Global Isopropylamine Market - Key Trends & Drivers Summarized

Why Is Isopropylamine Emerging as a Vital Chemical Across Industrial and Agricultural Sectors?

Isopropylamine, a colorless, flammable, and volatile organic compound, has established itself as a crucial chemical intermediate in numerous industries due to its versatility, reactivity, and ease of handling. As a secondary amine, it serves as a building block in the synthesis of a wide range of products including herbicides, pharmaceuticals, rubber chemicals, surfactants, and corrosion inhibitors. One of its most significant applications is in agriculture, where it is used to manufacture isopropylamine salts of glyphosate, the active ingredient in many widely used herbicides. This usage alone accounts for a substantial share of global isopropylamine consumption. In the pharmaceutical industry, isopropylamine plays a key role in the synthesis of analgesics and anti-infectives due to its compatibility with active pharmaceutical ingredients. Additionally, its use in the rubber and plastic industries as a curing and stabilizing agent helps enhances the durability and flexibility of finished materials. The chemical's favorable solubility and volatility characteristics make it ideal for gas purification and metal treatment processes. Furthermore, its relatively low toxicity compared to other amines, when handled correctly, makes it a preferred choice in manufacturing environments that require rigorous safety compliance. The broad utility and effectiveness of isopropylamine have made it indispensable to sectors aiming to streamline production and maintain cost-effectiveness, positioning it as a chemical of strategic importance in the global manufacturing landscape.How Are Innovations and Regulatory Trends Shaping the Future of Isopropylamine Applications?

Ongoing innovations in chemical synthesis and increasing environmental regulations are reshaping the production, application, and handling of isopropylamine across industrial domains. Manufacturers are investing in greener synthesis pathways using renewable feedstocks or catalytically enhanced processes to reduce by-products and energy consumption, aligning production with sustainability goals. In the agricultural sector, regulatory scrutiny surrounding herbicide residues and glyphosate-based products is influencing the reformulation of agrochemicals, where isopropylamine-based compounds are being re-engineered for improved environmental profiles. Pharmaceutical companies are also leveraging more precise synthesis techniques to enhance the purity and yield of isopropylamine intermediates, reducing waste and minimizing harmful emissions. Meanwhile, industries such as water treatment and gas purification are exploring its use in more controlled and automated systems, improving efficiency and worker safety. Regulatory bodies across Europe, North America, and Asia are tightening safety guidelines around volatile organic compounds, prompting producers and end-users to invest in improved storage, transportation, and containment technologies. The rise of closed-loop manufacturing systems and advanced monitoring tools is further helping companies remain compliant with emissions and occupational exposure limits. As the demand for low-footprint, high-output chemical intermediates grows, isopropylamine continues to be a strong candidate for substitution in legacy processes. Research into safer derivatives and synergistic formulations is also underway, potentially expanding its role in specialty chemicals and custom synthesis. These dynamics point to a future where isopropylamine is not only more widely used but also better integrated with the evolving standards of health, safety, and sustainability.How Do Sector-Specific Requirements Influence the Demand and Formulation of Isopropylamine-Based Products?

The demand for isopropylamine is strongly influenced by the unique needs and regulations of the sectors in which it is applied, prompting manufacturers to tailor formulations, packaging, and supply chain practices accordingly. In agriculture, where isopropylamine salts are a key component of systemic herbicides, there is a continuous need for formulations that offer high efficacy with reduced environmental runoff and residue. This has led to the development of adjuvant-enhanced and weather-resistant herbicide blends. In pharmaceuticals, the demand centers around ultra-pure grades of isopropylamine with tightly controlled impurity profiles to meet stringent regulatory guidelines from authorities like the FDA and EMA. These standards influence not only the chemical's production but also its documentation and traceability. In the chemical manufacturing sector, especially within specialty coatings, rubber vulcanization, and textile processing, there is a growing interest in stable, shelf-ready isopropylamine derivatives that ensure performance under varying climatic and industrial conditions. The transportation and logistics sector imposes further requirements related to hazard classification, corrosion resistance of storage vessels, and material compatibility with sealing and pumping systems. Moreover, consumer safety and environmental toxicity concerns in regions with advanced chemical legislation are pushing suppliers to offer robust labeling, training, and spill mitigation solutions. As industries seek supply chain reliability and regional compliance, producers are also offering customized delivery formats such as bulk tankers, drum shipments, and IBC totes, aligned with user-specific handling capacities. This multifaceted demand highlights the importance of adaptability in isopropylamine formulation and delivery, driven by a combination of regulatory expectations, technical performance needs, and end-user preferences.What Is Driving the Rapid Growth of the Global Isopropylamine Market?

The growth in the isopropylamine market is driven by a confluence of factors related to industrial expansion, evolving agricultural practices, pharmaceutical synthesis demand, and global efforts to enhance chemical processing efficiency. The increasing need for herbicide formulations in modern agriculture, particularly in developing nations with rising food production requirements, is significantly boosting the consumption of isopropylamine salts. Simultaneously, the pharmaceutical sector's ongoing development of new small molecule drugs and generic medicines is sustaining demand for isopropylamine as a key intermediate in active pharmaceutical ingredient synthesis. The expansion of the chemical manufacturing base in Asia-Pacific, especially China and India, is creating a robust downstream market for isopropylamine across multiple applications. Additionally, the growing adoption of emission control technologies and gas purification systems in power generation and heavy industry sectors is driving demand for efficient amines such as isopropylamine. Global environmental policies aimed at improving industrial safety and reducing hazardous emissions are encouraging the replacement of older, more toxic amines with alternatives like isopropylamine that offer a better safety and performance profile. The proliferation of precision agriculture, supported by government incentives and private sector investment, is leading to increased formulation of next-generation herbicides where isopropylamine plays a central role. Advancements in supply chain logistics and chemical handling systems are also making it easier to distribute isopropylamine safely to remote and rural industrial facilities. Furthermore, strategic mergers and acquisitions among chemical producers are streamlining production capacities and expanding geographic reach, ensuring better product availability and pricing stability. Together, these growth drivers are contributing to a positive outlook for the isopropylamine market, positioning it as a key chemical intermediate across global value chains.Report Scope

The report analyzes the Isopropylamine market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: End-Use (Agriculture End-Use, Pharmaceuticals End-Use, Rubber & Plastics End-Use, Paints & Coatings End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Agriculture End-Use segment, which is expected to reach US$168.7 Million by 2030 with a CAGR of a 3.1%. The Pharmaceuticals End-Use segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $97.1 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $89 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Isopropylamine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Isopropylamine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Isopropylamine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

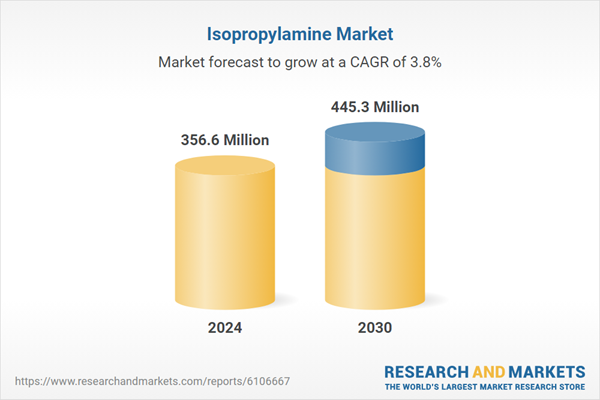

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AGCO Corporation, Ag Leader Technology, Argo-Hytos, Bernard Krone Holding GmbH & Co. KG, CNH Industrial and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Isopropylamine market report include:

- Alfa Aesar

- Arkema S.A.

- BASF SE

- Changzhou Baolong Chemical Co., Ltd.

- Eastman Chemical Company

- Hengyi Petrochemical Co., Ltd.

- Hubei Xinjing New Material Co., Ltd.

- Jiangsu Jiannong Chemical Co., Ltd.

- Kemira Oyj

- Koei Chemical Co., Ltd.

- LyondellBasell Industries

- Nanjing Qinzuofu Chemical Co., Ltd.

- Parchem Fine & Specialty Chemicals

- Qingdao Seawin Biotech Group Co., Ltd.

- Shandong IRO Amine Industry Co., Ltd.

- Solvay S.A.

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- VWR International, LLC

- Zibo Baolan Chemical Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Aesar

- Arkema S.A.

- BASF SE

- Changzhou Baolong Chemical Co., Ltd.

- Eastman Chemical Company

- Hengyi Petrochemical Co., Ltd.

- Hubei Xinjing New Material Co., Ltd.

- Jiangsu Jiannong Chemical Co., Ltd.

- Kemira Oyj

- Koei Chemical Co., Ltd.

- LyondellBasell Industries

- Nanjing Qinzuofu Chemical Co., Ltd.

- Parchem Fine & Specialty Chemicals

- Qingdao Seawin Biotech Group Co., Ltd.

- Shandong IRO Amine Industry Co., Ltd.

- Solvay S.A.

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- VWR International, LLC

- Zibo Baolan Chemical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 356.6 Million |

| Forecasted Market Value ( USD | $ 445.3 Million |

| Compound Annual Growth Rate | 3.8% |

| Regions Covered | Global |