Global IT Staffing Market - Key Trends & Drivers Summarized

Why Is IT Staffing a Strategic Priority in the Age of Digital Transformation?

IT staffing has evolved into a mission-critical function as organizations across the globe embark on accelerated digital transformation journeys that require robust technical expertise, flexibility in project execution, and rapid adaptation to emerging technologies. The proliferation of cloud computing, artificial intelligence, machine learning, cybersecurity, and data analytics has created an insatiable demand for specialized IT talent that traditional in-house teams cannot fulfill alone. As enterprises expand their digital initiatives, they are increasingly relying on IT staffing firms to fill talent gaps with contract professionals, project-based consultants, and full-time technology specialists. This trend is evident across sectors such as healthcare, finance, retail, logistics, and manufacturing, where new digital platforms and systems are central to competitiveness. The demand is not just for coders and developers but extends to roles like cybersecurity analysts, cloud architects, DevOps engineers, data scientists, and IT project managers. The speed at which organizations must adapt to market changes makes long recruitment cycles for permanent roles impractical. IT staffing offers a way to deploy skilled professionals quickly, often within days, to support critical deployments or troubleshoot legacy systems. Global expansion, remote work models, and the need for 24/7 operational support are further strengthening the case for flexible, on-demand IT staffing. As businesses seek agility, resilience, and innovation, they are treating IT staffing not as a stopgap, but as an integral component of workforce strategy that aligns people resources with rapidly shifting technological needs.How Are Technological Advancements and Platforms Enhancing the IT Staffing Experience?

The IT staffing industry is undergoing a profound transformation fueled by digital platforms, artificial intelligence, and advanced analytics that are streamlining the recruitment process, improving candidate-job matching, and delivering better outcomes for employers and professionals alike. AI-driven staffing platforms now parse through thousands of resumes in seconds, identifying ideal candidates based on technical skills, certifications, project history, and even behavioral patterns derived from social media and professional networks. Machine learning algorithms continue to refine recommendations by analyzing hiring success rates and on-the-job performance feedback. Applicant tracking systems (ATS) integrated with real-time labor market data allow staffing firms to provide precise insights into talent availability, compensation benchmarks, and competitive hiring trends. Robotic process automation is being used to handle repetitive tasks such as interview scheduling, document verification, and onboarding, freeing up recruiters to focus on candidate engagement and relationship-building. Video interviewing tools with embedded sentiment analysis are helping clients assess soft skills and cultural fit without geographic limitations. Skill assessment platforms powered by coding simulations and virtual labs are improving screening quality, ensuring that candidates are truly equipped for complex roles. Blockchain is beginning to make inroads by offering verifiable records of professional credentials, experience, and past contract fulfillment, reducing fraud and boosting transparency. These digital enhancements are not only improving the speed and accuracy of IT staffing but also elevating the candidate experience, making the entire recruitment cycle more intuitive, data-driven, and outcome-focused.How Do Client Expectations and Sector-Specific Needs Influence IT Staffing Strategies?

The growing complexity of client demands and the distinct operational requirements across industry verticals are significantly shaping IT staffing strategies, pushing staffing providers to specialize and tailor their offerings more precisely. In highly regulated sectors such as finance and healthcare, clients expect IT professionals to not only have technical acumen but also deep knowledge of compliance frameworks like HIPAA, PCI DSS, and SOX. Government contracts require background-checked, security-cleared professionals who can operate within rigid procurement and reporting structures. In manufacturing and industrial settings, there is a need for IT talent familiar with operational technology, SCADA systems, and the nuances of integrating IT with legacy machinery. Startups and high-growth tech firms prefer agile, full-stack developers and DevOps engineers who can work in fast-paced, iterative environments with minimal supervision. Larger enterprises may prioritize specialists in systems integration, cybersecurity, or cloud infrastructure for long-term transformation projects. The rise of remote work has also prompted clients to seek talent with proven ability to deliver in distributed environments using collaboration tools and adhering to virtual team protocols. Clients are increasingly requesting outcome-based contracts where performance is tied to milestones or service-level agreements rather than just time spent. This has raised the bar for staffing firms, pushing them to understand each client's technical landscape, cultural nuances, and operational tempo. Consequently, firms are investing in vertical-aligned talent pools, sector-specific training programs, and dedicated client success teams to ensure that placements are not just rapid, but also highly effective and contextually appropriate.What Factors Are Driving the Continued Growth of the Global IT Staffing Market?

The IT staffing market is experiencing sustained global growth driven by a convergence of digital acceleration, talent scarcity, economic volatility, and evolving workforce models. One of the most powerful drivers is the global shortage of skilled IT professionals, particularly in areas such as cybersecurity, cloud computing, data science, and software development. Organizations across all regions are facing mounting pressure to execute digital projects at speed, but the internal talent pipeline often falls short, leading to rising dependence on external staffing solutions. The flexibility offered by IT staffing enables businesses to scale teams up or down in response to project needs, market fluctuations, or budget constraints, which is especially valuable in uncertain economic climates. The normalization of remote and hybrid work has also broadened access to global talent pools, allowing staffing firms to tap into skilled professionals across borders and time zones. Startups and SMEs are leveraging contract-based staffing to access high-end skills without the cost and commitment of permanent hires. Meanwhile, large enterprises are building contingent labor strategies to address transformation backlogs and ensure continuity in the face of attrition or shifting business priorities. Regulatory changes in labor and data privacy laws are prompting firms to engage with reputable staffing partners who understand regional compliance and legal intricacies. The increasing use of IT outsourcing, managed services, and project-based consulting is also boosting demand for staffing models that can plug into diverse operational environments. All these factors combined are contributing to a dynamic, resilient, and fast-expanding IT staffing market that is reshaping how companies around the world source, deploy, and retain technical talent.Report Scope

The report analyzes the IT Staffing market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Temporary Staffing, Permanent Placement, Contract Staffing, Outsourced Recruitment, Executive Search); End-Use (Information Technology End-Use, BFSI End-Use, Telecommunication End-Use, Manufacturing End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Temporary Staffing segment, which is expected to reach US$121.3 Billion by 2030 with a CAGR of a 8.7%. The Permanent Placement segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $55.1 Billion in 2024, and China, forecasted to grow at an impressive 11.5% CAGR to reach $65.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global IT Staffing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global IT Staffing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global IT Staffing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Apto Solutions, Arrow Electronics (Arrow Value Recovery), Atlantix Global Systems, CNE Direct Inc., Computer Disposals Ltd (CDL) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this IT Staffing market report include:

- Accenture

- Adecco Group

- Allegis Group

- Apex Systems

- Cognizant Technology Solutions

- CSI Companies

- Experis (ManpowerGroup)

- HCLTech

- Infosys

- Insight Global

- Kelly Services

- Kforce

- L&T Technology Services

- Modis (now Akkodis)

- Mphasis

- NTT DATA

- Randstad NV

- Robert Half Technology

- Tata Consultancy Services (TCS)

- Wipro

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Adecco Group

- Allegis Group

- Apex Systems

- Cognizant Technology Solutions

- CSI Companies

- Experis (ManpowerGroup)

- HCLTech

- Infosys

- Insight Global

- Kelly Services

- Kforce

- L&T Technology Services

- Modis (now Akkodis)

- Mphasis

- NTT DATA

- Randstad NV

- Robert Half Technology

- Tata Consultancy Services (TCS)

- Wipro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

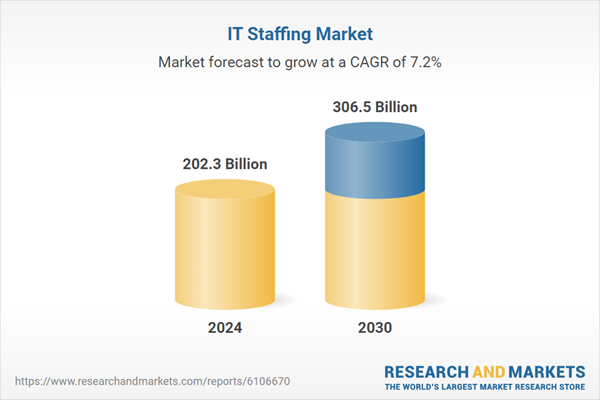

| Estimated Market Value ( USD | $ 202.3 Billion |

| Forecasted Market Value ( USD | $ 306.5 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |