Global Industrial Power Generation Market - Key Trends & Drivers Summarized

Is the Industrial Sector Ready for a New Era of Power Generation?

The industrial power generation market is experiencing a critical shift as industries worldwide confront the dual challenge of meeting escalating energy demands while complying with stringent sustainability mandates. Heavy industries such as steel, cement, mining, and petrochemicals are substantial energy consumers and are under pressure to secure stable, uninterrupted power supply amid rising fuel costs and grid instability. Consequently, industrial players are increasingly investing in dedicated on-site power generation systems that offer greater autonomy and operational resilience. While traditional fossil-fuel-based generators still dominate in many parts of the world, there is a growing shift toward hybrid systems that combine conventional sources with renewables such as solar and wind. These integrated solutions provide not only energy reliability but also help meet carbon reduction goals, a key concern in modern ESG frameworks. Another trend is the growing adoption of microgrids and distributed energy systems, especially in remote industrial locations where grid connectivity is either weak or non-existent. These systems enable localized energy generation and storage, allowing industries to reduce reliance on public grids and shield operations from outages and fluctuations. Additionally, energy-intensive sectors are deploying cogeneration and trigeneration systems to maximize energy efficiency, capturing waste heat for additional heating or cooling purposes. The emphasis on operational uptime, cost control, and environmental responsibility is fueling innovation across the industrial power generation ecosystem, fundamentally transforming how industries source and consume energy. As energy security becomes increasingly vital to maintaining industrial competitiveness, investments in advanced, self-sufficient power systems are becoming a strategic imperative.Can Technological Innovation Disrupt Traditional Power Generation Models?

Emerging technologies are playing a transformative role in reshaping the industrial power generation market, enabling more efficient, sustainable, and intelligent energy systems. One of the most significant developments is the rise of digital power management platforms that leverage AI and machine learning to optimize generation efficiency, anticipate maintenance needs, and minimize fuel consumption. These platforms integrate real-time data analytics to offer predictive insights, allowing plant operators to make informed decisions about load balancing, peak shaving, and equipment lifespan management. Additionally, advances in battery storage technologies are allowing for better integration of intermittent renewable sources such as solar and wind, making hybrid systems more reliable and feasible for round-the-clock industrial operations. Gas turbines and reciprocating engines, once considered mature technologies, are also seeing performance improvements through precision engineering and cleaner combustion techniques, which reduce emissions and improve thermal efficiency. Fuel diversification is another notable trend, with industries beginning to explore hydrogen, biofuels, and even ammonia as alternatives to traditional diesel or natural gas. Hydrogen-ready turbines and fuel cells are gradually moving from the pilot stage to commercial deployment, especially in forward-looking markets in Europe and Asia. Innovations in carbon capture technologies are also being integrated into power systems, particularly in emission-heavy sectors, to meet increasingly strict environmental compliance standards. The convergence of these technologies is breaking down the traditional boundaries of centralized, fossil-based generation and opening the door to modular, scalable, and intelligent systems that can be tailored to the unique energy profiles of different industrial applications.What Role Do Industry-Specific Requirements Play in Shaping Demand?

The industrial power generation market is highly influenced by the unique energy requirements and operational dynamics of different end-use sectors. In the oil and gas industry, where operations often take place in remote and harsh environments, the demand for rugged, high-output generator systems is particularly high. These systems must operate reliably under variable load conditions and often without access to stable grid connections. The manufacturing sector, on the other hand, requires scalable and efficient solutions that can adjust to shifting production loads while minimizing downtime and energy waste. In sectors like pharmaceuticals, semiconductors, and food processing, power quality and continuity are paramount to prevent disruptions that could compromise product integrity or process safety. This has led to the integration of uninterrupted power supply (UPS) systems and clean energy backups to maintain process consistency. Mining operations, often located in isolated regions, are driving demand for containerized power units and hybrid solutions that combine diesel generators with solar arrays and battery storage. Meanwhile, data centers, which are fast becoming critical infrastructure, are pushing the envelope on redundancy and energy efficiency, deploying next-generation gas turbines and modular power systems with advanced load-balancing features. Regionally, emerging economies are becoming hotspots for industrial power generation investments as they build out industrial infrastructure and seek to avoid the limitations of legacy power grids. Countries in Southeast Asia, Sub-Saharan Africa, and Latin America are particularly active in adopting decentralized generation models to support industrial growth. Each sector's operational needs, energy intensity, and tolerance for disruption play a critical role in shaping market demand and technology adoption patterns in industrial power generation.What Is Powering the Accelerated Growth of the Industrial Energy Market?

The growth in the industrial power generation market is driven by several factors rooted in evolving technological capabilities, changing industrial energy strategies, and macroeconomic developments. A primary driver is the global shift toward energy independence, with industries aiming to control their power supply in order to avoid the risks of unreliable grids and volatile energy markets. Rising electricity prices and frequent grid disturbances in many regions have pushed industrial players to adopt on-site generation solutions that offer both reliability and long-term cost savings. Regulatory pressure is another significant force, as governments tighten emissions norms and impose sustainability targets on energy-intensive industries, compelling them to transition toward cleaner and more efficient power systems. The increasing feasibility of integrating renewable energy into industrial operations - thanks to lower costs and improved storage options - is also driving adoption, particularly in manufacturing and mining sectors. The proliferation of smart technologies such as IoT-based energy monitoring, digital twins, and automated control systems is making it easier for industries to optimize energy use and respond dynamically to load changes. Furthermore, geopolitical concerns and supply chain disruptions in the global energy market are prompting a rethinking of energy sourcing strategies, with a focus on localization and diversification. Financial incentives and subsidies for clean energy infrastructure, particularly in Europe and North America, are also accelerating the shift toward hybrid and renewable-powered systems. In addition, the rise of ESG-focused investment strategies is encouraging industrial firms to align with sustainable practices, including the decarbonization of their energy supply. Together, these factors are propelling the industrial power generation market into a phase of rapid innovation, strategic importance, and sustained global growth.Report Scope

The report analyzes the Industrial Power Generation market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Gas Turbines, Steam Turbines, Diesel Generators, Combined Cycle Power Plants, Renewable Energy Technologies); Source (Fossil Fuels Source, Renewable Energy Sources); End-Use (Manufacturing End-Use, Mining End-Use, Oil & Gas End-Use, Food & Beverages End-Use, Chemicals End-Use, Pharmaceuticals End-Use, Data Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gas Turbines segment, which is expected to reach US$1.4 Trillion by 2030 with a CAGR of a 16.4%. The Steam Turbines segment is also set to grow at 21.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $338.8 Billion in 2024, and China, forecasted to grow at an impressive 23.6% CAGR to reach $745.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Power Generation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Power Generation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Power Generation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Alpha Pro Tech, Ansell Limited, Avon Protection plc, Bullard and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Industrial Power Generation market report include:

- ABB Ltd

- Aggreko Ltd

- Ansaldo Energia S.p.A.

- Bharat Heavy Electricals Limited (BHEL)

- Capstone Green Energy Corporation

- Caterpillar Inc.

- Cummins Inc.

- Doosan Enerbility

- E.ON SE

- Fluence Energy Inc.

- GE Vernova (General Electric spin-off)

- HIMOINSA (a Yanmar Company)

- Hitachi Energy

- Kirloskar Oil Engines Ltd

- MAN Energy Solutions

- Mitsubishi Power, Ltd.

- Rolls-Royce Power Systems (MTU)

- Siemens Energy AG

- Solar Turbines Incorporated (a Caterpillar company)

- Wärtsilä Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd

- Aggreko Ltd

- Ansaldo Energia S.p.A.

- Bharat Heavy Electricals Limited (BHEL)

- Capstone Green Energy Corporation

- Caterpillar Inc.

- Cummins Inc.

- Doosan Enerbility

- E.ON SE

- Fluence Energy Inc.

- GE Vernova (General Electric spin-off)

- HIMOINSA (a Yanmar Company)

- Hitachi Energy

- Kirloskar Oil Engines Ltd

- MAN Energy Solutions

- Mitsubishi Power, Ltd.

- Rolls-Royce Power Systems (MTU)

- Siemens Energy AG

- Solar Turbines Incorporated (a Caterpillar company)

- Wärtsilä Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 392 |

| Published | February 2026 |

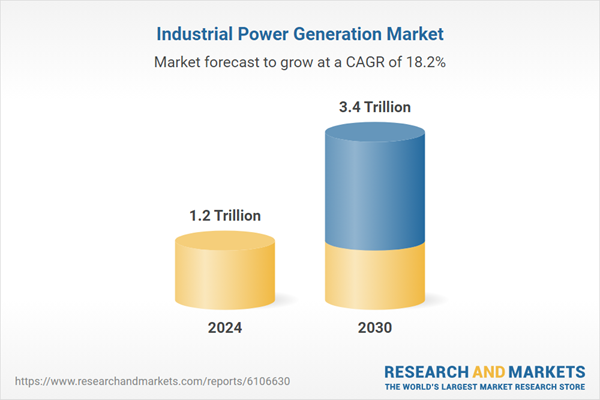

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Trillion |

| Forecasted Market Value ( USD | $ 3.4 Trillion |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | Global |