Global Pharmaceutical Aseptic Transfer Market - Key Trends & Drivers Summarized

Why Is Aseptic Transfer Crucial in Modern Sterile Drug Manufacturing?

Aseptic transfer refers to the controlled movement of sterile materials into and out of cleanrooms, isolators, or restricted access barrier systems without compromising sterility. It is critical in pharmaceutical manufacturing environments, especially during production of sterile injectables, biologics, vaccines, and advanced therapies. Any breach in aseptic technique can lead to contamination, compromising product quality and patient safety.To address these risks, aseptic transfer systems employ methods such as rapid transfer ports, sterile connectors, single-use bags, and pass-through chambers. These technologies are designed to maintain unidirectional flow, physical separation, and pressure differentials during transfer. The focus is on minimizing human intervention and airborne contamination while ensuring compatibility with high-potency or temperature-sensitive drug products.

How Are Transfer Technologies Evolving to Meet Regulatory and Production Needs?

Sterile connectors and single-use transfer systems are gaining prominence due to their reduced cleaning and validation requirements. These systems also support flexibility in multi-product manufacturing environments. Isolator-integrated rapid transfer ports (RTPs), β- and α-port assemblies, and pre-sterilized consumables are widely used in high-throughput aseptic filling lines. Manufacturers are also incorporating closed-loop transfer systems for high-risk or cytotoxic compounds.To align with stringent global regulatory expectations, companies are investing in validated, integrity-tested transfer technologies. Automation of material entry, barcoding, and integration with manufacturing execution systems (MES) is further reducing human error. Innovations in gamma-stable packaging materials and leak-proof designs are also supporting safe and scalable aseptic processes, especially for biologics and cell-based products.

Where Is Demand Increasing and Which Applications Are Expanding Adoption?

Demand for aseptic transfer solutions is expanding across sterile injectable facilities, biotech production units, and advanced therapy manufacturing suites. The growth of parenteral drug manufacturing and cell and gene therapy facilities is increasing demand for flexible, closed-system transfer solutions. Contract development and manufacturing organizations (CDMOs) are also significant adopters due to the need for high sterility assurance across multiple clients and products.Emerging markets are scaling up infrastructure for sterile injectables, prompting increased demand for modular aseptic transfer systems. North America and Europe lead in advanced facility investments, while Asia-Pacific is experiencing rapid growth in small-scale biologics and vaccine manufacturing. Pharmaceutical firms are increasingly prioritizing contamination control measures to comply with EU Annex 1 and FDA aseptic processing guidelines.

Growth in the Pharmaceutical Aseptic Transfer market is driven by several factors

Growth in the pharmaceutical aseptic transfer market is driven by increased production of sterile biologics, stricter regulatory enforcement of contamination control, and expansion of modular cleanroom and isolator technologies. Widespread adoption of single-use transfer systems, validated RTP devices, and integrity-tested packaging solutions is supporting manufacturing efficiency and sterility assurance.Higher adoption of closed systems in cytotoxic drug manufacturing, increased use of isolators in fill-finish operations, and demand for seamless integration with barrier systems are also contributing to market growth. Investments in high-speed aseptic filling lines, continuous manufacturing infrastructure, and personalized medicine production are further boosting reliance on advanced transfer technologies designed to maintain sterility and minimize risk.

Scope Of Study:

The report analyzes the Pharmaceutical Aseptic Transfer market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: System Type (Liquid Transfer System, Solid Transfer System); Usability (Single-Use, Multiple-Use); End-Use (Pharmaceuticals Companies End-Use, Contract Development & Manufacturing Organizations End-Use, Other End-Uses)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Liquid Transfer System segment, which is expected to reach US$1.1 Billion by 2030 with a CAGR of a 6.1%. The Solid Transfer System segment is also set to grow at 10.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $307.8 Million in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $369.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Aseptic Transfer Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Aseptic Transfer Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Aseptic Transfer Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABC Transfer, AES Clean Technology, Aseptic Technologies, Belimed Life Science AG, ChargePoint Technology and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Pharmaceutical Aseptic Transfer market report include:

- ABC Transfer

- AES Clean Technology

- Aseptic Technologies

- Belimed Life Science AG

- ChargePoint Technology

- Colanar Inc.

- Dec Group (Dietrich Engineering)

- Ecolab Life Sciences

- Franz Ziel GmbH

- Getinge AB

- ILC Dover

- Ortner Reinraumtechnik GmbH

- Pall Corporation

- Pharmaflex RX

- Skan AG

- Steriline S.r.l.

- Telstar (Azbil Corporation)

- Tema Sinergie S.p.A.

- Vanrx Pharmasystems (Cytiva)

- Walker Barrier Systems

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABC Transfer

- AES Clean Technology

- Aseptic Technologies

- Belimed Life Science AG

- ChargePoint Technology

- Colanar Inc.

- Dec Group (Dietrich Engineering)

- Ecolab Life Sciences

- Franz Ziel GmbH

- Getinge AB

- ILC Dover

- Ortner Reinraumtechnik GmbH

- Pall Corporation

- Pharmaflex RX

- Skan AG

- Steriline S.r.l.

- Telstar (Azbil Corporation)

- Tema Sinergie S.p.A.

- Vanrx Pharmasystems (Cytiva)

- Walker Barrier Systems

Table Information

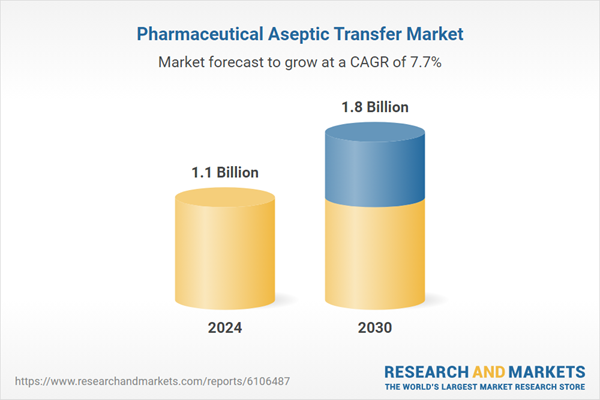

| Report Attribute | Details |

|---|---|

| No. of Pages | 361 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 1.1 Billion |

| Forecasted Market Value by 2030 | 1.8 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |