Global Oil and Gas Refinery Maintenance Services Market - Key Trends & Drivers Summarized

Why Are Maintenance Services Critical to Refinery Performance and Longevity?

Refinery maintenance services are essential to ensure safe, efficient, and uninterrupted processing operations in oil and gas facilities. Refineries operate under extreme thermal, chemical, and mechanical stress, which can lead to equipment wear, corrosion, and system failures if not properly maintained. Planned and unplanned maintenance activities directly impact operational continuity, safety compliance, and product quality. As global refining capacity increases and existing plants age, demand for specialized maintenance services is rising across all refinery types.Routine maintenance, turnaround services, inspection, and asset integrity programs are essential to avoid unplanned shutdowns and environmental risks. These services include mechanical repairs, instrumentation calibration, heat exchanger cleaning, welding, coating, and valve servicing. Turnaround maintenance, typically conducted every few years, involves a full shutdown of operations for in-depth equipment inspection and repair. Timely execution of these tasks is critical to maintaining operational efficiency and avoiding revenue loss from prolonged downtimes.

How Are Technological Tools Enhancing Refinery Maintenance Efficiency?

Advancements in predictive analytics, non-destructive testing, and robotic inspection tools are changing how maintenance services are delivered in refineries. Data collected from process equipment is now analyzed using digital twins and condition monitoring software to forecast failures and schedule preventive actions. This predictive approach is reducing unplanned outages and extending the life of critical refinery assets. Integration of asset performance management (APM) platforms with maintenance planning is also improving resource allocation and turnaround execution.Remote-controlled robots and drones are increasingly used for inspecting high-risk and hard-to-reach areas, minimizing human exposure to hazardous environments. Technologies such as thermographic imaging, ultrasonic thickness measurement, and corrosion mapping enable early detection of issues without interrupting operations. Cloud-based platforms facilitate centralized monitoring of maintenance schedules, contractor performance, and regulatory compliance. These tools are improving decision-making and contributing to cost savings by reducing unnecessary repairs and minimizing plant downtime.

What Operational and Market Trends Are Shaping Maintenance Demand?

Global trends in refining operations, regulatory compliance, and energy transition are shaping the nature and frequency of maintenance service demand. Increased processing complexity, particularly in refineries producing low-sulfur fuels or handling heavier crudes, results in higher stress on equipment and necessitates more specialized maintenance. Environmental regulations are pushing refiners to upgrade emission control systems, which require new inspection and servicing protocols.Aging refinery infrastructure in regions such as North America and Europe is creating sustained demand for refurbishment and replacement services. At the same time, refineries in Asia-Pacific and the Middle East are expanding capacity, creating a growing need for maintenance planning during commissioning and post-startup phases. Outsourcing of maintenance functions to third-party service providers is also increasing as operators seek to improve cost control, access skilled labor, and ensure regulatory compliance. These trends are driving greater demand for integrated, long-term maintenance contracts that cover both routine services and emergency support.

What Factors Are Driving Growth in the Refinery Maintenance Services Market?

Growth in the refinery maintenance services market is driven by several factors. Rising operational complexity due to fuel quality regulations and integration with petrochemical units is increasing maintenance requirements. Expansion of refining capacity in Asia and the Middle East is boosting demand for construction-phase maintenance planning and post-commissioning services. Adoption of predictive maintenance technologies, including sensors, analytics, and AI platforms, is driving upgrades in traditional maintenance strategies. Aging refinery infrastructure in mature markets is generating consistent demand for inspection, repair, and overhaul services. Outsourcing trends among refining companies are encouraging growth in third-party maintenance contracts, while increasing focus on safety and environmental compliance is reinforcing the need for reliable and specialized service providers. Together, these dynamics are shaping a more technology-driven and service-oriented refinery maintenance ecosystem.Report Scope

The report analyzes the Oil and Gas Refinery Maintenance Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service (Turnaround Services, Maintenance & Repair Services); End-Use (Small Scale Refinery End-Use, Medium Scale Refinery End-Use, Large Scale Refinery End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Turnaround Services segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 2.8%. The Maintenance & Repair Services segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 3.5% CAGR to reach $848 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oil and Gas Refinery Maintenance Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oil and Gas Refinery Maintenance Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oil and Gas Refinery Maintenance Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Archer Ltd., Ardyne Technologies, Baker Hughes, Bilco Tools, CMESwellbore (formerly Cameron) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Oil and Gas Refinery Maintenance Services market report include:

- AECOM

- Aegion Corporation

- APTIM

- Baker Hughes

- CHIYODA Corporation

- CIC Group Inc

- Envent Corporation

- Fluor Corporation

- Halliburton

- Intertek Group Plc

- KBR Inc

- Matrix Service Company

- MedEuropa Refining Group

- Petrofac Limited

- Pioneer Industrial Corp.

- Saipem S.p.A

- Schlumberger Limited

- STI Group

- TechnipFMC plc

- Turner Industries Group LLC

- WorleyParsons (Worley)

- Zachry Brands Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AECOM

- Aegion Corporation

- APTIM

- Baker Hughes

- CHIYODA Corporation

- CIC Group Inc

- Envent Corporation

- Fluor Corporation

- Halliburton

- Intertek Group Plc

- KBR Inc

- Matrix Service Company

- MedEuropa Refining Group

- Petrofac Limited

- Pioneer Industrial Corp.

- Saipem S.p.A

- Schlumberger Limited

- STI Group

- TechnipFMC plc

- Turner Industries Group LLC

- WorleyParsons (Worley)

- Zachry Brands Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

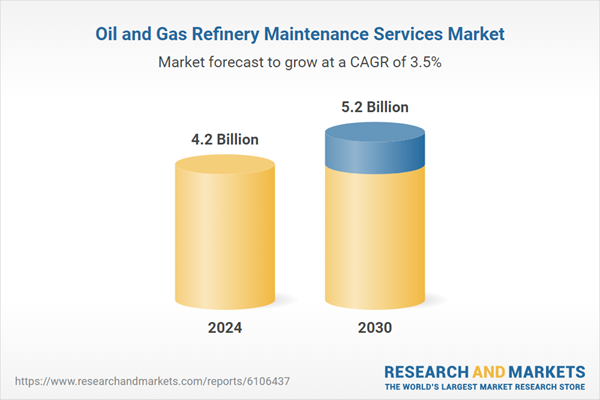

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 5.2 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |