Global Liner Hanger Systems Market - Key Trends & Drivers Summarized

Why Are Liner Hanger Systems Becoming Integral to Modern Oil and Gas Well Construction?

Liner hanger systems have emerged as a critical component in the construction and completion of oil and gas wells, especially in complex drilling environments where operational efficiency, well integrity, and cost control are top priorities. These systems are used to suspend a liner - a shorter casing string - inside the wellbore, connecting it to the previous casing section and allowing for zonal isolation, pressure containment, and borehole stability. As drilling operations push into deeper, high-pressure, and high-temperature (HPHT) reservoirs, liner hanger systems offer several advantages over full casing strings, including reduced material usage, lower cementing costs, and improved hydraulic performance. They enable operators to isolate specific sections of the wellbore for controlled production and better reservoir management. Moreover, with the increasing prevalence of horizontal and deviated wells, liner hangers help maintain wellbore geometry and minimize the risk of casing buckling or mechanical failure. The demand for these systems has grown in both onshore and offshore drilling projects, driven by the need for enhanced efficiency and operational safety. Innovations in liner hanger designs, such as expandable, mechanical, and hydraulic systems, are catering to a broad spectrum of drilling environments and challenges. As oil and gas companies seek to extract hydrocarbons more safely and economically, the role of liner hanger systems has become increasingly central to strategic planning and field development activities.How Are Technological Innovations Reshaping the Capabilities of Liner Hanger Systems?

Advancements in liner hanger technology are revolutionizing how wells are completed and optimized across diverse geological conditions. One of the most significant developments is the transition from traditional mechanical systems to more advanced hydraulic and expandable liner hangers that offer greater reliability and sealing integrity under extreme conditions. These innovations have improved the performance of liner hangers in extended-reach drilling and unconventional plays, where traditional systems often struggle with alignment, sealing, and torque handling. Expandable liner hangers, in particular, have gained traction due to their ability to conform to varying wellbore geometries, reduce annular clearances, and enhance zonal isolation. Integration with intelligent monitoring systems and real-time data analytics is also emerging as a transformative trend, enabling operators to track pressure, temperature, and liner setting events remotely. Material science has contributed as well, with corrosion-resistant alloys and elastomeric seal enhancements allowing systems to perform reliably in sour gas and HPHT environments. Furthermore, modular hanger designs are being adopted for faster installation and compatibility with a wide range of casing sizes, promoting operational flexibility. These innovations not only reduce the risks of non-productive time (NPT) and wellbore instability but also align with the industry's growing emphasis on digitalization and automation. As drilling becomes more data-driven, liner hanger systems are increasingly designed to integrate seamlessly with downhole tools and advanced completion technologies, setting the stage for more efficient, intelligent well construction.What Operational Trends and Market Needs Are Driving the Use of Liner Hangers in Oilfield Projects?

The use of liner hanger systems is being driven by shifting operational priorities within the oil and gas industry, particularly the focus on optimizing well construction while minimizing costs and environmental risks. In today's market, operators are under constant pressure to reduce drilling times and maximize reservoir contact, especially in mature fields and unconventional plays. Liner hangers support these objectives by enabling more staged and selective completions, which are essential for maximizing hydrocarbon recovery. They allow operators to segment the wellbore, control fluid movement, and target multiple zones within a single well, all while maintaining structural integrity and downhole pressure control. Moreover, as oil prices fluctuate and capital expenditure becomes more tightly controlled, liner hanger systems offer an economically attractive alternative to running full casing strings. Their use reduces the volume of cement and steel required, lowering both direct costs and the carbon footprint of drilling operations. Offshore projects, where logistics and operational risks are magnified, particularly benefit from the reliability and compact deployment of modern liner hanger systems. In shale plays, where multiple wells are drilled from a single pad, the ability to standardize and streamline liner installation is a significant advantage. Regulatory compliance and well integrity standards are also influencing adoption, with authorities demanding robust casing and cementing programs to prevent blowouts and subsurface leaks. Consequently, liner hangers are not only being selected for their functional benefits but also for their contribution to regulatory and environmental conformance.What Key Drivers Are Fueling the Rapid Growth of the Liner Hanger Systems Market?

The growth in the liner hanger systems market is driven by several factors directly tied to evolving drilling practices, technological adoption, and increasing complexity in global oil and gas projects. A primary driver is the industry-wide shift toward more complex well architectures, including deeper vertical wells, long horizontal laterals, and multistage completions, all of which require advanced casing and liner solutions to ensure operational success. The expansion of offshore drilling, particularly in ultra-deepwater basins of West Africa, the Gulf of Mexico, and Southeast Asia, is increasing the demand for liner hanger systems that can perform reliably under high pressure and corrosive conditions. Additionally, the resurgence of drilling activities in shale formations across North America and the Middle East has led to a greater need for cost-effective, high-integrity liner deployment solutions that can support frequent and rapid well completions. Technological improvements in setting mechanisms, pressure control, and real-time monitoring are enhancing the performance and appeal of modern liner hangers to both large operators and independent drillers. Increasing focus on minimizing non-productive time and avoiding costly well failures has encouraged wider adoption of premium liner hanger systems with proven reliability records. Environmental and regulatory requirements are also playing a pivotal role, as liner hangers contribute to better zonal isolation and reduce the risk of fluid migration across formations. Lastly, competitive pressures within the oilfield services sector are prompting manufacturers to offer customized and region-specific liner hanger solutions, further expanding their global market penetration and usage across both conventional and unconventional drilling operations.Report Scope

The report analyzes the Liner Hanger Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Mechanical Liner Hanger, Hydraulic Liner Hanger, Expandable Liner Hanger); Location (Onshore Location, Offshore Location); Well Type (Horizontal Well, Vertical Well).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Mechanical Liner Hanger segment, which is expected to reach US$3 Billion by 2030 with a CAGR of a 4.2%. The Hydraulic Liner Hanger segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 7.9% CAGR to reach $1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Liner Hanger Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Liner Hanger Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Liner Hanger Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A123 Systems, BYD, CALB (China Aviation Lithium Battery), CATL (Contemporary Amperex), EVE Energy and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Liner Hanger Systems market report include:

- Allamon Tool Company

- Baker Hughes

- BOTIL Oil Tools Pvt. Ltd.

- Canam Pipe & Supply

- Completion Oil Tools Private Limited

- DEW Wartungs und Reparatur GmbH

- Dril-Quip, Inc.

- Halliburton Company

- Innovex Downhole Solutions Inc.

- Maximus Completion Systems

- National Oilwell Varco (NOV)

- NCS Multistage LLC

- Packers Plus Energy Services Inc.

- Procyon Technology

- Pt. Sagatrade Murni

- Sawan Oil Tools Pvt. Ltd.

- Schlumberger Limited

- Sovonex Technology

- TIW Corporation

- Weatherford International PLC

- Well Innovation AS

- Wellcare Oil Tools Private Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allamon Tool Company

- Baker Hughes

- BOTIL Oil Tools Pvt. Ltd.

- Canam Pipe & Supply

- Completion Oil Tools Private Limited

- DEW Wartungs und Reparatur GmbH

- Dril-Quip, Inc.

- Halliburton Company

- Innovex Downhole Solutions Inc.

- Maximus Completion Systems

- National Oilwell Varco (NOV)

- NCS Multistage LLC

- Packers Plus Energy Services Inc.

- Procyon Technology

- Pt. Sagatrade Murni

- Sawan Oil Tools Pvt. Ltd.

- Schlumberger Limited

- Sovonex Technology

- TIW Corporation

- Weatherford International PLC

- Well Innovation AS

- Wellcare Oil Tools Private Limited

Table Information

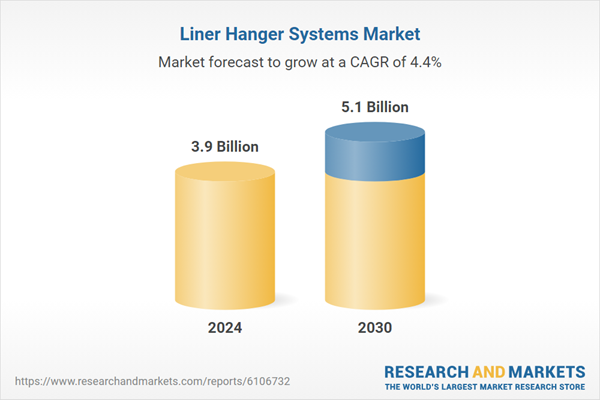

| Report Attribute | Details |

|---|---|

| No. of Pages | 369 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 5.1 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |