Global Marine Air Conditioning Systems Market - Key Trends & Drivers Summarized

How Are Technological Advancements Steering Innovation in Marine Air Conditioning?

The marine air conditioning systems market is witnessing a wave of technological innovation tailored to the unique challenges of maritime environments. With increasing emphasis on energy efficiency and environmental compliance, manufacturers are developing compact, high-performance units that deliver cooling with lower power consumption and minimal emissions. Innovations such as variable refrigerant flow (VRF), inverter-driven compressors, and seawater-cooled condensers are significantly enhancing system performance while optimizing space utilization aboard vessels. Advanced control systems using IoT and smart automation are enabling real-time monitoring of temperature, humidity, and energy use, allowing ship operators to reduce operational costs and improve climate management. Moreover, the integration of hybrid systems that utilize both electric and alternative energy sources is gaining traction, especially among luxury yachts and eco-conscious vessel owners. With stricter environmental regulations like IMO 2020 and MARPOL Annex VI in place, refrigerant choices have also evolved, with a shift from high-GWP (global warming potential) substances to low-impact alternatives such as R-32 and R-1234yf. These environmentally friendly refrigerants are helping ship operators meet global emission standards without compromising cooling capacity. Additionally, modular designs are making systems easier to install and maintain, a crucial consideration for retrofitting aging vessels or customizing new builds. As ship designs become increasingly complex and passenger expectations rise, especially in the cruise and luxury marine segments, air conditioning systems are evolving not just in terms of function, but also in design sophistication and integration capabilities.Can Regulatory Pressures and Environmental Challenges Influence Market Direction?

Environmental regulation is becoming one of the most powerful forces shaping the marine air conditioning systems market. As global maritime bodies tighten emission controls and encourage sustainability, vessels are under increasing pressure to comply with standards that directly impact the design and operation of onboard HVAC systems. Regulations targeting energy efficiency, greenhouse gas emissions, and refrigerant use are prompting significant R&D investment from manufacturers to develop compliant and future-ready systems. Additionally, marine environments pose distinct challenges such as corrosion, humidity, and variable power availability, which are influencing the engineering of air conditioning systems that can withstand harsh sea conditions without degrading performance. Many governments and international bodies are now mandating the use of ozone-friendly and energy-efficient systems, thus accelerating the transition to next-generation technologies. The need to reduce operational carbon footprints is especially critical for cruise liners and large commercial ships, which consume massive amounts of energy for passenger comfort. In regions like Northern Europe and North America, shipbuilders are increasingly specifying green-certified HVAC systems during the procurement process. Moreover, environmental activism and consumer awareness are influencing ship operators to prioritize sustainability not just in fuel but in auxiliary systems like air conditioning. Maritime climate zones also impact system requirements, as tropical and polar operations demand vastly different HVAC configurations, further complicating compliance and design strategies. The interplay between regulatory enforcement and technical innovation is therefore driving the evolution of marine HVAC in a more sustainable and compliant direction.How Do Vessel Types and End-Use Requirements Influence Product Demand?

The demand for marine air conditioning systems is closely tied to the diverse requirements of different vessel types and their operational environments. Commercial shipping, naval defense fleets, cruise liners, fishing boats, ferries, offshore platforms, and luxury yachts all present varying cooling demands, driving a need for highly customized solutions. Cruise ships and mega yachts, for instance, demand multi-zone climate control systems capable of maintaining stable temperatures across hundreds of cabins and public areas, often while navigating through widely different climate zones. In contrast, smaller boats may prioritize energy-efficient, noise-reduced systems with minimal footprint. Offshore platforms and defense vessels often need HVAC systems with explosion-proof features and redundancy in design to ensure uninterrupted operation. The rise of luxury maritime travel and high-end leisure yachts is contributing significantly to demand, as buyers seek sophisticated climate systems with integrated dehumidification, air purification, and smart zone management. Fishing vessels and cargo ships operating in humid equatorial waters often require robust and corrosion-resistant systems that can endure prolonged exposure to saline air and vibration. Military vessels have highly specific demands for stealth, endurance, and operational reliability, often requiring bespoke designs. Moreover, the growing use of automation in marine operations necessitates onboard systems that integrate with vessel-wide management platforms. As shipbuilders look to differentiate vessel types with performance and comfort, HVAC systems are becoming a key area of investment, influencing not just passenger experience but also crew efficiency and vessel longevity.What Drives the Expansion of the Marine Air Conditioning Systems Market Today?

The growth in the marine air conditioning systems market is driven by several factors directly tied to changing maritime dynamics, technology preferences, and end-user behavior. First, the steady expansion of the global shipping and cruise industries, especially in Asia-Pacific and North America, is creating sustained demand for climate control systems that can ensure comfort and compliance across a growing fleet of vessels. Second, rising consumer expectations in the leisure marine sector are prompting a surge in demand for luxury-focused air conditioning units with advanced control features and silent operation. Third, increasing investments in offshore oil and gas exploration, particularly in harsh and remote regions, are necessitating ruggedized, high-capacity HVAC solutions capable of 24/7 operation under extreme conditions. Fourth, environmental mandates and the phasing out of ozone-depleting refrigerants are pushing vessel owners toward energy-efficient, low-GWP systems that meet both performance and ecological criteria. Fifth, the trend of vessel electrification and the move toward hybrid propulsion systems is creating compatibility needs for low-voltage, energy-efficient onboard appliances, including air conditioning units. Sixth, retrofitting of older vessels with new HVAC technologies is becoming more common as fleet operators aim to extend the lifespan of their assets while remaining compliant with current environmental standards. Lastly, growing awareness of crew health and comfort, particularly in long-haul shipping and naval operations, is strengthening the role of HVAC systems as a critical onboard infrastructure. These factors, coupled with advances in materials, design, and control interfaces, are fueling consistent expansion across both OEM and aftermarket segments of the marine air conditioning industry.Report Scope

The report analyzes the Marine Air Conditioning Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Chiller Systems, Self-Contained Systems, Split systems); End-Use (Leisure Ships End-Use, Commercial Ships End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Chiller Systems segment, which is expected to reach US$18.2 Billion by 2030 with a CAGR of a 2.6%. The Self-Contained Systems segment is also set to grow at 1.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.4 Billion in 2024, and China, forecasted to grow at an impressive 4% CAGR to reach $5.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Marine Air Conditioning Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Marine Air Conditioning Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Marine Air Conditioning Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Homestar Corporation, Athens Park Homes, Berkshire Hathaway (Clayton Homes), Cavco Industries, Inc., Champion Home Builders and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Marine Air Conditioning Systems market report include:

- Aqua-Air Manufacturing

- Btuair

- Carrier Marine & Offshore

- Climma

- Condaria S.p.A.

- CruiseAir (Dometic Group)

- Daikin Industries Ltd.

- Danfoss Marine

- EcoMarine Power

- Frigomar Srl

- Heinen & Hopman

- Johnson Controls Marine

- Kahlenberg Industries

- Koja Marine

- Maveko Marine Systems

- MHI Marine Machinery & Equipment

- Nautic Air

- Rexair Marine HVAC

- Thermowell SRL

- Webasto Thermo & Comfort SE

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aqua-Air Manufacturing

- Btuair

- Carrier Marine & Offshore

- Climma

- Condaria S.p.A.

- CruiseAir (Dometic Group)

- Daikin Industries Ltd.

- Danfoss Marine

- EcoMarine Power

- Frigomar Srl

- Heinen & Hopman

- Johnson Controls Marine

- Kahlenberg Industries

- Koja Marine

- Maveko Marine Systems

- MHI Marine Machinery & Equipment

- Nautic Air

- Rexair Marine HVAC

- Thermowell SRL

- Webasto Thermo & Comfort SE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

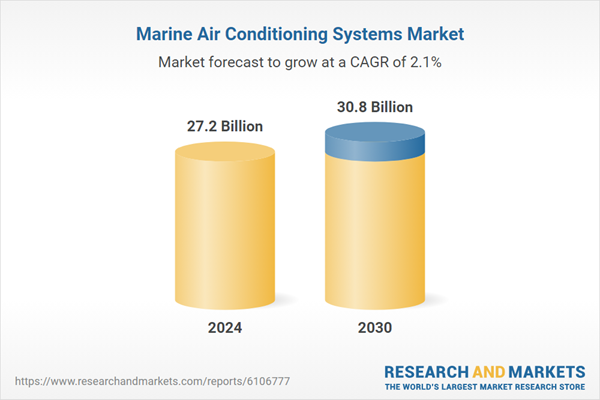

| Estimated Market Value ( USD | $ 27.2 Billion |

| Forecasted Market Value ( USD | $ 30.8 Billion |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |