Global Nutritional Bars Market - Key Trends & Drivers Summarized

Why Are Nutritional Bars Gaining Widespread Consumer Acceptance?

Nutritional bars have evolved into a convenient dietary solution that supports diverse lifestyle needs, ranging from meal replacement to on-the-go snacking. They are widely accepted among fitness enthusiasts, busy professionals, and health-conscious individuals who prioritize portion control and nutrient intake. Their compact format and shelf stability make them a practical alternative to traditional meals, especially in urban settings where time constraints limit access to balanced food options.The appeal of nutritional bars extends beyond convenience. Manufacturers are offering formulations enriched with protein, fiber, vitamins, and functional ingredients to cater to specific goals such as muscle recovery, energy boost, or weight management. Bars designed for children, seniors, and diabetic users are becoming more common, reflecting a broader demographic reach. This versatility is reinforcing their position in both mainstream grocery channels and specialty health stores.

How Are Product Formulations Shaping Consumer Preferences?

Formulation strategies are increasingly focused on ingredient transparency and targeted nutrition. High-protein bars using plant-based sources such as pea, rice, or soy protein are gaining preference among vegetarians and those seeking dairy alternatives. Likewise, sugar-free or reduced-carb variants are becoming popular among consumers managing their glucose levels or following ketogenic diets. Functional ingredients such as adaptogens, collagen peptides, and probiotics are being incorporated into newer formats, further expanding the functional scope of nutritional bars.Texture and taste play a crucial role in consumer acceptance. Brands are working to balance nutritional value with palatability by using clean-label binders, natural sweeteners, and innovative processing techniques that prevent hardening or crumbling. Allergen-free options that eliminate gluten, nuts, or dairy are also gaining traction. Product innovation is no longer limited to nutritional content alone but also includes variety in textures, flavors, and packaging suited to portion control and portability.

What Supply Chain and Retail Shifts Are Influencing Market Reach?

Changes in retail structure and distribution have supported the growth of nutritional bars in both physical and digital spaces. Initially concentrated in fitness and health food stores, these products are now widely available across convenience stores, supermarkets, vending platforms, and e-commerce channels. This broader access has contributed to greater trial and repeat purchases, especially in urban centers and travel-focused retail environments such as airports and train stations.Private label offerings and regionally tailored flavors are also contributing to market penetration. Retailers are launching their own functional bar lines, creating affordable alternatives without compromising ingredient quality. In parallel, contract manufacturing partnerships are enabling emerging brands to scale production efficiently. Supply chains are adapting to incorporate sustainable packaging materials, shorter delivery cycles, and direct-to-consumer models that provide personalized subscriptions or bundle offerings.

Growth in the nutritional bars market is driven by several factors.

Consumer demand for portable, nutrient-dense food options is encouraging rapid expansion of the category across demographics and use cases. Advances in formulation science are enabling inclusion of targeted ingredients such as plant proteins, functional herbs, and gut-friendly compounds. Wider retail penetration through both online and offline channels is increasing accessibility and brand visibility. Improvements in packaging, shelf life, and allergen-free certifications are strengthening consumer confidence and product differentiation. Additionally, scalable manufacturing solutions and private label initiatives are helping to meet growing demand while maintaining price competitiveness and consistency.Report Scope

The report analyzes the Nutritional Bars market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Protein Bars, High-Fiber Bars); Category (Conventional Category, Gluten-Free Category); Distribution Channel (Supermarkets / Hypermarkets, Convenience Stores, Online Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Protein Bars segment, which is expected to reach US$7.2 Billion by 2030 with a CAGR of a 5.2%. The High-Fiber Bars segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $2.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Nutritional Bars Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Nutritional Bars Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Nutritional Bars Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AECOM, Ansaldo Energia Spa, Augean Plc, Babcock International Group Plc, Bechtel Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Nutritional Bars market report include:

- Aloha (ALOHA Organic)

- Atkins Nutritionals (Simply Good Foods)

- Bakery Barn, LLC

- BellRock Brands

- Clif Bar & Company

- GoMacro

- General Mills (Nature Valley, Larabar)

- Glanbia PLC (think!, Optimum Nutrition)

- Hearthside Food Solutions

- Kellogg Company

- KIND LLC

- Mars, Incorporated (Snickers Protein)

- Nature Valley (General Mills brand)

- ONE Brands, LLC

- Penzeys Spices (health-focused bars)

- PowerBar (Post Holdings brand)

- Quest Nutrition (Simply Good Foods)

- RXBAR (Kellogg-owned)

- SunOpta Inc.

- The Balance Bar Company

- Think! (Glanbia brand)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aloha (ALOHA Organic)

- Atkins Nutritionals (Simply Good Foods)

- Bakery Barn, LLC

- BellRock Brands

- Clif Bar & Company

- GoMacro

- General Mills (Nature Valley, Larabar)

- Glanbia PLC (think!, Optimum Nutrition)

- Hearthside Food Solutions

- Kellogg Company

- KIND LLC

- Mars, Incorporated (Snickers Protein)

- Nature Valley (General Mills brand)

- ONE Brands, LLC

- Penzeys Spices (health-focused bars)

- PowerBar (Post Holdings brand)

- Quest Nutrition (Simply Good Foods)

- RXBAR (Kellogg-owned)

- SunOpta Inc.

- The Balance Bar Company

- Think! (Glanbia brand)

Table Information

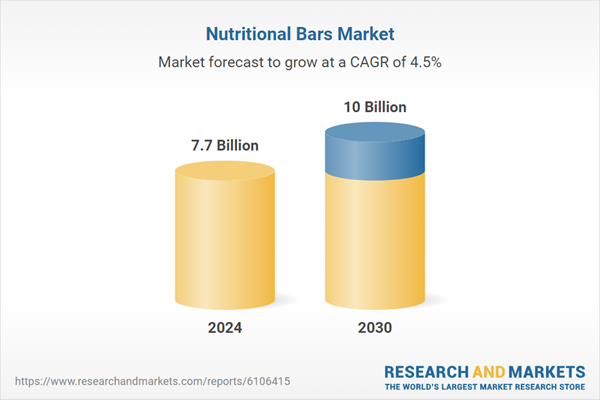

| Report Attribute | Details |

|---|---|

| No. of Pages | 370 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.7 Billion |

| Forecasted Market Value ( USD | $ 10 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |