Global Oil and Gas Pipeline Fabrication and Construction Market - Key Trends & Drivers Summarized

Why Pipeline Fabrication and Construction Is Critical to Oil and Gas Value Chains?

Pipeline fabrication and construction is a core segment of oil and gas infrastructure development, enabling the safe and efficient transport of crude oil, natural gas, and refined products over long distances. This process involves detailed engineering, material procurement, welding, bending, coating, joint testing, trenching, and installation across a variety of terrains. Pipelines connect production fields to refineries, storage terminals, and end-user markets, making them essential for continuous flow and distribution.Fabrication encompasses prefabricated pipe spools, modular segments, valve stations, metering systems, and compressor or pump stations. Construction requires robust planning to navigate environmental challenges, regulatory requirements, land access issues, and safety standards. As production expands across remote and difficult terrains, such as deserts, mountains, seabeds, and permafrost regions, the role of advanced pipeline fabrication and field construction has become increasingly complex and essential for meeting operational deadlines.

How Are Technologies and Standards Reshaping Pipeline Engineering and Execution?

Technological progress is significantly enhancing efficiency, safety, and precision in pipeline fabrication and construction. Use of high-grade steel with improved corrosion resistance and strength-to-weight ratios allows for thinner walls and longer spans without compromising safety. Automated and semi-automated welding systems are now widely used to ensure consistent weld quality, reduce human error, and meet stringent inspection standards. Non-destructive testing (NDT) methods such as radiography and ultrasonic testing are integrated into workflows for real-time quality validation.Digital tools including geographic information systems (GIS), building information modeling (BIM), and project management platforms are improving route optimization, construction sequencing, and risk mitigation. Trenchless technologies such as horizontal directional drilling (HDD) are increasingly employed for river crossings, urban areas, and ecologically sensitive zones. Coating systems with enhanced abrasion, chemical, and UV resistance are being applied in fabrication yards to extend service life and reduce maintenance needs. Compliance with global construction codes, including ASME, API, and ISO standards, is also reinforcing quality, especially for cross-border and subsea pipelines.

What Deployment Trends Are Influencing Global Pipeline Construction Activity?

Large-scale oil and gas transmission projects across regions such as North America, the Middle East, Central Asia, and Africa are shaping global pipeline construction trends. In North America, expansion of shale output is driving the buildout of intra-basin and interregional pipelines for crude, natural gas, and NGLs. In the Middle East, national oil companies are investing in pipeline corridors to support refinery integration, export terminal access, and regional gas trade. Africa is witnessing pipeline development tied to emerging offshore projects and cross-border export opportunities.Onshore pipeline networks remain dominant in volume, but offshore pipeline construction is expanding in support of deepwater production in Brazil, the Gulf of Mexico, and West Africa. Subsea fabrication demands greater precision and high-strength materials due to environmental conditions. Moreover, geopolitical drivers and energy diversification goals are prompting investments in transcontinental gas pipelines across Europe and Asia. Growing emphasis on hydrogen, CO2 transport, and ammonia pipelines is introducing new fabrication needs focused on compatibility with alternative fuels and corrosion mitigation.

What Factors Are Driving Growth in the Pipeline Fabrication and Construction Market?

Growth in the oil and gas pipeline fabrication and construction market is driven by several factors. Rising global demand for natural gas and crude oil is spurring development of long-distance transmission infrastructure. Expansion of LNG facilities and associated feeder pipelines is increasing fabrication of cryogenic-ready segments. Technological improvements in automated welding, digital project management, and corrosion-resistant materials are enhancing construction efficiency and service life. Upgrades and replacement of aging pipeline systems are contributing to steady refurbishment and expansion projects in North America and Europe. Increased offshore exploration and gas monetization projects are creating demand for subsea pipeline construction with complex specifications. Additionally, emerging infrastructure for hydrogen blending, carbon capture and storage, and synthetic fuels is expanding the scope of specialized pipeline fabrication. These factors collectively support continued investment across fabrication yards, construction contractors, and equipment suppliers involved in global pipeline deployment.Report Scope

The report analyzes the Oil Gas Pipeline Fabrication and Construction market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: End-Use (Oil End-Use, Gas End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oil End-Use segment, which is expected to reach US$377.8 Billion by 2030 with a CAGR of a 12.4%. The Gas End-Use segment is also set to grow at 17.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $73.2 Billion in 2024, and China, forecasted to grow at an impressive 13.6% CAGR to reach $97 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Oil Gas Pipeline Fabrication and Construction Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Oil Gas Pipeline Fabrication and Construction Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Oil Gas Pipeline Fabrication and Construction Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ArcelorMittal, Benteler Steel/Tube GmbH, Borusan Mannesmann, Chelpipe Group, Dongyang Steel Pipe Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Oil Gas Pipeline Fabrication and Construction market report include:

- Aegion Corporation

- Bechtel Corporation

- Bonatti S.p.A.

- China Petroleum Pipeline Engineering Co.

- CRC Evans

- Denys NV

- Enppi (Engineering for Petroleum & Process Industries)

- EPCM Holdings

- GAIL (India) Limited

- IL&FS Engineering and Construction

- Kalpataru Projects International Ltd.

- Laney Directional Drilling Co.

- Ledcor Group

- McDermott International, Ltd.

- Punj Lloyd Group

- Saipem S.p.A.

- Spiecapag (Vinci Group)

- Techint Engineering & Construction

- Tenaris Global Services S.A.

- Wilbros Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aegion Corporation

- Bechtel Corporation

- Bonatti S.p.A.

- China Petroleum Pipeline Engineering Co.

- CRC Evans

- Denys NV

- Enppi (Engineering for Petroleum & Process Industries)

- EPCM Holdings

- GAIL (India) Limited

- IL&FS Engineering and Construction

- Kalpataru Projects International Ltd.

- Laney Directional Drilling Co.

- Ledcor Group

- McDermott International, Ltd.

- Punj Lloyd Group

- Saipem S.p.A.

- Spiecapag (Vinci Group)

- Techint Engineering & Construction

- Tenaris Global Services S.A.

- Wilbros Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 125 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

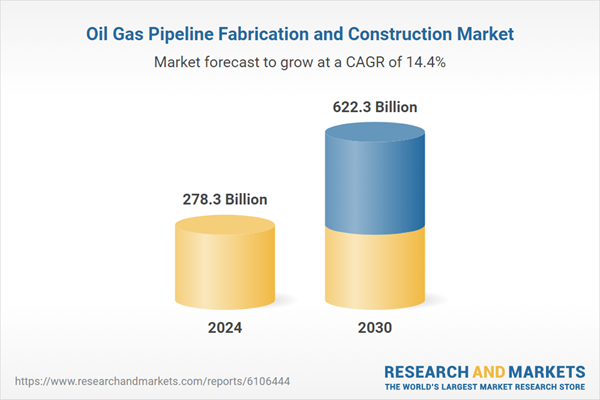

| Estimated Market Value ( USD | $ 278.3 Billion |

| Forecasted Market Value ( USD | $ 622.3 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |