Global Oil and Gas Fabrication Market - Key Trends & Drivers Summarized

Why Fabrication Services Remain Indispensable to Oil and Gas Infrastructure Development?

Fabrication in the oil and gas industry refers to the construction and assembly of complex structural and mechanical components used across upstream, midstream, and downstream segments. This includes pressure vessels, piping systems, offshore platforms, skids, modules, jackets, topsides, and storage tanks. These fabricated systems must meet rigorous quality, safety, and performance standards due to the hazardous and high-pressure environments in which they operate. Fabrication is central to building both greenfield and brownfield energy infrastructure projects, from onshore refineries to offshore production units.Given the industry's highly customized needs, fabrication involves a wide range of services, such as precision cutting, welding, forming, coating, and non-destructive testing. Modular fabrication, where systems are built off-site and transported for assembly, is becoming a preferred approach due to faster timelines and lower onsite labor costs. As oil and gas projects grow in size and complexity, the scope of fabrication contracts continues to expand, making these services a vital link in the project supply chain.

How Are Technology and Automation Enhancing Fabrication Efficiency and Quality?

Technological advancements in fabrication are improving quality control, accelerating project timelines, and reducing error rates. Computer-aided design (CAD) and building information modeling (BIM) systems enable precise digital modeling, clash detection, and structural analysis before actual production begins. These tools help reduce rework, improve fit-up accuracy, and support better coordination between engineering and fabrication teams.Automation is playing a growing role in welding, cutting, and material handling processes, especially for repetitive or high-volume tasks. Robotic welding systems are increasing consistency and reducing dependency on skilled manual labor, which remains in short supply in many regions. Non-destructive testing using ultrasonic, radiographic, or thermographic technologies is being integrated into fabrication workflows for real-time quality assurance. Materials innovation, including the use of corrosion-resistant alloys and composite structures, is enhancing component lifespan, especially in offshore and sour service environments. Together, these tools are raising fabrication standards across global facilities.

What Project and Regional Trends Are Shaping Demand for Fabrication Services?

Large-scale infrastructure developments across upstream, LNG, and petrochemical projects are driving robust demand for fabrication services. In offshore oil and gas, the construction of floating production systems, subsea modules, and platform topsides is generating long lead-time fabrication contracts. Onshore, refinery upgrades, terminal expansions, and pipeline compressor stations are fueling demand for structural and process fabrication. LNG projects, in particular, require extensive fabrication of cryogenic piping, pressure vessels, and modular processing units.Geographically, Asia-Pacific and the Middle East remain prominent hubs for fabrication activity due to a combination of lower labor costs, well-developed industrial bases, and proximity to major oil and gas projects. North America is seeing rising investment in modular fabrication for shale gas and LNG projects, with an emphasis on local content and short project cycles. Africa and Latin America are also emerging as key markets as offshore exploration increases and midstream networks expand. Demand is influenced not only by capital projects but also by routine maintenance and plant turnaround cycles.

What Factors Are Driving Growth in the Oil and Gas Fabrication Market?

Growth in the oil and gas fabrication market is driven by several factors. Expansion of LNG export terminals, petrochemical complexes, and offshore production units is generating steady demand for structural and process fabrication. Adoption of modular construction approaches is accelerating off-site fabrication for improved project control and reduced commissioning time. Technological integration in design, welding automation, and quality testing is raising throughput and fabrication accuracy. Demand for corrosion-resistant and high-pressure systems is growing due to increased deployment in deepwater and sour gas fields. Investments by national oil companies in upstream development and refining capacity are fueling long-term fabrication contracts, especially in Asia and the Middle East. Additionally, increased focus on operational safety, equipment reliability, and project delivery efficiency is driving greater reliance on specialized fabrication providers with advanced capabilities and adherence to international standards.Report Scope

The report analyzes the Oil Gas Fabrication market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vertical (Upstream Vertical, Midstream Vertical, Downstream Vertical).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Upstream Vertical segment, which is expected to reach US$70.7 Billion by 2030 with a CAGR of a 4.4%. The Midstream Vertical segment is also set to grow at 3.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $22.7 Billion in 2024, and China, forecasted to grow at an impressive 3.9% CAGR to reach $17.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oil Gas Fabrication Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oil Gas Fabrication Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oil Gas Fabrication Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aker Solutions ASA, APTOM Limited, Baker Hughes Company, Cameron (SLB), Capstone Turbine Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Oil Gas Fabrication market report include:

- Aibel AS

- Aker Solutions ASA

- Chiyoda Corporation

- COOEC (Offshore Oil Engineering)

- Daewoo Shipbuilding & Marine Eng.

- Fluor Corporation

- Hyundai Heavy Industries Co., Ltd.

- Jacobs Solutions Inc.

- JGC Corporation

- KBR Inc.

- Larsen & Toubro (L&T) Hydrocarbon

- McDermott International, Ltd.

- National Petroleum Construction Co.

- Petrofac Limited

- Saipem S.p.A.

- Samsung Heavy Industries Co., Ltd.

- Sapura Energy Berhad

- SNC-Lavalin Group Inc. (AtkinsRéalis)

- Technip Energies

- Worley Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aibel AS

- Aker Solutions ASA

- Chiyoda Corporation

- COOEC (Offshore Oil Engineering)

- Daewoo Shipbuilding & Marine Eng.

- Fluor Corporation

- Hyundai Heavy Industries Co., Ltd.

- Jacobs Solutions Inc.

- JGC Corporation

- KBR Inc.

- Larsen & Toubro (L&T) Hydrocarbon

- McDermott International, Ltd.

- National Petroleum Construction Co.

- Petrofac Limited

- Saipem S.p.A.

- Samsung Heavy Industries Co., Ltd.

- Sapura Energy Berhad

- SNC-Lavalin Group Inc. (AtkinsRéalis)

- Technip Energies

- Worley Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

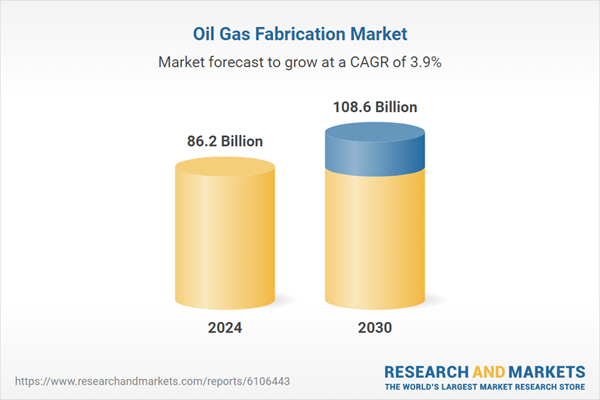

| Estimated Market Value ( USD | $ 86.2 Billion |

| Forecasted Market Value ( USD | $ 108.6 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |