Global Rotorcraft Blade Systems Market - Key Trends & Drivers Summarized

What Role Are Advanced Materials Playing in Shaping Next-Gen Rotorcraft Blades?

Rotorcraft blade systems are undergoing a fundamental transformation driven by the demand for improved performance, durability, and operational efficiency in both military and civilian aviation segments. A major factor fueling this evolution is the increasing use of advanced composite materials-such as carbon fiber reinforced polymers (CFRP), fiberglass, and aramid fibers-in blade manufacturing. These materials offer superior strength-to-weight ratios, corrosion resistance, and fatigue durability compared to traditional metal-based designs. The adoption of such lightweight materials significantly reduces rotor inertia, allowing helicopters and tiltrotor aircraft to respond faster to pilot inputs, improve fuel efficiency, and extend operational ranges. Additionally, these modern materials minimize vibrations and noise generation, meeting both regulatory and passenger comfort requirements.Thermoplastic composites are also gaining traction due to their recyclability, faster production cycles, and ability to maintain structural integrity under extreme conditions. Blade manufacturers are investing in hybrid material configurations that combine metals and composites, optimizing both stiffness and impact resistance. This hybrid approach helps rotorcraft endure demanding environments such as battlefield zones, offshore oil platforms, and high-altitude terrains. Enhanced resin systems and nano-engineered matrix materials are being explored to further improve the fatigue life and delamination resistance of rotor blades. These developments are not only extending the service life of rotorcraft but also reducing lifecycle costs and downtime through more predictable maintenance schedules and increased resilience to field-induced damage.

How Is Smart Blade Technology Changing the Dynamics of Rotorcraft Performance?

Technological advances are bringing intelligence to rotorcraft blade systems through the integration of active control mechanisms and real-time health monitoring capabilities. Smart blades, which use embedded sensors and actuators, are capable of adjusting blade pitch, camber, and twist during flight to adapt to aerodynamic conditions. This results in optimized lift-to-drag ratios, reduced vibration, and improved maneuverability. Systems like active blade tracking and Individual Blade Control (IBC) are becoming more common in advanced platforms, offering the ability to dampen oscillations and reduce acoustic signatures. Such capabilities are especially relevant in military stealth operations and urban air mobility vehicles, where low noise and smooth handling are critical.Health and usage monitoring systems (HUMS) are now embedded directly into rotorcraft blades, providing real-time diagnostics on stress, fatigue, delamination, and impact events. These smart monitoring systems reduce reliance on manual inspection cycles and allow predictive maintenance based on actual usage data. Additionally, blade designs are now incorporating features like trailing edge flaps, shape memory alloys, and morphing structures to further improve aerodynamic efficiency. Electric and hybrid-electric VTOL aircraft under development for urban air mobility are accelerating the adoption of such intelligent blade systems, where weight savings, quiet operation, and adaptive control are fundamental to commercial viability. As rotorcraft OEMs shift toward next-generation flight platforms, blade intelligence is expected to become a key performance differentiator.

Which End-User Segments and Regional Markets Are Fueling Demand for Rotorcraft Blade Innovations?

The rotorcraft blade systems market is primarily driven by defense applications, including tactical helicopters, maritime patrol, and heavy-lift utility aircraft. Military programs across the U.S., Russia, China, and NATO countries are continuously upgrading rotor blades to extend the operational envelope of legacy aircraft and equip next-generation platforms with higher maneuverability, speed, and survivability. For instance, the U.S. Army's Future Vertical Lift (FVL) program and India's Light Combat Helicopter (LCH) initiative have placed considerable emphasis on advanced rotor technologies that enhance flight performance in diverse operational theaters. The replacement and retrofitting of rotor blades on aging helicopter fleets in Eastern Europe and Southeast Asia are also contributing to sustained demand.On the civilian side, demand is being driven by sectors such as emergency medical services (EMS), search and rescue (SAR), offshore oil and gas logistics, and tourism. With increasing air traffic congestion and a renewed focus on point-to-point regional transport, rotorcraft are being positioned as fast, flexible, and low-infrastructure mobility solutions. Urban Air Mobility (UAM) concepts, including air taxis and electric VTOLs, are pushing manufacturers to innovate rotor blade systems with lower noise, higher power-to-weight ratios, and simplified maintenance. Regionally, North America and Western Europe lead in technology adoption, while emerging markets in the Middle East, Latin America, and Asia-Pacific are expected to register high growth due to rising investments in defense modernization and civil aviation infrastructure.

What Key Factors Are Accelerating Growth in the Rotorcraft Blade Systems Market?

The growth in the rotorcraft blade systems market is driven by several factors, including defense modernization, lightweighting trends, smart system integration, and the emergence of advanced air mobility platforms. Defense procurement programs focused on replacing aging helicopter fleets and improving mission readiness are acting as primary demand drivers. High-performance rotor blades extend mission duration, reduce fuel consumption, and allow for operation in more hostile environments-all of which align with evolving military doctrines. Additionally, rotorcraft used in border surveillance, disaster relief, and rapid troop deployment benefit from enhanced lift and low noise capabilities made possible by composite blade systems.In the civil domain, the growth of emergency and medical evacuation services, combined with expansion in offshore wind farms and energy logistics, is increasing rotorcraft utilization and in turn, demand for durable and efficient blade systems. The shift toward eVTOLs and hybrid rotorcraft is also expected to be a structural catalyst in the long term. Government support for noise abatement regulations and low-emission aviation technology is further incentivizing manufacturers to invest in high-performance rotor blade technologies. Finally, digital design tools, additive manufacturing, and materials science breakthroughs are lowering production costs and accelerating development timelines-enhancing supply chain agility and market responsiveness. These multifaceted drivers are collectively ensuring sustained innovation and market expansion for rotorcraft blade systems across both legacy and future-oriented aviation segments.

Scope Of Study:

The report analyzes the Rotorcraft Blade Systems market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Distribution Channel (OEM Distribution Channel, Aftermarket Distribution Channel); Application (Civil Application, Military Application)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the OEM Distribution Channel segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 4.7%. The Aftermarket Distribution Channel segment is also set to grow at 7.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $520.9 Million in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $439.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Rotorcraft Blade Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Rotorcraft Blade Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Rotorcraft Blade Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus Helicopters, Bell Textron Inc., Boeing (Rotorcraft Division), Carson Helicopters Inc., Dowty Propellers (GE Aerospace) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Rotorcraft Blade Systems market report include:

- Airbus Helicopters

- Bell Textron Inc.

- Boeing (Rotorcraft Division)

- Carson Helicopters Inc.

- Dowty Propellers (GE Aerospace)

- Ducommun Incorporated

- Enstrom Helicopter Corporation

- General Electric (GE Aerospace)

- GKN Aerospace

- Hindustan Aeronautics Ltd. (HAL)

- Kaman Corporation

- Kawasaki Aerospace Company

- Leonardo S.p.A.

- MD Helicopters

- Nordex SE

- NHIndustries

- Powerfin Propellers

- Robinson Helicopter Company

- Sikorsky Aircraft (Lockheed Martin)

- UMS Skeldar AG

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Helicopters

- Bell Textron Inc.

- Boeing (Rotorcraft Division)

- Carson Helicopters Inc.

- Dowty Propellers (GE Aerospace)

- Ducommun Incorporated

- Enstrom Helicopter Corporation

- General Electric (GE Aerospace)

- GKN Aerospace

- Hindustan Aeronautics Ltd. (HAL)

- Kaman Corporation

- Kawasaki Aerospace Company

- Leonardo S.p.A.

- MD Helicopters

- Nordex SE

- NHIndustries

- Powerfin Propellers

- Robinson Helicopter Company

- Sikorsky Aircraft (Lockheed Martin)

- UMS Skeldar AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 171 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

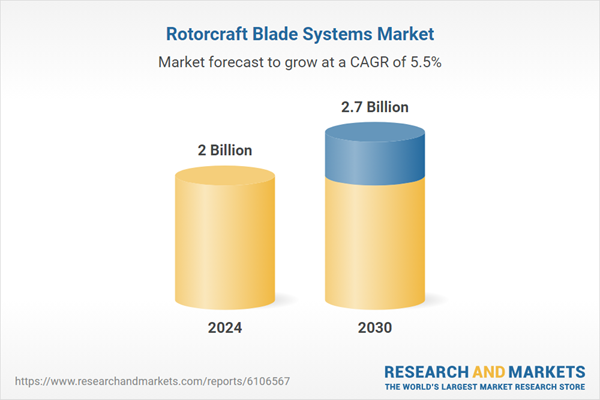

| Estimated Market Value in 2024 | 2 Billion |

| Forecasted Market Value by 2030 | 2.7 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |