Global Platform Supply Vessels Market - Key Trends & Drivers Summarized

Navigating the Strategic Maritime Backbone of Offshore Energy Logistics and Infrastructure SupportWhy Are Platform Supply Vessels Critical to Offshore Oil & Gas Operations?

Platform supply vessels (PSVs) are purpose-built ships designed to transport essential cargo and equipment between shore bases and offshore drilling and production platforms. These vessels are indispensable to the functioning of offshore oil and gas installations, supporting logistics chains with dry bulk (cement, barite, bentonite), liquid cargo (fuel, drilling mud, potable water), and deck loads such as risers, pipes, containers, and spare parts. PSVs are built with dynamic positioning systems, firefighting capabilities, and large open decks-often exceeding 700 m²-to meet the multi-role demands of exploration, production, and decommissioning stages. A typical PSV is equipped with redundant propulsion systems and Class 2 or Class 3 dynamic positioning (DP) technology, allowing safe station-keeping near offshore rigs in high-sea conditions. Their role extends beyond logistics into standby rescue support, waste transport, and chemical dispersant deployment. Some advanced models also integrate moonpools and ROV handling systems, making them suitable for subsea inspection and light intervention work. The market features a range of PSV sizes-small vessels (< 2500 DWT), medium (2500-3500 DWT), and large (>3500 DWT)-each serving different field sizes and water depths.Which Markets and Offshore Segments Are Fueling Demand for PSVs Globally?

The global offshore oil and gas industry is the principal driver of PSV demand. Shallow water oilfields in the Gulf of Mexico, North Sea, West Africa, and Southeast Asia continue to rely heavily on medium-sized PSVs for regular logistics. In deepwater and ultra-deepwater fields-particularly in Brazil and Guyana-there is rising demand for high-capacity, DP2/DP3 PSVs with long endurance and hybrid propulsion to reduce fuel costs. The global rig count, field development activity, and E&P spending directly influence PSV deployment cycles and vessel charter rates. Floating production storage and offloading (FPSO) facilities represent another key segment where PSVs are deployed for continuous support. As FPSO fleets grow, especially in Latin America and Asia-Pacific, associated PSV activity is increasing. The Arctic region and harsh environment projects, including those off Norway and Canada, are creating demand for ice-class PSVs with specialized hull reinforcement and de-icing systems. In addition, the Middle East market, led by Qatar, UAE, and Saudi Arabia, is ramping up offshore expansion, further expanding the PSV fleet requirement.The offshore wind energy sector is beginning to emerge as a secondary market for PSVs. Repurposed and dual-use PSVs are being deployed for wind turbine component transport, cable laying assistance, and crew transfer operations. As Europe, China, and the U.S. expand offshore wind capacity, opportunities for hybrid or retrofitted PSVs with environmental certifications are growing. Governments and operators are beginning to prefer low-emission vessels compliant with IMO Tier III and Energy Efficiency Design Index (EEDI) guidelines, which is reshaping procurement patterns in greenfield projects.

What Technical Innovations Are Advancing PSV Efficiency and Capabilities?

The PSV market is undergoing rapid transformation through digital integration, fuel optimization, and multifunctional vessel design. Hybrid propulsion systems that combine diesel-electric engines with battery packs are being deployed to reduce emissions, improve fuel efficiency, and support low-speed maneuvering. Leading shipbuilders are now offering modular PSV designs with interchangeable cargo tanks and deck configurations, allowing operators to switch between drilling support and renewable energy logistics roles. Advanced navigation and automation features such as DP-assisted auto-docking, remote condition monitoring, and AI-powered fuel management systems are being integrated into modern PSVs. These capabilities improve operational safety, reduce crew workload, and enhance voyage planning, especially in congested or environmentally sensitive zones. Additionally, liquefied natural gas (LNG) and methanol-powered PSV variants are being introduced to meet the decarbonization goals of operators with ESG mandates.Digital twin platforms are being used to simulate vessel performance under varying sea states, cargo loads, and engine configurations. This data is enabling predictive maintenance and reducing unplanned downtime. Modular accommodation units, improved HVAC systems, and ergonomic bridge designs are also elevating onboard crew welfare. Furthermore, class societies are encouraging smart certification for PSVs equipped with cyber-secure architecture and digital compliance logging, expanding their appeal among global charterers.

What Market Dynamics Are Steering the Future of Platform Supply Vessels?

The growth in the platform supply vessels market is driven by several factors rooted in global offshore energy expansion, vessel replacement cycles, and operational optimization. A central growth driver is the rebound in offshore oil and gas exploration after years of underinvestment. With Brent crude stabilizing above cost-recovery thresholds and new field licenses being issued across Brazil, West Africa, and Southeast Asia, operators are securing PSV charters to support ramp-up activities. Older tonnage (>20 years) is being phased out, prompting orders for next-generation, low-emission PSV designs. Another driver is the rising complexity of offshore logistics operations. As multi-well platforms and FPSOs increase in number, the demand for higher-deck capacity, faster turnaround time, and automated cargo handling is growing. Ports are also upgrading infrastructure to accommodate PSVs with larger beam and deeper drafts, enabling more efficient loading/unloading cycles. Additionally, regional cabotage rules and local content mandates in Brazil, Nigeria, and Indonesia are stimulating investment in domestic PSV fleets through joint ventures and leasing models.Environmental regulations are reshaping the market, with charterers increasingly seeking vessels that meet IMO 2023 emissions limits, ballast water treatment mandates, and reduced fuel burn per ton-mile. Offshore wind development is creating auxiliary PSV demand, particularly for supply chain functions during installation and maintenance phases. Furthermore, the digital transformation of offshore logistics-via satellite-based fleet tracking, smart inventory systems, and charter management portals-is enhancing visibility and cost control, encouraging wider PSV adoption among integrated service providers.

Scope Of Study:

The report analyzes the Platform Supply Vessels market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Type (Below 3000 DWT, Above 3000 DWT); Type (Cargo Type, Support Type); Fuel (Diesel Fuel, LNG Fuel, Electric Fuel, Hybrid Fuel); Application (Oil & Gas Production Application, Offshore Construction Application, Military Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 3000 DWT segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 2.8%. The Above 3000 DWT segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $901.0 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $776.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Platform Supply Vessels Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Platform Supply Vessels Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Platform Supply Vessels Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.P. Moller-Maersk (Maersk Supply Service), Bourbon Offshore, Bumi Armada Berhad, China Oilfield Services (COSL), DOF Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Platform Supply Vessels market report include:

- A.P. Moller-Maersk (Maersk Supply Service)

- Bourbon Offshore

- Bumi Armada Berhad

- China Oilfield Services (COSL)

- DOF Group

- Edison Chouest Offshore (ECO)

- Eidesvik Offshore

- Harvey Gulf International Marine

- Havila Shipping

- Hornbeck Offshore Services

- Island Offshore Management AS

- Maersk Supply Service

- Pacific Radiance Ltd.

- Rem Offshore

- Seacor Marine Holdings

- Siem Offshore AS

- Solstad Offshore ASA

- Swire Pacific Offshore

- Tidewater Inc.

- Vroon Offshore Services (VOS)

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- A.P. Moller-Maersk (Maersk Supply Service)

- Bourbon Offshore

- Bumi Armada Berhad

- China Oilfield Services (COSL)

- DOF Group

- Edison Chouest Offshore (ECO)

- Eidesvik Offshore

- Harvey Gulf International Marine

- Havila Shipping

- Hornbeck Offshore Services

- Island Offshore Management AS

- Maersk Supply Service

- Pacific Radiance Ltd.

- Rem Offshore

- Seacor Marine Holdings

- Siem Offshore AS

- Solstad Offshore ASA

- Swire Pacific Offshore

- Tidewater Inc.

- Vroon Offshore Services (VOS)

Table Information

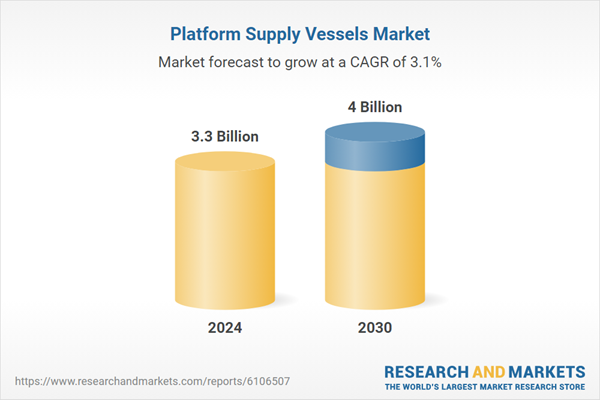

| Report Attribute | Details |

|---|---|

| No. of Pages | 383 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 3.3 Billion |

| Forecasted Market Value by 2030 | 4 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |