Global Pharmaceutical Automation Market - Key Trends & Drivers Summarized

Why Is Automation Becoming Fundamental in Pharmaceutical Manufacturing?

Pharmaceutical automation involves the use of control systems, robotics, and digital tools to perform manufacturing, packaging, inspection, and material handling processes with minimal human intervention. It improves product consistency, reduces contamination risks, and enhances regulatory compliance. As pharmaceutical products become more complex and production volumes grow, automation is playing a central role in ensuring efficiency and traceability.Automation spans upstream and downstream processes, including formulation, aseptic filling, inspection, labeling, and warehousing. Automated systems ensure batch accuracy, real-time monitoring, and documentation for regulatory audits. Robotics are particularly valuable in reducing manual handling in sterile environments and high-containment zones, where safety and precision are critical.

How Are Technologies Advancing and Where Are They Being Applied?

Modern pharmaceutical automation is integrating programmable logic controllers (PLCs), distributed control systems (DCS), and manufacturing execution systems (MES). These tools support process consistency, batch monitoring, and deviation control. Robotics are increasingly used for packaging, vial filling, syringe handling, and visual inspection of finished products.Adoption of process analytical technology (PAT) and digital twins is advancing real-time process monitoring and predictive control. Automated guided vehicles (AGVs) are being deployed in warehouse logistics, while cleanroom-compatible robots are entering aseptic and hazardous production lines. Artificial intelligence and machine learning are also being applied to predictive maintenance, yield optimization, and quality risk assessment.

Where Is Automation Being Deployed Most Aggressively and in Which Product Areas?

Large-scale biologics, vaccine production, and sterile injectable facilities are leading in automation adoption due to high process sensitivity and the need for consistent contamination control. Oral solid dosage manufacturing lines are also automated for granulation, blending, and tablet coating. High-throughput facilities in North America, Europe, and Japan are incorporating automation to reduce operational costs and increase output predictability.In developing markets, pharmaceutical companies are beginning to automate packaging lines, warehouse operations, and quality control units. CDMOs and generics manufacturers are investing in automation to maintain competitiveness and ensure compliance with international standards. Automation is also being used to support small-batch production in personalized medicine and niche biologics.

Growth in the Pharmaceutical Automation market is driven by several factors

Growth in the pharmaceutical automation market is driven by increasing complexity of drug manufacturing, need for contamination-free production, and adoption of scalable, data-driven process control systems. Expansion of biologics manufacturing, rise of cell and gene therapy platforms, and stricter global quality requirements are encouraging automation across all production phases.Wider use of MES, robotics in aseptic zones, and real-time quality inspection tools is enabling manufacturers to improve traceability and reduce error rates. Investments in continuous manufacturing, automated visual inspection, and high-speed fill-finish lines are also expanding the market. As regulatory expectations for data integrity and process validation grow, pharmaceutical automation is becoming integral to future-ready production infrastructure.

Scope Of Study:

The report analyzes the Pharmaceutical Automation market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Component (Solutions Component, Services Component); Automation Mode (Semi-Automatic Systems, Fully Automatic Systems); End-Use (Pharmaceuticals End-Use, Biotech End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$12.9 Billion by 2030 with a CAGR of a 8.2%. The Services Component segment is also set to grow at 11.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 12.6% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Automation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Automation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Automation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd, ACG Group, Aerotech Inc., ATS Corporation, Bausch+Ströbel Maschinenfabrik and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Pharmaceutical Automation market report include:

- ABB Ltd

- ACG Group

- Aerotech Inc.

- ATS Corporation

- Bausch+Ströbel Maschinenfabrik

- Bosch Rexroth AG

- Brooks Automation (now Azenta)

- Festo AG & Co. KG

- Honeywell International Inc.

- IMA Group

- Körber Pharma

- Marchesini Group

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Romaco Group

- Schneider Electric

- Siemens AG

- Systec & Services GmbH

- Yaskawa Electric Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- ACG Group

- Aerotech Inc.

- ATS Corporation

- Bausch+Ströbel Maschinenfabrik

- Bosch Rexroth AG

- Brooks Automation (now Azenta)

- Festo AG & Co. KG

- Honeywell International Inc.

- IMA Group

- Körber Pharma

- Marchesini Group

- Mitsubishi Electric Corporation

- Omron Corporation

- Rockwell Automation, Inc.

- Romaco Group

- Schneider Electric

- Siemens AG

- Systec & Services GmbH

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 371 |

| Published | February 2026 |

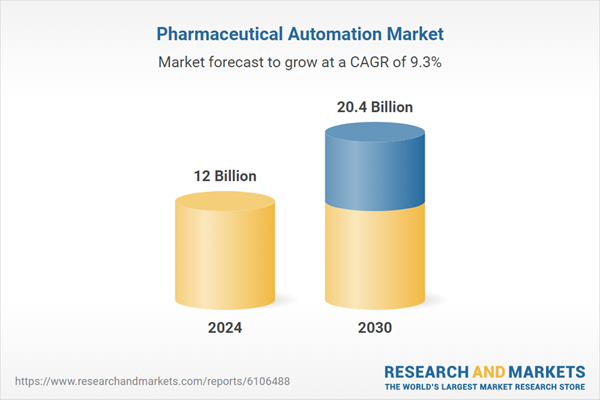

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 12 Billion |

| Forecasted Market Value by 2030 | 20.4 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | Global |