Global Oil and Gas Turbomachinery Market - Key Trends & Drivers Summarized

Why Turbomachinery Remains Core to Oil and Gas Processing Infrastructure?

Turbomachinery, including compressors, turbines, and pumps, plays a foundational role in oil and gas operations. These machines enable critical functions such as gas compression, power generation, oil transportation, and liquefied natural gas (LNG) processing. In upstream fields, turbomachinery supports drilling and enhanced oil recovery by providing mechanical power and fluid movement. In midstream, it ensures efficient gas transmission across vast pipeline networks. In downstream refining and petrochemical plants, turbomachinery supports processing, cooling, and energy recovery systems.High reliability, efficiency, and performance under extreme pressure and temperature conditions make turbomachinery indispensable across all segments. As oil and gas projects expand into deeper offshore basins, arid environments, and remote regions, the need for robust and adaptable turbomachinery systems has grown. These machines are designed for continuous operation and must meet strict performance standards to avoid costly shutdowns and production losses, reinforcing their strategic importance in oil and gas asset portfolios.

How Are Technological Innovations Shaping the Next Generation of Turbomachinery?

Advancements in materials, aerodynamics, and digital control systems are driving significant performance improvements in turbomachinery. New alloys and coatings are increasing resistance to corrosion, erosion, and thermal fatigue, allowing equipment to operate longer in harsh environments. High-efficiency impeller and blade designs are improving flow dynamics, reducing energy consumption, and lowering emissions. Variable-speed drives and magnetic bearings are being integrated to enhance operational flexibility and reduce mechanical wear.Digitalization is transforming turbomachinery maintenance and performance management. Embedded sensors monitor vibration, temperature, and pressure, enabling condition-based maintenance and early fault detection. Predictive analytics powered by artificial intelligence helps optimize machine operation and extend service intervals. Advanced control systems allow remote operation and real-time performance optimization. Together, these innovations are reducing lifecycle costs and improving overall asset utilization, especially in LNG facilities and high-throughput refineries where machinery uptime is critical.

What Operational Shifts Are Influencing Turbomachinery Demand?

Several structural changes in oil and gas operations are affecting turbomachinery demand patterns. LNG expansion projects, particularly in North America, the Middle East, and Asia-Pacific, are driving demand for gas turbines and centrifugal compressors capable of handling cryogenic conditions. Growth in gas-to-power initiatives and offshore gas monetization projects is also supporting turbomachinery installations for onsite generation and processing. Decarbonization trends are influencing machinery design, with operators seeking lower-emission and hydrogen-ready equipment.Refineries and petrochemical plants are upgrading existing machinery to meet stricter energy efficiency targets, often replacing legacy systems with modular, high-performance units. As operators aim to reduce emissions and energy intensity, turbomachinery is being integrated with waste heat recovery and carbon capture systems. Service contracts and performance-based maintenance agreements are also on the rise, as plant operators seek to ensure long-term reliability without expanding in-house maintenance capabilities. These trends are reshaping how turbomachinery is procured, deployed, and managed.

What Factors Are Driving Growth in the Oil and Gas Turbomachinery Market?

Growth in the oil and gas turbomachinery market is driven by several factors. Expansion of LNG infrastructure and gas processing capacity is generating strong demand for high-capacity compressors and turbines. Upgrades in refinery and petrochemical plants to meet energy efficiency and emission standards are fueling replacement and retrofit activity. Increased adoption of condition-based and predictive maintenance tools is enhancing machinery uptime and reducing unplanned failures, encouraging broader investment. Advances in high-temperature materials, control systems, and aerodynamic design are boosting equipment efficiency, supporting new installations in complex environments. Growing interest in hydrogen blending and carbon capture integration is prompting development of next-generation turbomachinery compatible with low-carbon fuels. These factors are contributing to sustained investment in high-performance, digitally integrated turbomachinery across global oil and gas value chains.Report Scope

The report analyzes the Oil and Gas Turbomachinery market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Gas & Steam Turbine, Gas Compressor, Pumps, Other Types); Deployment (Onshore Deployment, Offshore Deployment).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gas & Steam Turbine segment, which is expected to reach US$9.3 Billion by 2030 with a CAGR of a 5%. The Gas Compressor segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.6 Billion in 2024, and China, forecasted to grow at an impressive 4.1% CAGR to reach $2.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oil and Gas Turbomachinery Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oil and Gas Turbomachinery Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oil and Gas Turbomachinery Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AECOM, Aegion Corporation, APTIM, Baker Hughes, CHIYODA Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Oil and Gas Turbomachinery market report include:

- Air Products & Chemicals, Inc.

- Atlas Copco AB

- Baker Hughes

- Capstone Turbine Corporation

- Caterpillar Inc. (Solar Turbines)

- Dresser-Rand (Siemens Energy)

- Elliott Group (Ebara subsidiary)

- Flowserve Corporation

- GE Vernova (General Electric)

- Hitachi Ltd.

- Howden Group

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MTU Aero Engines AG

- Rolls-Royce Holdings plc

- Siemens Energy

- SPIE Turbomachinery

- Sulzer Ltd.

- Wärtsilä Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Air Products & Chemicals, Inc.

- Atlas Copco AB

- Baker Hughes

- Capstone Turbine Corporation

- Caterpillar Inc. (Solar Turbines)

- Dresser-Rand (Siemens Energy)

- Elliott Group (Ebara subsidiary)

- Flowserve Corporation

- GE Vernova (General Electric)

- Hitachi Ltd.

- Howden Group

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- MTU Aero Engines AG

- Rolls-Royce Holdings plc

- Siemens Energy

- SPIE Turbomachinery

- Sulzer Ltd.

- Wärtsilä Corporation

Table Information

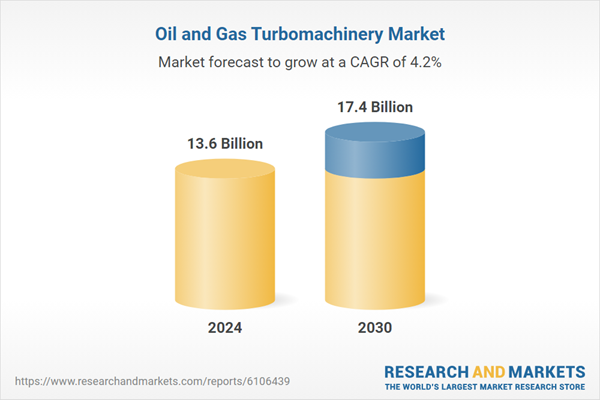

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.6 Billion |

| Forecasted Market Value ( USD | $ 17.4 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |