Global Industrial Lubricant Additives Market - Key Trends & Drivers Summarized

Why Are Lubricant Additives Essential for Modern Industrial Machinery Performance?

Industrial lubricant additives play a fundamental role in enhancing the performance, longevity, and reliability of machinery used in manufacturing, transportation, energy production, and heavy-duty operations. While base oils serve as the primary carrier fluid, it is the additive packages that transform these oils into high-performance lubricants capable of withstanding extreme pressure, high temperatures, and aggressive contaminants. Additives are specifically designed to reduce friction and wear, prevent oxidation and corrosion, disperse sludge and deposits, and maintain viscosity under varying load conditions. In environments where mechanical parts operate continuously under high stress and speed, such as power plants, mining rigs, and steel mills, the failure of lubrication systems due to inadequate additives can lead to catastrophic equipment breakdowns and expensive downtime. This has made lubricant additives an indispensable component in preventive maintenance strategies across sectors. Different types of additives serve unique purposes, such as anti-wear agents, viscosity modifiers, antioxidants, rust inhibitors, and detergents. Together, these components ensure that the lubricant performs reliably over long service intervals and under fluctuating operational demands. In modern industrial systems where automation and precision are increasingly important, even minor inefficiencies in lubrication can lead to performance degradation. As a result, the engineering of lubricant additives has evolved to address more complex performance requirements, providing customized solutions for each industrial segment. Without these chemical enhancers, base oils alone would not meet the rigorous standards of modern mechanical systems, making lubricant additives the unsung heroes behind smooth industrial operations.How Is Innovation Shaping the Capabilities of Lubricant Additive Formulations?

Technological advancements and evolving industrial requirements have pushed the boundaries of what lubricant additives can achieve, leading to increasingly sophisticated and efficient formulations. Innovation in this field is primarily driven by the dual need to enhance machinery performance while also meeting environmental regulations and sustainability goals. One of the most notable developments has been the shift toward ashless and low-sulfur additive technologies, which are crucial in reducing emissions and complying with international environmental standards. Advances in molecular chemistry have enabled the design of additives that perform specific tasks at the microscopic level, such as forming protective films only at high-contact points or neutralizing acids formed during fuel combustion. Synthetic esters and advanced polymers are also being used to create additives that maintain stability over longer periods and under harsher conditions. Additionally, the integration of nanotechnology is gaining traction, with nano-lubricants offering superior film strength, thermal conductivity, and anti-wear characteristics. Manufacturers are also investing in multifunctional additives that reduce the number of components required in a formulation, simplifying logistics and improving efficiency. Digital tools and simulation software are now being used to predict additive behavior under different operating conditions, accelerating the formulation process and enabling customization for specific equipment or industries. The rise of electric vehicles and renewable energy technologies has created new challenges, such as the need for coolants and lubricants that can perform in electrically sensitive environments. Lubricant additive innovation is therefore not just about improving performance but also about adapting to the changing technological landscape of global industry.What Factors Are Influencing Additive Demand Across Diverse Industrial Applications?

The demand for industrial lubricant additives is being shaped by a combination of evolving application needs, increasingly complex machinery, and stricter operational requirements. In the manufacturing sector, high-speed CNC machines, automated conveyor systems, and robotic arms require lubricants with precise viscosity control and thermal stability to ensure consistent performance. Similarly, in heavy industries like mining and construction, equipment operates under severe pressure and often in dusty or wet environments, requiring additives that can offer extreme pressure resistance and water separation capabilities. The marine industry demands anti-corrosion and demulsifying additives to protect engine and gearbox components from saltwater exposure and humidity. In the energy sector, especially within wind turbines and gas compressors, the need for long-drain interval lubricants that resist oxidation and deposit formation has significantly driven demand for high-quality additive packages. The growth of food-grade lubricants in the food and beverage industry is also contributing to specialized additive development that complies with non-toxicity and cleanliness standards without sacrificing performance. As industrial facilities become more automated and interconnected, machinery is expected to operate continuously for longer periods, which means lubricants must also provide extended protection and cleanliness under load. Furthermore, as global supply chains become more integrated, industrial manufacturers increasingly seek lubricants that perform consistently across geographies with varying climate and operating conditions. These cross-industry and cross-environment needs are compelling lubricant producers to collaborate more closely with additive suppliers to develop application-specific solutions. The broadening scope of industrial activity and the rising expectations for performance and reliability are making lubricant additives more central to every phase of machinery life, from commissioning to decommissioning.What Is Propelling the Accelerated Growth of the Industrial Lubricant Additives Market?

The growth in the industrial lubricant additives market is driven by several factors rooted in industrial modernization, stringent environmental mandates, and changing maintenance philosophies. One of the primary growth drivers is the increasing emphasis on operational efficiency and equipment longevity, especially in capital-intensive industries like aerospace, automotive manufacturing, steel production, and petrochemicals. As equipment becomes more complex and expensive, companies are prioritizing lubrication solutions that offer not just protection but also extend service intervals, reduce downtime, and support condition-based monitoring. Another major driver is regulatory pressure to reduce environmental impact, prompting the development and use of additives that enable bio-based and low-toxicity lubricants to match the performance of conventional options. The global shift toward sustainability and circular economy practices is encouraging the adoption of additives that enhance lubricant recyclability and reduce disposal volumes. Demand is also being bolstered by the growth of energy infrastructure, both traditional and renewable, where turbines, generators, and hydraulic systems all require high-performance lubricants with tailor-made additive packages. The rise of smart factories and Industry 4.0 is increasing demand for sensor-compatible, thermally stable, and multifunctional additives that can support predictive maintenance frameworks. Small and mid-sized manufacturers, once reluctant to invest in premium lubricant solutions, are now adopting advanced formulations to remain competitive, further expanding the customer base. The expansion of global trade and the increase in industrial activity in emerging markets, especially in Asia-Pacific and Latin America, are also fueling volume growth. Lastly, ongoing research and strategic collaborations between chemical companies and equipment manufacturers are accelerating the development of next-generation additive technologies. These dynamics are converging to drive robust, sustained growth in the industrial lubricant additives market across all geographies and industry verticals.Report Scope

The report analyzes the Industrial Lubricant Additives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Performance Enhancing Additives, Surface Protecting Additives, Lubricant Protecting Additives); Application (Engines Application, Gears Application, Hydraulic Systems Application, Steam Turbines Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Performance Enhancing Additives segment, which is expected to reach US$4.8 Billion by 2030 with a CAGR of a 1.6%. The Surface Protecting Additives segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 3.8% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Lubricant Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Lubricant Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Lubricant Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIT Products, Borescopes R Us, COBRA Vision GmbH, GE Inspection Technologies (Waygate Technologies), Gradient Lens Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Industrial Lubricant Additives market report include:

- Afton Chemical Corporation

- BASF SE

- BRB International BV

- Chevron Oronite Company LLC

- Croda International Plc

- Dorf Ketal Chemicals India Pvt. Ltd.

- Evonik Industries AG

- Infineum International Limited

- Jiangsu Zhongneng Chemical Technology Co., Ltd.

- Jinzhou Kangtai Lubricant Additives Co., Ltd.

- Koehler Instrument Company, Inc.

- LANXESS AG

- Lubrizol Corporation

- MidContinental Chemical Company, Inc. (MCC)

- Multisol Group Ltd.

- R.T. Vanderbilt Company, Inc.

- Sanyo Chemical Industries, Ltd.

- Shanghai Minglan Chemical Co., Ltd.

- Tianhe Chemicals Group Limited

- Vanderbilt Chemicals, LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemical Corporation

- BASF SE

- BRB International BV

- Chevron Oronite Company LLC

- Croda International Plc

- Dorf Ketal Chemicals India Pvt. Ltd.

- Evonik Industries AG

- Infineum International Limited

- Jiangsu Zhongneng Chemical Technology Co., Ltd.

- Jinzhou Kangtai Lubricant Additives Co., Ltd.

- Koehler Instrument Company, Inc.

- LANXESS AG

- Lubrizol Corporation

- MidContinental Chemical Company, Inc. (MCC)

- Multisol Group Ltd.

- R.T. Vanderbilt Company, Inc.

- Sanyo Chemical Industries, Ltd.

- Shanghai Minglan Chemical Co., Ltd.

- Tianhe Chemicals Group Limited

- Vanderbilt Chemicals, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

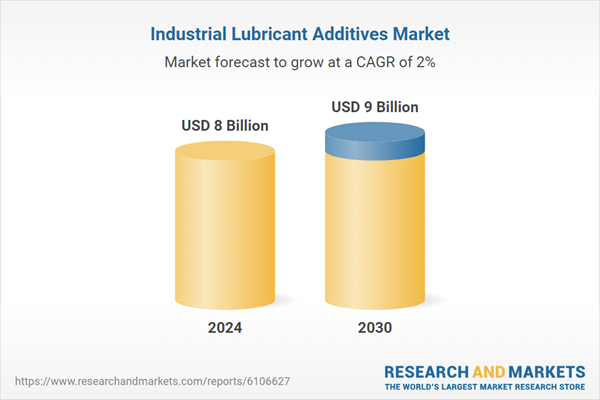

| Estimated Market Value ( USD | $ 8 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 2.0% |

| Regions Covered | Global |