Global Liquor Bottles Market - Key Trends & Drivers Summarized

Why Are Liquor Bottles More Than Just Packaging in Today's Alcohol Industry?

Liquor bottles have evolved far beyond their original purpose of simply containing and transporting alcohol. In today's competitive and image-conscious spirits industry, the design, material, and functionality of liquor bottles play a central role in brand identity, market positioning, and consumer experience. Bottles are now considered an extension of the product itself, often serving as a key factor in a consumer's purchasing decision, especially at retail shelves or in high-end hospitality settings. Glass remains the dominant material of choice due to its clarity, recyclability, and premium perception, although innovations in eco-friendly materials are beginning to diversify packaging options. Custom bottle shapes, embossing, colored glass, and artisanal closures are frequently used to signal authenticity, tradition, or exclusivity. The rise of craft spirits and small-batch distilleries has intensified the demand for unique, hand-crafted bottle designs that stand out in a crowded market and communicate a story. Limited editions and commemorative releases often come in bespoke bottles that elevate the value perception and encourage collection. Meanwhile, major brands use consistent bottle design to reinforce recognition and customer loyalty across global markets. Increasingly, liquor bottles also serve practical purposes, incorporating features like tamper-proof caps, pour spouts, and resealable closures to improve usability and safety. As consumer expectations shift toward aesthetics, sustainability, and convenience, liquor bottles are playing a multifaceted role in shaping the identity, accessibility, and perceived value of alcoholic beverages.How Are Design and Innovation Trends Influencing the Evolution of Liquor Bottles?

Design and innovation are reshaping liquor bottles into dynamic branding tools and sustainable packaging solutions. One of the most notable trends is the rise of premiumization, where brands invest in visually striking, high-quality bottles to differentiate their products and justify higher price points. This includes everything from elegant curves and bold geometries to intricate labels and metallic foils. Technological advancements in glass molding and decoration techniques have enabled more detailed and cost-effective personalization, making it easier for both large and niche producers to create custom bottle aesthetics. At the same time, the shift toward sustainability is pushing the industry to explore lighter-weight bottles, recycled content, and alternative materials such as biodegradable plastics or paper-based composites. Digital technologies are also influencing innovation, with brands experimenting with smart bottles that feature QR codes, NFC chips, or augmented reality experiences to engage consumers post-purchase. In some markets, refillable bottle programs are being tested as a way to reduce waste and foster brand loyalty through reusable packaging. Functional improvements are also gaining ground, including ergonomic shapes for easier pouring and innovative closures that preserve freshness or provide controlled dispensing. Beyond the bottle itself, secondary packaging such as display boxes and carriers is being integrated into overall design strategies, especially for gifting and seasonal promotions. These design and innovation trends are transforming liquor bottles into high-impact branding assets that offer not just aesthetic value but also interactive, sustainable, and consumer-friendly features.What Consumer and Cultural Trends Are Shaping the Demand for Liquor Bottles Worldwide?

Changing consumer behaviors and evolving cultural attitudes toward alcohol consumption are significantly shaping demand for liquor bottles in different markets. In many regions, the increasing preference for premium and craft spirits is driving growth in uniquely designed, upscale bottle formats that reflect quality and individuality. Consumers are looking for more than just a drink; they seek an experience, and the bottle plays a central role in that narrative. In emerging economies, rising disposable income and expanding urban populations are fueling demand for imported spirits and stylish packaging that reflects aspirational lifestyles. Social media platforms have added a new dimension to liquor bottle appeal, as photogenic packaging becomes part of the social sharing culture, especially among younger consumers. Eco-consciousness is also becoming a stronger purchase driver, leading buyers to favor brands that offer sustainable packaging, including recyclable bottles and minimalistic labeling. In the hospitality industry, bottle presentation continues to be a critical element of bar and restaurant branding, influencing how products are displayed, served, and perceived. Additionally, personalization and gifting trends are prompting consumers to seek customized bottles for weddings, corporate events, and holidays. Collectability has emerged as a niche but influential trend, where limited-edition or artist-collaborated bottles are purchased for display rather than consumption. Regional preferences and cultural associations with specific spirits also impact bottle design choices, with certain shapes, colors, or motifs holding symbolic meaning in local markets. Together, these consumer and cultural shifts are redefining what liquor bottles represent and how they function in a globalized, design-savvy, and environmentally aware market.What Key Factors Are Driving the Global Growth of the Liquor Bottles Market?

The growth in the liquor bottles market is driven by several interrelated factors linked to branding strategies, industry expansion, regulatory frameworks, and consumer lifestyle trends. One of the core drivers is the ongoing global rise in alcohol consumption, particularly in premium segments like whiskey, gin, tequila, and craft liqueurs, which require distinct and often high-end packaging to align with their brand values. The proliferation of microdistilleries and private-label spirits is adding diversity and competitive energy to the market, increasing the demand for differentiated and small-batch packaging solutions. Rapid urbanization and increased alcohol accessibility in emerging economies are also creating new opportunities for liquor brands and bottle manufacturers alike. Furthermore, stringent regulations around alcohol labeling, traceability, and safety are pushing producers to adopt more standardized, secure, and traceable bottle formats, including tamper-evident closures and serialized labeling. Evolving e-commerce trends are impacting packaging as well, as bottles must now be designed not only for shelf presence but also for durability in direct-to-consumer shipping. Consumer preferences for convenience and personalization are encouraging innovations in smaller serving sizes, customizable labels, and on-the-go packaging options. Additionally, growing investments in sustainable production processes and circular economy initiatives are compelling companies to incorporate recycled materials and reduce environmental impact in their packaging choices. Strategic collaborations between bottle designers, distilleries, and branding agencies are also helping to accelerate product development and global market penetration. Collectively, these forces are driving consistent expansion in the liquor bottles market, making it an essential and evolving segment of the global alcoholic beverage industry.Report Scope

The report analyzes the Liquor Bottles market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Glass Type (Clear Glass, Cosmetics Flint Glass); Capacity (Below 180 ml Capacity, 180 - 500 ml Capacity); Application (Beer Application, Spirits Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Clear Glass Bottles segment, which is expected to reach US$3.1 Billion by 2030 with a CAGR of a 2.2%. The Cosmetics Flint Glass Bottles segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 5.4% CAGR to reach $964.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Liquor Bottles Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Liquor Bottles Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Liquor Bottles Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2023 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACG Group, Altasciences, Bactolac Pharmaceutical, Biovencer Healthcare, Bright Pharma Caps and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Liquor Bottles market report include:

- AGI glaspac

- Ajanta Bottle Pvt. Ltd.

- Ardagh Group

- BA Glass

- Bormioli Rocco

- Consol Glass

- ESTAL

- Gerresheimer AG

- Haldyn Glass Limited

- Heinz-Glas GmbH

- Hindusthan National Glass & Industries Ltd (HNG)

- Nihon Yamamura Glass Co., Ltd.

- O-I Glass (Owens-Illinois)

- Orora Packaging Solutions

- PGP Glass Private Limited (Piramal Glass)

- Saverglass

- Stoelzle Glass Group

- Toyo Glass Co., Ltd.

- Verallia

- Vetropack Group

- Vidrala S.A.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AGI glaspac

- Ajanta Bottle Pvt. Ltd.

- Ardagh Group

- BA Glass

- Bormioli Rocco

- Consol Glass

- ESTAL

- Gerresheimer AG

- Haldyn Glass Limited

- Heinz-Glas GmbH

- Hindusthan National Glass & Industries Ltd (HNG)

- Nihon Yamamura Glass Co., Ltd.

- O-I Glass (Owens-Illinois)

- Orora Packaging Solutions

- PGP Glass Private Limited (Piramal Glass)

- Saverglass

- Stoelzle Glass Group

- Toyo Glass Co., Ltd.

- Verallia

- Vetropack Group

- Vidrala S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 363 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

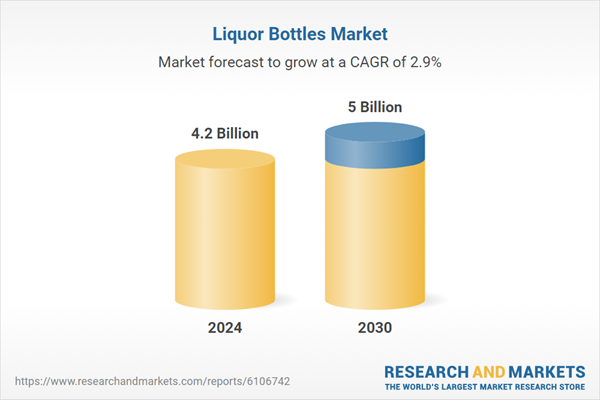

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 5 Billion |

| Compound Annual Growth Rate | 2.9% |

| Regions Covered | Global |