Global Pneumatic Waste Collection Services Market - Key Trends & Drivers Summarized

Reinventing Urban Sanitation: How Underground Waste Transport Is Shaping Smart and Sustainable CitiesWhat Makes Pneumatic Waste Collection a Revolutionary Urban Waste Management Solution?

Pneumatic Waste Collection Systems (PWCS), also known as automated waste collection systems (AWCS), represent a paradigm shift in municipal sanitation. These systems transport waste through underground pneumatic tubes using airflow or vacuum pressure, eliminating the need for traditional surface-level waste bins and collection trucks. Waste is deposited into designated inlet points across residential buildings, commercial spaces, or public zones and transported at high velocity to centralized collection terminals for compaction, sorting, or disposal. The key advantage lies in minimizing street-level clutter, odors, noise, and emissions while ensuring hygienic, on-demand waste disposal. These systems typically segregate waste at source across multiple inlet chutes for organic, recyclable, and general waste streams. High-speed airflow-generated by fans or vacuum pumps-moves the waste through underground conduits to a terminal facility located on the city periphery. These facilities may integrate with material recovery centers or incinerators, enabling complete system-level integration from waste origin to endpoint. Modern PWCS installations are equipped with real-time monitoring systems, flow sensors, and automated controls to optimize operational efficiency and detect blockages or contamination events.Which Urban Environments and Institutional Stakeholders Are Driving Adoption of Pneumatic Waste Collection?

Municipal governments in high-density urban areas are among the earliest and most prominent adopters of pneumatic waste collection services. Cities with spatial constraints, high pedestrian traffic, and sustainability mandates-such as Stockholm, Seoul, Singapore, and Dubai-have implemented or piloted AWCS systems in residential districts, commercial hubs, and mixed-use developments. These systems help free up valuable real estate by removing above-ground bins and reduce heavy vehicle traffic in narrow or historic areas where conventional waste logistics are challenging. Public housing authorities and private real estate developers are increasingly incorporating PWCS infrastructure into large-scale housing projects and master-planned communities. Integration at the design phase allows for streamlined waste flow, reduced operating costs, and long-term cleanliness. Airports, hospitals, stadiums, and universities are emerging as specialized use cases, where the high volume of waste, tight operational timelines, and hygiene requirements make pneumatic systems attractive. For example, Changi Airport and Disney resorts have both deployed closed-loop AWCS systems to enhance operational efficiency and public experience.Industrial zones and food processing parks are also evaluating PWCS services to manage organic and hazardous waste more securely and discreetly. These systems minimize manual handling, potential contamination, and pest activity while facilitating integration with internal waste treatment units. Finally, government urban planning departments and smart city development boards are partnering with service providers to incorporate pneumatic waste systems as part of future-ready sanitation infrastructure.

How Are Service Models, Technologies, and Integration Capabilities Evolving in This Market?

Pneumatic waste collection services are evolving from fixed-installation CAPEX-intensive models to flexible, modular systems supported by service-based OPEX models. Vendors are offering build-operate-transfer (BOT), leasing, and design-operate-maintain (DOM) contracts to make systems viable for municipalities and large private clients. Some service providers now bundle waste collection with maintenance, analytics dashboards, and system upgrades under long-term contracts. Technologically, systems are becoming smarter, more scalable, and digitally integrated. Advanced control algorithms optimize fan operation, waste flow timing, and terminal load balancing, resulting in lower energy consumption and noise levels. IoT-based sensors are used to monitor waste volume at inlet stations and detect potential blockages, wear in pipe joints, or unauthorized waste dumping. Digital twins of entire AWCS networks are being developed for predictive maintenance and real-time system management.Multistream systems that handle segregated waste types using dedicated piping and inlet modules are being introduced to support sustainability mandates. Modular inlet designs now support retrofitting into existing buildings without major structural modifications. Centralized terminals are increasingly being co-located with composting or material recovery facilities (MRFs) to create circular sanitation ecosystems. AI and robotic sorters at terminals are enhancing the recycling potential of captured waste while reducing contamination levels. To support sustainable urban development, some vendors are integrating PWCS infrastructure into underground utility corridors, combining waste, water, power, and telecom pipelines. This integrated subterranean infrastructure model is being piloted in smart city corridors in the Middle East, Northern Europe, and parts of East Asia.

What Are the Primary Market Drivers Accelerating Global Demand for Pneumatic Waste Collection Services?

The growth in the pneumatic waste collection services market is driven by several interrelated trends including urban densification, smart city planning, environmental regulation, and citizen-centric infrastructure development. A primary driver is the urgent need for cleaner, quieter, and more space-efficient waste collection methods in rapidly urbanizing regions. Cities with space constraints, traffic congestion, and aesthetic preservation goals are turning to PWCS to eliminate traditional waste trucks and curbside bins from public spaces. Environmental regulations and zero-emission goals are catalyzing investment in underground waste networks that reduce the carbon footprint of municipal solid waste (MSW) logistics. AWCS systems reduce daily fuel consumption, noise pollution, and air quality impacts associated with diesel-powered garbage trucks. Additionally, labor shortages in the sanitation sector and rising costs of manual waste collection are prompting city councils to evaluate automation as a strategic alternative.The smart city movement and associated funding from national governments, multilateral institutions, and PPP models are making large-scale AWCS installations financially feasible. Integrated waste analytics, performance dashboards, and digital citizen feedback loops are aligning PWCS projects with broader digital urban governance goals. In emerging markets, government-sponsored housing projects and SEZs (special economic zones) are being targeted for initial deployments, where centralized planning allows for embedded infrastructure from the outset.

Public health concerns, particularly in the aftermath of the COVID-19 pandemic, have heightened demand for contactless waste handling solutions. Pneumatic systems eliminate open waste accumulation, reduce pest-related disease vectors, and limit human exposure-making them an ideal option in hospitals, food markets, and tourist zones. As cities seek long-term resilience and hygiene optimization, pneumatic waste collection services are expected to become a standard component of modern urban infrastructure planning.

Scope Of Study:

The report analyzes the Pneumatic Waste Collection Services market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: End-Use (Hospitals End-Use, Hostels / Restaurants End-Use, Airports End-Use, Educational Institutes End-Use, Other End-Uses)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hospitals End-Use segment, which is expected to reach US$178.1 Million by 2030 with a CAGR of a 7.0%. The Hostels / Restaurants End-Use segment is also set to grow at 8.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $91.1 Million in 2024, and China, forecasted to grow at an impressive 11.3% CAGR to reach $106.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pneumatic Waste Collection Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pneumatic Waste Collection Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pneumatic Waste Collection Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AERBIN APS, Aerobin (part of Ecosir Group), Air-Log International GmbH, AMCS Group, Atreo and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Pneumatic Waste Collection Services market report include:

- AERBIN APS

- Aerobin (part of Ecosir Group)

- Air-Log International GmbH

- AMCS Group

- Atreo

- AWC Berhad

- Caverion Corporation

- Ecosir Group Oy

- Envac

- G.F. Puhl

- GreenWave Solutions

- Logiwaste AB

- MariMatic Oy

- Peakway Environmental Sci & Tech Co.

- Stream Environment Sdn. Bhd.

- URD - Urban Refuse Development SL

- Veolia

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AERBIN APS

- Aerobin (part of Ecosir Group)

- Air-Log International GmbH

- AMCS Group

- Atreo

- AWC Berhad

- Caverion Corporation

- Ecosir Group Oy

- Envac

- G.F. Puhl

- GreenWave Solutions

- Logiwaste AB

- MariMatic Oy

- Peakway Environmental Sci & Tech Co.

- Stream Environment Sdn. Bhd.

- URD – Urban Refuse Development SL

- Veolia

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

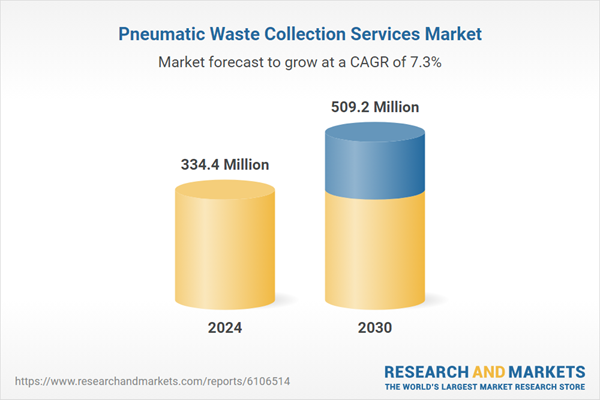

| Estimated Market Value in 2024 | 334.4 Million |

| Forecasted Market Value by 2030 | 509.2 Million |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |