Global LED Driver ICs Market - Key Trends & Drivers Summarized

How Are LED Driver ICs Enabling the Growth of Advanced Lighting and Display Technologies?

LED driver ICs have become indispensable in the evolution of modern lighting and display systems, serving as the core electronic component that regulates power and ensures optimal performance of light-emitting diodes. These integrated circuits control the amount of current supplied to LEDs, safeguarding them against voltage fluctuations, thermal stress, and efficiency losses. As lighting shifts globally from incandescent and fluorescent systems to energy-efficient LED-based alternatives, the demand for high-performance driver ICs has surged. They play a crucial role in maintaining consistent brightness, color accuracy, and longevity of LED fixtures across applications including general lighting, automotive headlamps, digital signage, and consumer electronics. In the context of displays, LED driver ICs are essential for achieving precise control over each pixel in OLED and Mini-LED panels, contributing to sharper images, higher contrast ratios, and reduced power consumption. Moreover, these components support dynamic features such as dimming, flicker control, and adaptive brightness adjustment, which are increasingly expected by consumers. Their integration into smart systems has further expanded their relevance, as modern lighting solutions are often linked to sensors, wireless controllers, and home automation platforms. As industries and consumers alike prioritize energy efficiency, reliability, and customization, LED driver ICs are emerging not only as facilitators of innovation but also as enablers of sustainability and user-centric design in the rapidly expanding world of solid-state lighting.What Technological Advancements Are Shaping the Capabilities of Modern LED Driver ICs?

The technological landscape for LED driver ICs is rapidly advancing, with innovations focused on miniaturization, energy optimization, and intelligent control features. One of the most transformative developments is the integration of digital and analog control within a single chip, enabling fine-tuned brightness control and power regulation while reducing external component count. Advances in thermal management and current sensing are allowing for greater reliability and longer LED lifespan, particularly in high-power applications such as street lighting and automotive lighting systems. The rise of constant current and constant voltage driver architectures tailored for different load conditions has enabled more precise and efficient operation across a variety of lighting scenarios. Additionally, the emergence of wireless communication protocols such as Bluetooth Low Energy and Zigbee in lighting systems has prompted the development of driver ICs with built-in communication capabilities, allowing seamless integration into smart lighting networks. Pulse-width modulation and digital dimming functions have been refined to eliminate flicker and enhance visual comfort, especially in displays and interior environments. Moreover, gallium nitride (GaN) and silicon carbide (SiC) technologies are being explored to push the efficiency boundaries further, especially in high-frequency switching applications. These technological advancements are not only improving the electrical performance of driver ICs but also expanding their applicability in intelligent lighting systems, automotive innovation, and next-generation display solutions.Why Are Market Demands and Application Diversity Driving New Design Strategies for LED Driver ICs?

The growing diversity of applications using LED technology is placing new demands on LED driver IC design, prompting manufacturers to adopt more flexible and scalable architectures. In residential and commercial lighting, consumers are seeking smart, dimmable solutions that provide both aesthetic appeal and energy savings, which requires driver ICs capable of precision control and compatibility with digital interfaces. In automotive applications, LEDs are now used extensively in exterior and interior lighting, including adaptive headlights, dashboard displays, and ambient illumination, necessitating driver ICs that can withstand harsh environmental conditions while offering high current accuracy and fast response times. The consumer electronics sector is pushing for ultra-compact driver ICs to meet the slim form factors of wearables, smartphones, and tablets, where power efficiency and thermal performance are critical. Additionally, industrial applications such as warehouse lighting and machine vision systems demand high-lumen outputs and robust driver solutions that can support long duty cycles. Regulatory pressure to improve energy efficiency across all these sectors is also shaping the design of driver ICs, with increasing emphasis on compliance with global standards such as ENERGY STAR and IEC efficiency regulations. To meet these broad and evolving needs, chip designers are embracing modular, programmable, and application-specific IC designs that can be rapidly adapted to new product requirements. This shift in design strategy reflects the changing landscape of LED technology and highlights the growing importance of driver ICs as not just passive components but key enablers of functional, safe, and sustainable lighting systems.What Is Driving the Growth in the Global LED Driver ICs Market?

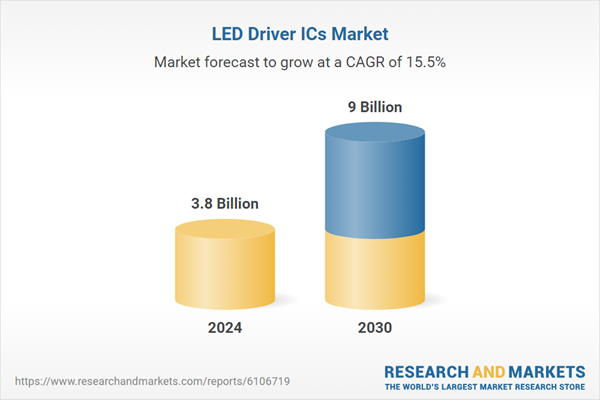

The growth in the global LED driver ICs market is being fueled by a combination of widespread LED adoption, rising energy efficiency standards, and ongoing advancements in electronics and semiconductor technology. As governments around the world implement regulations that mandate the phase-out of inefficient lighting sources, the transition to LED-based solutions is accelerating across public infrastructure, residential buildings, and industrial facilities. This trend is directly boosting the demand for reliable and high-performance driver ICs that can support these energy-efficient systems. The expansion of smart homes and IoT-enabled environments is also contributing to market growth, as LED lighting increasingly integrates with voice control, motion sensors, and automated scheduling. Growth in the automotive sector, particularly in electric and autonomous vehicles, is creating new opportunities for advanced lighting systems powered by sophisticated driver ICs. In the display segment, the shift toward OLED, Mini-LED, and Micro-LED technologies for TVs, monitors, and handheld devices is driving the need for driver ICs capable of handling high pixel densities and fast refresh rates. Technological innovations that improve power conversion efficiency, reduce component size, and offer higher levels of integration are making driver ICs more versatile and attractive across markets. In emerging economies, increased urbanization and infrastructure development are further supporting the expansion of LED lighting projects, thereby fueling regional demand. Together, these drivers are shaping a robust and fast-evolving market for LED driver ICs, positioning them as critical components in the global transition toward intelligent, sustainable, and visually enhanced lighting and display systems.Report Scope

The report analyzes the LED Driver ICs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Buck Boost LED Driver IC, Current Sink LED Driver IC, Inductor less LED Driver IC, Step Down LED Driver IC, Other Types); Application (Consumer Electronics Application, Healthcare Application, IT & ITES Application, Automotive Application, Telecommunication Application, Government Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Buck Boost LED Driver IC segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of a 13.9%. The Current Sink LED Driver IC segment is also set to grow at 18.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1 Billion in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $1.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LED Driver ICs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LED Driver ICs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LED Driver ICs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BSH Home Appliances, Chicago Dryer Company, Consolidated Laundry Machinery (CLM), Electrolux Professional, Fagor Professional and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this LED Driver ICs market report include:

- Allegro MicroSystems, Inc.

- Analog Devices, Inc.

- Diodes Incorporated

- Eaglerise

- Euchips

- HEP

- Infineon Technologies AG

- Inventronics

- KEGU Power

- Lifud

- Littelfuse, Inc.

- LTECH

- Macroblock, Inc.

- MEAN WELL Enterprises Co. Ltd.

- Melexis NV

- Microchip Technology Inc.

- Moso

- NXP Semiconductors

- ON Semiconductor (onsemi)

- OSRAM GmbH

- Power Integrations

- Renesas Electronics Corporation

- Rohm Semiconductor

- Samsung Electronics Co., Ltd.

- Semtech Corporation

- Signify Holding (Philips)

- STMicroelectronics

- Texas Instruments Inc.

- Toshiba Corporation

- Tridonic GmbH & Co KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allegro MicroSystems, Inc.

- Analog Devices, Inc.

- Diodes Incorporated

- Eaglerise

- Euchips

- HEP

- Infineon Technologies AG

- Inventronics

- KEGU Power

- Lifud

- Littelfuse, Inc.

- LTECH

- Macroblock, Inc.

- MEAN WELL Enterprises Co. Ltd.

- Melexis NV

- Microchip Technology Inc.

- Moso

- NXP Semiconductors

- ON Semiconductor (onsemi)

- OSRAM GmbH

- Power Integrations

- Renesas Electronics Corporation

- Rohm Semiconductor

- Samsung Electronics Co., Ltd.

- Semtech Corporation

- Signify Holding (Philips)

- STMicroelectronics

- Texas Instruments Inc.

- Toshiba Corporation

- Tridonic GmbH & Co KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 9 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |