Global Lignocellulosic Feedstock-based Biofuel Market - Key Trends & Drivers Summarized

Why Is Lignocellulosic Biomass Emerging as the Cornerstone of Next-Generation Biofuels?

Lignocellulosic feedstock, derived from non-food plant materials such as agricultural residues, forestry waste, and dedicated energy crops, is rapidly gaining prominence as a sustainable alternative to conventional biofuel sources. Unlike first-generation biofuels that rely on food crops like corn and sugarcane, lignocellulosic biofuels are produced from cellulose, hemicellulose, and lignin-rich biomass, offering a solution that circumvents the food-versus-fuel debate. This category of feedstock includes corn stover, wheat straw, rice husks, switchgrass, miscanthus, and even municipal solid waste, making it abundant, cost-effective, and geographically diverse. The growing urgency to decarbonize the transport sector, particularly aviation, shipping, and heavy road transport, is prompting increased investments in lignocellulosic biofuel technologies. These sectors are often harder to electrify and require high energy density fuels, a demand that lignocellulosic biofuels can help address. Additionally, many governments are instituting mandates and subsidies to encourage second-generation biofuel production, viewing it as a critical pathway to achieving carbon neutrality. This policy support, coupled with global climate targets and rising fossil fuel volatility, is catalyzing research and commercialization efforts in lignocellulosic conversion technologies. These include enzymatic hydrolysis, thermochemical pathways such as pyrolysis and gasification, and microbial fermentation, all aimed at maximizing yield and process efficiency. As innovation accelerates and production costs decline, lignocellulosic feedstock is set to become a foundational element in the global bioenergy mix.How Are Technological Advancements Unlocking the Potential of Complex Biomass Conversion?

Transforming lignocellulosic feedstock into usable biofuel has traditionally been a complex and resource-intensive process, but recent technological breakthroughs are overcoming many of the historical barriers to commercial scalability. One of the most significant advancements is in the area of pretreatment, where physical, chemical, and biological methods are being optimized to break down the rigid structure of lignocellulose and improve the accessibility of cellulose and hemicellulose to enzymes. Innovative pretreatment approaches using ionic liquids, ammonia fiber expansion, and steam explosion are showing promise in improving overall conversion efficiencies while reducing energy and water usage. Furthermore, the development of genetically engineered microbes and robust enzyme cocktails has significantly enhanced the yield of fermentable sugars, enabling higher biofuel outputs from the same amount of feedstock. In parallel, biorefineries are adopting integrated processes that combine biofuel production with the co-generation of valuable by-products such as biochar, bioplastics, and biochemicals, thereby improving economic viability. Machine learning and AI-driven process optimization are also being utilized to monitor and fine-tune production in real-time, ensuring maximum yield with minimal input. The deployment of modular bioreactor systems and decentralized processing units is helping to reduce logistics costs and bring production closer to feedstock sources. These advancements are transforming what was once a niche and technically constrained segment into a commercially viable, scalable, and environmentally resilient solution for low-carbon fuel production.What Market Dynamics Are Influencing the Rise of Lignocellulosic Biofuels Globally?

The market for lignocellulosic feedstock-based biofuels is being shaped by a combination of economic, environmental, and policy-driven dynamics that are fostering both supply-side innovation and demand-side adoption. One major factor is the growing emphasis on circular economies and waste valorization, which positions agricultural and forestry residues not as waste but as valuable inputs into clean fuel production. As nations aim to reduce landfilling and open burning of biomass waste, lignocellulosic biofuel technologies offer an attractive solution for converting waste into energy while reducing greenhouse gas emissions. The rise of low-carbon fuel standards, particularly in jurisdictions such as California and the European Union, is creating lucrative markets for advanced biofuels that can demonstrate significant lifecycle emissions reductions. In addition, national blending mandates, renewable fuel quotas, and carbon pricing mechanisms are incentivizing fuel producers to integrate lignocellulosic biofuels into their supply chains. On the demand side, corporations are increasingly making net-zero pledges and seeking to decarbonize their logistics and operations, creating new market opportunities for second-generation biofuels. The aviation sector in particular has emerged as a critical market segment, with sustainable aviation fuel (SAF) derived from lignocellulosic sources gaining traction as airlines and regulatory bodies seek viable alternatives to kerosene. However, feedstock supply chain logistics, seasonal availability, and regional processing capabilities remain important factors influencing the scalability of production. Partnerships between feedstock suppliers, biofuel producers, and technology developers are therefore becoming central to achieving long-term market growth and supply chain resilience.What Forces Are Driving the Accelerated Growth of the Lignocellulosic Biofuel Market?

The growth in the lignocellulosic biofuel market is driven by several factors closely linked to technological progress, policy evolution, industrial application, and sustainability imperatives. A major driver is the increasing global consensus on the need to decarbonize transportation and reduce reliance on fossil fuels, particularly in sectors that are less amenable to electrification. Lignocellulosic biofuels provide a renewable, drop-in replacement for conventional fuels and are especially attractive for aviation, marine, and heavy-duty road transport. Another key factor is the growing pressure on governments and industries to adopt low-carbon solutions that also promote energy security, particularly in regions dependent on imported petroleum. The abundance of feedstock in agricultural and forestry economies presents a compelling case for domestic biofuel production, which can support rural economies and reduce environmental degradation from biomass waste. Advances in process engineering, from pretreatment to enzymatic hydrolysis and fermentation, have significantly improved conversion efficiencies and reduced overall production costs, making lignocellulosic biofuels more commercially competitive. The establishment of dedicated biorefineries, backed by public and private funding, is further enabling large-scale deployment. Consumer awareness around sustainable fuels and corporate demand for carbon-neutral logistics are accelerating end-use adoption. Additionally, favorable regulatory frameworks, including tax incentives, biofuel blending mandates, and research subsidies, are directly supporting market expansion. These forces, taken together, are creating a robust foundation for the continued acceleration of lignocellulosic biofuel development and adoption across a diverse array of geographic and industrial contexts.Report Scope

The report analyzes the Lignocellulosic Feedstock-based Biofuel market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Conversion Process (Biochemical Process, Thermochemical Process); Application (Automotive Application, Aviation Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Biochemical Process segment, which is expected to reach US$83.1 Billion by 2030 with a CAGR of a 55.8%. The Thermochemical Process segment is also set to grow at 41.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 49.3% CAGR to reach $14.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Lignocellulosic Feedstock-based Biofuel Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Lignocellulosic Feedstock-based Biofuel Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Lignocellulosic Feedstock-based Biofuel Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ace Manufacturing, Align Manufacturing, AmTech OEM, BorgWarner Inc., Schaeffler Group (LuK brand) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Lignocellulosic Feedstock-based Biofuel market report include:

- Abengoa

- Aemetis Inc.

- ALTRET GREENFUELS Ltd

- Archer Daniels Midland (ADM)

- BDI BioEnergy International GmbH

- Beta Renewables SpA

- Biochemtex SpA

- Blue Biofuels Inc.

- Borregaard ASA

- Bunge Limited

- China Petrochemical Corp. (Sinopec)

- Clariant International Ltd.

- COSAN S.A.

- DuPont de Nemours Inc.

- ENERKEM Inc.

- Genera Inc.

- Gevo Inc.

- GranBio Investimentos SA

- Iogen Corporation

- New Energy Blue LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abengoa

- Aemetis Inc.

- ALTRET GREENFUELS Ltd

- Archer Daniels Midland (ADM)

- BDI BioEnergy International GmbH

- Beta Renewables SpA

- Biochemtex SpA

- Blue Biofuels Inc.

- Borregaard ASA

- Bunge Limited

- China Petrochemical Corp. (Sinopec)

- Clariant International Ltd.

- COSAN S.A.

- DuPont de Nemours Inc.

- ENERKEM Inc.

- Genera Inc.

- Gevo Inc.

- GranBio Investimentos SA

- Iogen Corporation

- New Energy Blue LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 164 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

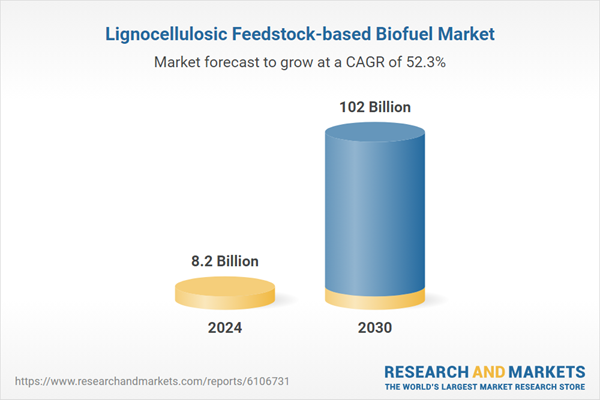

| Estimated Market Value ( USD | $ 8.2 Billion |

| Forecasted Market Value ( USD | $ 102 Billion |

| Compound Annual Growth Rate | 52.3% |

| Regions Covered | Global |