Global Natural Thickeners Market - Key Trends & Drivers Summarized

Why Are Natural Thickeners Being Widely Adopted Across Industries?

Natural thickeners are increasingly used across food, cosmetics, pharmaceuticals, and industrial formulations as clean-label, biodegradable, and non-toxic alternatives to synthetic additives. Derived from plant, algal, or microbial sources, these thickeners provide viscosity, texture, stability, and suspension without altering taste or chemical properties. Common natural thickeners include starches, guar gum, xanthan gum, agar, pectin, locust bean gum, and cellulose derivatives. Their rising use is linked to growing consumer preference for natural and minimally processed products.In food applications, natural thickeners help improve mouthfeel, maintain product consistency, and prevent ingredient separation in soups, sauces, bakery products, and beverages. In cosmetics and personal care products, they provide smooth textures and emulsification while ensuring stability in creams, gels, and lotions. Pharmaceutical formulations rely on natural thickeners for drug delivery consistency and palatability. Their broad functionality and safety profile make them ideal for products targeting sensitive consumers, such as infants or people with allergies.

How Are Innovations in Processing and Formulation Enhancing Performance?

Advancements in extraction, purification, and blending techniques are improving the quality and application range of natural thickeners. Modified starches, enzymatically treated gums, and micronized plant fibers are offering greater solubility, thermal stability, and pH tolerance. These improvements allow manufacturers to fine-tune viscosity, gelation speed, and moisture retention depending on the end-use requirement. Fermentation-based production of xanthan and gellan gums has made these materials more accessible and consistent in quality.Blending multiple natural thickeners is becoming a common strategy to achieve tailored rheological properties. For instance, combining guar gum with xanthan gum provides enhanced viscosity control and freeze-thaw stability in frozen foods or emulsions. In cosmetics, thickener combinations improve absorption and reduce greasiness in creams. Manufacturers are also incorporating thickeners with functional benefits such as prebiotic fiber content, opening new opportunities in wellness-oriented products.

Which End-Use Markets Are Driving Demand for Natural Thickeners?

Food and beverage remain the dominant application sector, particularly in dairy products, gluten-free baked goods, beverages, and meat substitutes. As plant-based food categories expand, demand for natural thickeners that maintain structure and texture in soy, oat, or almond-based products is rising. In cosmetics, clean beauty trends are driving the use of natural gums and starches in skincare, haircare, and personal hygiene products. Formulators seek ingredients that offer gentle thickening with minimal skin irritation.Pharmaceutical and nutraceutical companies use natural thickeners in oral suspensions, gels, syrups, and topical applications. In industrial segments, bio-based thickeners are gaining ground in adhesives, paints, and textile printing, where environmental safety and biodegradability are critical. Growth is also visible in pet food and animal health sectors, where natural binders and stabilizers enhance product appeal and nutritional consistency.

Growth in the Natural Thickeners Market Is Driven by Several Factors…

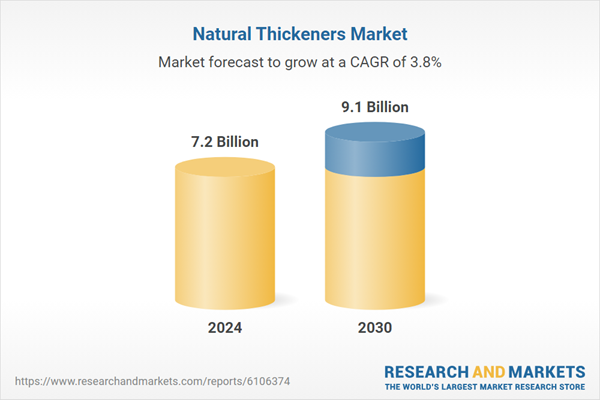

Growth in the natural thickeners market is driven by several factors. Increased demand for clean-label, plant-based, and allergen-free formulations supports their adoption in food, cosmetics, and pharma sectors. Innovations in extraction and modification technologies improve functional performance and formulation versatility. Rising consumer awareness of ingredient safety and sustainability accelerates the shift from synthetic to natural additives. Expansion of plant-based foods and natural skincare products creates new application opportunities. Regulatory approval and global supply chains for key thickeners ensure broader availability and commercial viability. As industries prioritize environmental responsibility and transparency, natural thickeners are gaining a stronger foothold across global product development pipelines.Report Scope

The report analyzes the Natural Thickeners market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Plant-based Thickeners, Animal-based Thickeners); Application (Food & Beverages Application, Cosmetics & Personal Care Application, Pharmaceuticals Application, Paint & Coatings Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plant-based Thickeners segment, which is expected to reach US$6 Billion by 2030 with a CAGR of a 3.2%. The Animal-based Thickeners segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 6.9% CAGR to reach $1.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Natural Thickeners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Natural Thickeners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Natural Thickeners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ashland Inc., BASF SE, Cargill, Incorporated, Clariant AG, Croda International Plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Natural Thickeners market report include:

- Archer Daniels Midland Company (ADM)

- Ashland Global Holdings Inc.

- Avebe U.A.

- BASF SE

- Brenntag AG

- Cargill, Incorporated

- Clariant AG

- CP Kelco (J.M. Huber Company)

- DuPont de Nemours, Inc.

- Fiberstar Inc.

- Glanbia plc

- Ingredion Incorporated

- J.M. Huber Corporation

- Kerry Group plc

- Lamberti SpA

- Lonza Group Ltd.

- Nexira

- Roquette Frères SA

- Seppic (Air Liquide)

- Tate & Lyle PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Archer Daniels Midland Company (ADM)

- Ashland Global Holdings Inc.

- Avebe U.A.

- BASF SE

- Brenntag AG

- Cargill, Incorporated

- Clariant AG

- CP Kelco (J.M. Huber Company)

- DuPont de Nemours, Inc.

- Fiberstar Inc.

- Glanbia plc

- Ingredion Incorporated

- J.M. Huber Corporation

- Kerry Group plc

- Lamberti SpA

- Lonza Group Ltd.

- Nexira

- Roquette Frères SA

- Seppic (Air Liquide)

- Tate & Lyle PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 9.1 Billion |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |