Global Individually Quick Frozen (IQF) Vegetables Market - Key Trends & Drivers Summarized

Why Are IQF Vegetables Gaining Ground in Modern Food Consumption Habits?

Individually Quick Frozen (IQF) vegetables are rapidly becoming a staple in households and commercial kitchens alike due to their convenience, nutritional retention, and long shelf life. Unlike traditional freezing methods, IQF technology freezes each vegetable piece separately at extremely low temperatures, preserving texture, color, and nutrient profile. This makes the final product visually appealing and easier to use in portion-controlled servings, which is highly valued by both consumers and food service operators. The modern consumer's fast-paced lifestyle has increased demand for ready-to-use foods that do not compromise on health or flavor, and IQF vegetables provide an ideal solution. They eliminate the need for washing, peeling, or chopping, making meal preparation faster without sacrificing quality. Moreover, the ability to store them for long periods without preservatives appeals to the growing market segment concerned with clean-label foods. Seasonal availability is another factor that drives demand, as IQF vegetables offer access to out-of-season produce year-round. Restaurants and institutional kitchens also rely on IQF vegetables to maintain consistency in taste and portion sizes across menus. The rise of plant-based diets and the broader health and wellness trend have further enhanced the appeal of IQF vegetables, positioning them not just as a time-saving option but as a key component of balanced nutrition. This shift in eating behavior reflects a broader transition toward practical, nutritious, and waste-reducing food solutions.How Is Technology Enhancing Product Quality and Expanding the Application of IQF Vegetables?

Recent technological advancements in freezing methods, sorting machinery, and packaging solutions are significantly elevating the quality and range of IQF vegetable offerings. Newer IQF tunnel freezers are capable of achieving ultra-fast freezing rates, which prevent the formation of large ice crystals that can damage vegetable cell structures. As a result, the vegetables maintain their original shape, crunch, and taste even after thawing. Innovations in optical sorting and robotic handling are improving product uniformity and reducing contamination risks, leading to higher consumer satisfaction and reduced rejection rates in bulk processing operations. Vacuum packaging and recyclable multilayer films are also being adopted to improve shelf life and sustainability. Additionally, manufacturers are investing in specialized IQF processing lines that cater to specific vegetable types, ensuring that sensitive items like spinach or asparagus are treated differently than more robust vegetables like carrots or peas. These enhancements are broadening the application scope of IQF vegetables into ready meals, soups, smoothies, and even baby food segments. Customizable vegetable mixes and value-added products such as herbed or pre-seasoned vegetables are becoming popular in retail and food service, offering greater culinary versatility. Automation and data analytics are further refining supply chains, enabling processors to respond quickly to demand spikes while minimizing energy and resource consumption. The cumulative impact of these technological improvements is a more sophisticated and diversified IQF market that meets the evolving demands of both health-conscious consumers and operationally efficient businesses.What Market and Consumer Trends Are Driving IQF Vegetable Adoption Globally?

The global demand for IQF vegetables is being shaped by a complex web of market trends and shifting consumer preferences that favor health, convenience, and sustainability. One of the strongest trends is the global rise in dual-income households, where both partners work and have limited time for elaborate cooking routines. In such scenarios, IQF vegetables offer a perfect solution by drastically reducing prep time while enabling nutritious home-cooked meals. Another significant factor is the increasing awareness of food waste, which IQF products help combat through portion control and extended usability. Younger consumers, especially millennials and Gen Z, are embracing frozen vegetables for their practicality and compatibility with diverse culinary preferences, from stir-fries to grain bowls. In many urban centers, limited kitchen space and smaller refrigerators make frozen products a logical choice over bulky fresh produce that spoils quickly. The growing emphasis on plant-based eating and vegetarian lifestyles is also spurring demand, as frozen vegetables provide consistent availability and variety that fresh produce sections may lack. Retailers are expanding their frozen food sections to include more IQF vegetable options, often collaborating with local farms or co-branding with wellness influencers to target niche audiences. Simultaneously, food service providers and institutional buyers are increasing their IQF procurement to ensure consistency in quality and cost. Rising incomes in developing economies are further democratizing access to frozen foods, while improvements in cold chain logistics are making it feasible to distribute IQF vegetables across broader geographies. These overlapping trends are creating a dynamic market landscape where IQF vegetables are no longer viewed as a compromise but rather as a smart, modern food choice.What Factors Are Fueling the Growth of the Global IQF Vegetables Market?

The growth in the Individually Quick Frozen (IQF) vegetables market is driven by several interlinked factors, each contributing to the broadening appeal and expanding footprint of the product category across both developed and developing regions. A primary growth catalyst is the increasing demand for convenient and time-saving food options that align with busy lifestyles without sacrificing health benefits. As more consumers prioritize home-cooked meals and meal-prepping habits, IQF vegetables provide a ready resource that fits seamlessly into those routines. The enhanced shelf life of frozen vegetables compared to their fresh counterparts also appeals to budget-conscious consumers looking to minimize grocery trips and avoid spoilage. Rising urbanization, improved access to electricity, and expanding freezer ownership in emerging markets are enabling more households to adopt frozen food habits. Additionally, the food service industry, including fast-casual restaurants, catering services, and institutional kitchens, continues to drive high-volume demand due to the operational efficiencies IQF products offer. The availability of global cuisines and fusion recipes has also led to increased usage of specific vegetable varieties that may not be available fresh in local markets, further supporting IQF product relevance. On the supply side, agricultural surpluses and government support for food preservation methods are encouraging farmers and processors to invest in IQF infrastructure. Sustainability considerations are another growth driver, as freezing helps reduce post-harvest losses and supports more predictable year-round supply chains. Retail innovation, including improved labeling, resealable packs, and smaller portion sizes, is making IQF vegetables more attractive to diverse consumer segments. Collectively, these drivers are not only expanding market volume but also transforming IQF vegetables into an essential component of the global food economy.Report Scope

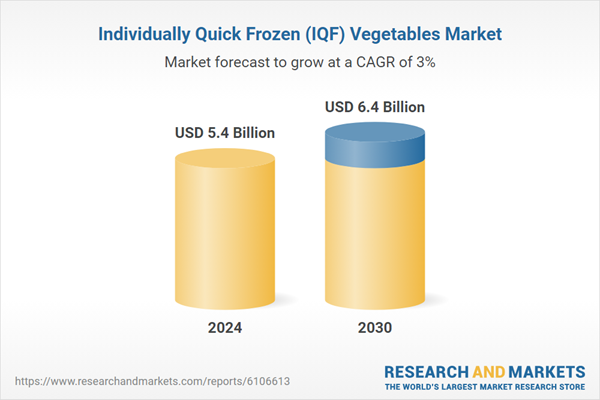

The report analyzes the Individually Quick Frozen (IQF) Vegetables market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Distribution Channel (B2B Distribution Channel, Supermarket / Hypermarket, Online Distribution Channel).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the B2B Distribution Channel segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of a 3.7%. The Supermarket / Hypermarket segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 3% CAGR to reach $1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Individually Quick Frozen (IQF) Vegetables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Individually Quick Frozen (IQF) Vegetables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Individually Quick Frozen (IQF) Vegetables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ambu A/S, BD (Becton, Dickinson & Co.), Bio-Med Devices, Inc., Drägerwerk AG & Co. KGaA, Fisher & Paykel Healthcare and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Individually Quick Frozen (IQF) Vegetables market report include:

- Ardo Group

- B&G Foods, Inc.

- Bonduelle Group

- Capricorn Food Products India

- Congelados Navarra S.A.

- Dole Food Company, Inc.

- Earthbound Farm

- Findus Sverige AB

- GIVREX

- Greenyard NV

- JR Simplot Company

- McCain Foods Limited

- Nature's Touch Frozen Foods

- Nomad Foods Ltd.

- Pinnacle Foods Inc.

- Shimla Hills Offerings Pvt Ltd

- Sinofrost Co. Ltd.

- Sun Impex International Foods

- Titan Frozen Fruits

- Virto Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ardo Group

- B&G Foods, Inc.

- Bonduelle Group

- Capricorn Food Products India

- Congelados Navarra S.A.

- Dole Food Company, Inc.

- Earthbound Farm

- Findus Sverige AB

- GIVREX

- Greenyard NV

- JR Simplot Company

- McCain Foods Limited

- Nature's Touch Frozen Foods

- Nomad Foods Ltd.

- Pinnacle Foods Inc.

- Shimla Hills Offerings Pvt Ltd

- Sinofrost Co. Ltd.

- Sun Impex International Foods

- Titan Frozen Fruits

- Virto Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 6.4 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |