Global Instant Shipping Market - Key Trends & Drivers Summarized

Why Is Instant Shipping Becoming a Standard Expectation in Modern Commerce?

Instant shipping, once a premium service limited to niche markets, is now evolving into a mainstream expectation as consumers across the globe demand faster and more reliable delivery options. The rise of e-commerce, fueled by digital marketplaces and mobile shopping apps, has created a cultural shift where customers expect near-immediate fulfillment of their orders. This transformation has been accelerated by the practices of major retailers and logistics players who have normalized same-day and next-day delivery options. The psychological appeal of instant gratification, combined with the convenience of doorstep delivery, has significantly raised consumer expectations, prompting even small and mid-sized retailers to reconsider their shipping strategies. In urban areas, where competition among service providers is fierce and customer loyalty is volatile, instant shipping can be a critical differentiator. Industries such as groceries, pharmaceuticals, electronics, and fashion are particularly impacted, with consumers often needing products delivered within hours rather than days. Businesses are responding by building micro-fulfillment centers, deploying real-time inventory systems, and partnering with local courier services to reduce delivery times. As more customers prioritize speed over cost, retailers are under pressure to offer fast shipping without increasing prices, driving innovation across the supply chain. The growing dependence on digital transactions and mobile-first commerce has made logistics a key pillar of customer satisfaction. Instant shipping is no longer a luxury but an operational necessity, reshaping how businesses plan inventory, manage warehouses, and structure last-mile delivery strategies.Can Technology and Infrastructure Keep Pace With Instant Shipping Demand?

The expansion of instant shipping is heavily reliant on advanced technology and modern infrastructure that can support rapid order fulfillment and real-time logistics management. To meet consumer demands for faster delivery times, companies are investing in sophisticated warehouse automation, predictive analytics, and dynamic route optimization systems. Robotic picking systems and autonomous vehicles are being deployed in distribution centers to streamline the picking and packing process, while AI-powered platforms are helping retailers forecast demand spikes and optimize stock placement. Geo-tracking and real-time delivery updates have become standard features in customer-facing applications, offering transparency and improving satisfaction. Drone delivery and sidewalk robots, although still in pilot stages in many regions, are being tested to enhance last-mile capabilities in urban settings. Furthermore, cloud-based logistics platforms are enabling seamless communication between suppliers, couriers, and customers, reducing errors and delays. The proliferation of micro-fulfillment centers in high-density areas is shortening the distance between inventory and end-users, which is critical to achieving sub-24-hour delivery windows. Retailers are also turning to hybrid fulfillment models that combine in-store pick-up, dark stores, and third-party logistics partnerships to increase agility. Despite these advancements, challenges remain, particularly around urban congestion, labor shortages, and sustainability. Nevertheless, continuous investment in digital infrastructure and physical networks is enabling the instant shipping ecosystem to evolve rapidly. As technology continues to mature, instant shipping is expected to become not only faster but also more efficient and environmentally responsible.How Are Shifting Consumer Habits and Industry Trends Reshaping Instant Shipping Models?

Consumer behavior is undergoing a profound transformation that is directly influencing the evolution of instant shipping models across industries. Today's shoppers prioritize convenience, speed, and reliability over traditional shopping values such as price alone. This shift is being driven by a new generation of consumers who are digitally native and accustomed to on-demand services across all areas of life, from streaming content to food delivery. The expectation that goods should arrive within hours of purchase is redefining how retailers approach inventory management and customer engagement. Subscription models and loyalty programs increasingly incorporate expedited shipping as a core benefit, encouraging brand loyalty in exchange for instant fulfillment. Additionally, the growth of direct-to-consumer (DTC) brands has created new challenges and opportunities for instant shipping, as these companies must balance speed with cost efficiency in order to scale sustainably. The expansion of social commerce and live shopping events has also increased the frequency of impulse purchases, many of which require immediate shipping to maintain customer excitement and satisfaction. On the business side, B2B sectors such as manufacturing, healthcare, and electronics are integrating just-in-time delivery systems to reduce warehousing costs and ensure production continuity. Seasonal demand spikes and promotional sales are now managed with real-time data analytics to prevent shipping bottlenecks and inventory shortfalls. These evolving habits are forcing logistics providers to develop flexible, customer-centric delivery models that can adapt quickly to market shifts. As a result, instant shipping is becoming an essential part of the customer experience, influencing not only purchase decisions but also brand perception and long-term retention.What Is Driving the Rapid Global Growth of the Instant Shipping Market?

The growth in the instant shipping market is driven by a combination of technological innovation, changing consumer expectations, increased urbanization, and evolving business models that prioritize speed and convenience. One of the most influential drivers is the explosive rise of e-commerce and mobile commerce, particularly in markets like North America, Europe, and Asia-Pacific, where consumers are accustomed to rapid digital transactions and demand equally fast fulfillment. The globalization of supply chains has also increased pressure on businesses to deliver quickly and efficiently across diverse geographies. Urban population growth is another critical factor, as dense city environments create both the demand for and the feasibility of instant delivery networks. In response, companies are investing heavily in last-mile infrastructure, smart logistics hubs, and agile distribution strategies to meet urban demand. The competitive landscape is further intensifying as tech giants, retailers, and third-party logistics providers race to offer faster and more reliable delivery options. Public and private sector investment in smart transportation systems and green delivery technologies is also supporting the scalability of instant shipping. Meanwhile, consumer trust in digital platforms is at an all-time high, encouraging even traditionally cautious shoppers to embrace fast online purchasing. Business adoption is increasing as well, with service providers offering instant shipping for office supplies, equipment, and industrial components. Regulatory frameworks are beginning to support innovation by enabling the use of drones, autonomous vehicles, and expanded delivery hours. Together, these trends are creating a strong foundation for continued expansion, with instant shipping positioned as a transformative force in the global logistics and retail industries. As technology matures and operational models evolve, instant shipping is expected to redefine the standard for delivery across sectors and regions.Report Scope

The report analyzes the Instant Shipping market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Business-to-Customer, Business-to-Business); Application (E-Commerce Application, Automotive Application, Pharmaceuticals & Healthcare Application, Consumer Electronics Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Business-to-Customer Shipping segment, which is expected to reach US$98.5 Billion by 2030 with a CAGR of a 8.4%. The Business-to-Business Shipping segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $25.8 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $30.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Instant Shipping Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Instant Shipping Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Instant Shipping Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aker Solutions, Boskalis Westminster, DeepOcean, DNV, DOF Subsea and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Instant Shipping market report include:

- Aramex

- Blue Dart Express

- CJ Logistics

- Correios

- DHL Express

- DTDC Express Limited

- FedEx Corporation

- Gati Ltd

- GLS Group

- J&T Express

- Japan Post Holdings

- Kerry Express

- La Poste Group

- Poste Italiane

- Royal Mail

- SF Express

- Singapore Post

- TCS Express & Logistics

- UPS (United Parcel Service)

- Yamato Transport

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aramex

- Blue Dart Express

- CJ Logistics

- Correios

- DHL Express

- DTDC Express Limited

- FedEx Corporation

- Gati Ltd

- GLS Group

- J&T Express

- Japan Post Holdings

- Kerry Express

- La Poste Group

- Poste Italiane

- Royal Mail

- SF Express

- Singapore Post

- TCS Express & Logistics

- UPS (United Parcel Service)

- Yamato Transport

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

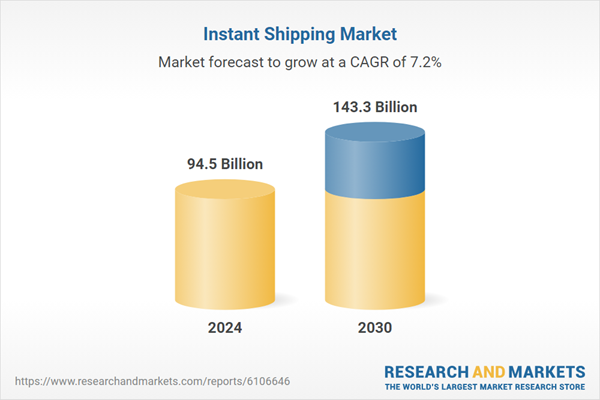

| Estimated Market Value ( USD | $ 94.5 Billion |

| Forecasted Market Value ( USD | $ 143.3 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |