise and individuals seek financial safeguards that complement traditional health policies. Unlike comprehensive medical insurance that reimburses treatment-related expenses, this product provides a fixed cash payout for each day of hospitalization, offering flexibility to cover ancillary costs such as transportation, accommodation for family members, lost income, or non-medical necessities. With inflation in healthcare services becoming a persistent global challenge, many individuals are turning to daily cash benefit plans as a way to fill financial gaps left by standard insurance. Insurers are responding to this demand by redesigning products to offer broader coverage options, longer benefit durations, and tiered payout structures that vary based on illness severity or hospital type. New plans may include specialized riders that cover intensive care stays, surgical recovery periods, or hospitalization due to specific illnesses such as cancer or heart disease. Digital platforms are also simplifying enrollment and claims processes, allowing policyholders to receive cash benefits within hours of submission. This increased efficiency is enhancing the appeal of daily cash benefit insurance among younger, tech-savvy consumers who value convenience and speed. In some regions, government-sponsored insurance schemes are integrating these policies into broader social protection initiatives, recognizing their role in improving financial resilience. As healthcare financing models become more fragmented, daily cash plans offer a simple and direct form of support that empowers individuals to handle the incidental costs of hospitalization with greater confidence.Why Are Changing Demographics and Lifestyle Patterns Fueling Demand for Daily Cash Benefit Insurance?

The shifting demographic and lifestyle landscape is a critical factor influencing the rising popularity of hospital daily cash benefit insurance, particularly among urban populations and middle-income groups. An increasing number of households today operate on dual incomes, and a sudden hospitalization of a family member often leads to lost earnings and unexpected expenses that are not fully addressed by traditional medical insurance. Daily cash benefit plans are being viewed as an affordable way to ensure financial continuity during such disruptions. Additionally, with life expectancy rising across the globe, older adults are seeking coverage that helps manage the costs of frequent or prolonged hospital stays without exhausting retirement savings. Lifestyle changes, including rising stress levels, sedentary habits, and dietary challenges, are contributing to a higher incidence of non-communicable diseases such as diabetes, hypertension, and cardiovascular ailments. These conditions often require repeated hospitalization, making daily cash benefits a practical and necessary financial tool. Younger generations, too, are showing increased interest in supplementary insurance as awareness of health risks grows and digital literacy makes it easier to explore and purchase plans online. Many insurers are targeting millennials and Gen Z with customizable and app-managed policies that provide transparency, ease of access, and digital claims handling. For women, especially those managing family care responsibilities or recovering from childbirth-related hospitalizations, these plans offer valuable support that enhances financial independence. The evolving structure of modern households, where extended family support is less common, also makes it crucial for individuals to have access to quick, no-strings-attached financial relief in times of medical need. These trends are collectively expanding the scope and customer base for hospital daily cash benefit products.What Strategic Shifts Are Insurers Making to Enhance Product Appeal and Market Penetration?

To adapt to rising consumer expectations and an increasingly competitive insurance market, providers of hospital daily cash benefit policies are making significant strategic shifts in product design, delivery, and outreach. One of the key trends is personalization, where insurers are offering flexible benefit amounts and durations to align with the individual needs and budgets of policyholders. Instead of rigid, one-size-fits-all plans, consumers can now select daily payout levels, opt for add-ons like ICU multipliers, or choose coverage for specific health conditions such as maternity, dengue, or post-operative care. Another major shift is the integration of value-added services into policy packages, including teleconsultation access, hospital locator tools, or discounts on diagnostic services, which enhance perceived value and customer loyalty. Distribution channels are also being diversified, with insurers leveraging online platforms, mobile apps, and embedded insurance partnerships with hospitals, employers, and fintech providers to improve reach and convenience. Insurtech firms are playing a growing role in the daily cash benefit space by offering seamless onboarding, AI-powered underwriting, and automated claim verification that significantly reduces turnaround times. Consumer education is being prioritized, with insurers investing in digital campaigns, explainer videos, and interactive tools that help users understand the purpose and advantages of these plans in a straightforward manner. Microinsurance models targeting low-income populations are emerging in regions where healthcare access is limited and financial safety nets are sparse. Additionally, insurers are collaborating with governments and NGOs to create awareness and build trust, especially in underserved rural areas. These strategic innovations are helping to reposition daily cash benefit insurance from a niche offering to a mainstream component of health risk management for a wide array of consumers.What Are the Key Drivers Behind the Growth of the Hospital Daily Cash Benefit Insurance Market?

The growth in the hospital daily cash benefit insurance market is driven by several factors that reflect changing healthcare realities, evolving financial planning behavior, and technological progression in the insurance industry. One major driver is the gap between medical insurance coverage and the real-world expenses faced by patients during hospitalization, which daily cash benefits are uniquely suited to address. Rising out-of-pocket costs, especially for meals, transportation, caregiver assistance, and alternative lodging, are prompting individuals to seek supplementary financial support beyond what standard health policies provide. Another crucial factor is the surge in short-term and day-care procedures, which are often not fully reimbursed by regular insurance but may still incur substantial incidental costs. This has led consumers to look for products that offer benefits even for brief hospital visits. Additionally, the growing awareness of financial vulnerability during illness, driven by high-profile public health crises and economic uncertainties, has pushed both individuals and families to diversify their health protection portfolios. Technological advancements are also playing a critical role, enabling quick policy issuance, user-friendly digital platforms, and real-time claims processing that enhance user trust and satisfaction. Employers are increasingly adding hospital cash plans to their employee wellness offerings, recognizing the importance of holistic health benefits that go beyond conventional insurance. The expansion of private healthcare facilities, especially in emerging markets, has created demand for insurance solutions that help patients manage variable costs across different tiers of care. Finally, supportive regulatory frameworks and government-backed insurance literacy programs are making it easier for consumers to explore and purchase these policies. Together, these drivers are fueling sustained interest and adoption of hospital daily cash benefit insurance across diverse demographic and income groups.Report Scope

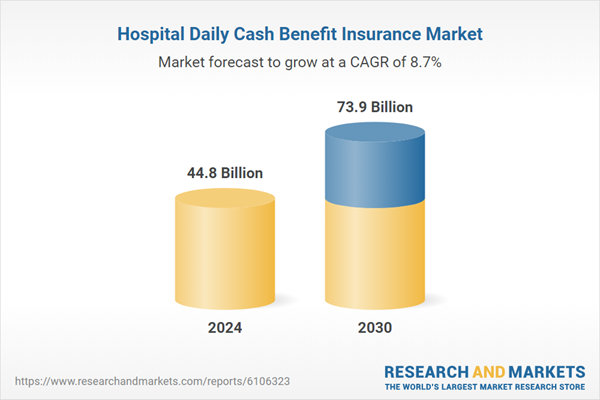

The report analyzes the Hospital Daily Cash Benefit Insurance market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Plan Type (Rider Plan, Standalone Cover Plan, Part of Health Insurance Plan); Coverage Term (Lifetime Coverage, Term Insurance); Benefit (Emergency Admission Benefit, Accident Benefit, Medical Treatment Benefit, Surgery Benefit, Other Benefits).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rider Plan segment, which is expected to reach US$46.9 Billion by 2030 with a CAGR of a 10.2%. The Standalone Cover Plan segment is also set to grow at 5.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.2 Billion in 2024, and China, forecasted to grow at an impressive 13.8% CAGR to reach $16.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hospital Daily Cash Benefit Insurance Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hospital Daily Cash Benefit Insurance Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hospital Daily Cash Benefit Insurance Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arena Racing Company, Arrowfield Stud Pty. Limited, Bally's Corporation, Betfair Group Limited, Churchill Downs Incorporated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Hospital Daily Cash Benefit Insurance market report include:

- Aflac Inc.

- Allstate Corporation

- AMA Insurance (Hospital Income)

- Chubb Ltd.

- Colonial Life & Accident Ins. Co.

- GTL (Guarantee Trust Life)

- HCF Insurance (Hospitals Contribution Fund)

- Hong Leong Insurance (Asia) Ltd.

- ManipalCigna Health Insurance

- MetLife, Inc.

- Niva Bupa (formerly Max Bupa)

- Securian Financial (Group Hospital Indemnity)

- Shriram General Insurance (Shriram GI)

- Simplyhealth

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aflac Inc.

- Allstate Corporation

- AMA Insurance (Hospital Income)

- Chubb Ltd.

- Colonial Life & Accident Ins. Co.

- GTL (Guarantee Trust Life)

- HCF Insurance (Hospitals Contribution Fund)

- Hong Leong Insurance (Asia) Ltd.

- ManipalCigna Health Insurance

- MetLife, Inc.

- Niva Bupa (formerly Max Bupa)

- Securian Financial (Group Hospital Indemnity)

- Shriram General Insurance (Shriram GI)

- Simplyhealth

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 44.8 Billion |

| Forecasted Market Value ( USD | $ 73.9 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |