Global Medical Gas Blenders Market - Key Trends & Drivers Summarized

How Are Medical Gas Blenders Supporting Precision and Safety in Respiratory Care?

Medical gas blenders are critical components in respiratory therapy and anesthesia delivery, allowing healthcare providers to precisely mix medical gases such as oxygen and air to meet specific patient requirements. These devices are essential in maintaining controlled concentrations of oxygen, particularly in neonatal intensive care units, operating rooms, and emergency settings where exact dosing is crucial to avoid complications from hyperoxia or hypoxia. Unlike manual blending or cylinder mixing, modern medical gas blenders offer accurate and consistent output ratios, which are vital for fragile patients including premature infants or those with chronic respiratory illnesses. Many blenders now feature built-in safety alarms, flow meters, and backup systems that ensure uninterrupted operation even during sudden pressure drops or supply inconsistencies. These features significantly reduce human error and contribute to better patient outcomes. With rising incidences of respiratory conditions such as COPD, asthma, and pulmonary fibrosis, the demand for finely controlled respiratory support is increasing, positioning gas blenders as indispensable tools in intensive care units and general hospital wards alike. Their role has become even more critical in the wake of global health emergencies such as COVID-19, where high-flow oxygen therapy and non-invasive ventilation strategies rely heavily on precise gas delivery. As respiratory care standards continue to evolve, medical gas blenders are providing clinicians with the technological assurance and operational flexibility required to deliver safe and effective treatment across diverse patient populations.How Are Technological Advancements Enhancing the Performance and Usability of Gas Blenders?

Rapid technological advancements are significantly improving the functionality, precision, and user-friendliness of medical gas blenders, making them more adaptive to complex healthcare environments. Digital and electronic gas blenders are gaining prominence over traditional mechanical models due to their enhanced accuracy, programmable settings, and integration capabilities with hospital information systems. These newer models offer touchscreen interfaces, customizable alarms, and real-time monitoring of flow rates and oxygen concentrations, enabling clinicians to fine-tune treatment with greater control and insight. Automation features reduce manual workload and the risk of human error, while built-in calibration systems help maintain long-term performance reliability. The use of durable, corrosion-resistant materials and modular designs is also extending the lifespan of these devices and simplifying maintenance procedures. Some advanced systems come equipped with dual flow capabilities, allowing simultaneous gas delivery to two patients or devices, which is particularly beneficial in emergency or high-demand settings. Moreover, portability is being addressed through compact and lightweight designs that facilitate use in ambulatory care, home settings, and field hospitals. Integration with electronic medical records and smart ventilator systems is also becoming increasingly common, providing seamless data exchange and better overall patient management. These innovations not only streamline workflows but also improve compliance with safety standards and operational protocols. As medical institutions continue to modernize and adopt digital health infrastructure, technologically advanced gas blenders are emerging as essential tools in providing personalized, efficient, and responsive respiratory care.How Do Clinical Applications and Healthcare Settings Influence Blender Adoption?

The adoption of medical gas blenders varies widely depending on the clinical applications and healthcare settings in which they are deployed. In neonatal intensive care units, for example, precision oxygen blending is critical for preventing conditions such as retinopathy of prematurity, which can occur if oxygen levels are not tightly regulated. Blenders in these environments must support very low flow rates with extreme accuracy, often in the range of 0.1 to 3 liters per minute, necessitating highly specialized equipment. In contrast, operating rooms and post-anesthesia care units require gas blenders that can handle higher flow rates and integrate seamlessly with anesthesia machines and ventilators. Emergency departments and ambulance services depend on compact, ruggedized blenders that can be rapidly deployed and operated under variable conditions, including during patient transport. In long-term care and home healthcare environments, user-friendly and low-maintenance blenders are favored to support chronic oxygen therapy for conditions such as COPD and sleep apnea. Each of these settings places unique demands on device performance, reliability, and ease of use, influencing purchasing decisions and product development priorities. Hospitals and clinics also consider training requirements, compatibility with existing gas sources, and service support when selecting gas blenders for clinical use. The diverse and expanding range of clinical scenarios underscores the need for a wide array of gas blender configurations, including wall-mounted, standalone, and integrated units, tailored to specific patient care workflows. As healthcare delivery becomes more specialized and patient-centric, the versatility and adaptability of medical gas blenders are becoming increasingly important.What Are the Main Drivers Fueling the Growth of the Medical Gas Blenders Market?

The growth in the medical gas blenders market is being driven by a combination of healthcare trends, technological innovations, and increased demand for precision in respiratory therapy. First, the global rise in respiratory diseases such as asthma, chronic obstructive pulmonary disease, and pneumonia is creating higher demand for controlled oxygen delivery systems across all levels of care. Second, the aging population and higher rates of surgical interventions are increasing the need for anesthesia delivery systems that rely on precise gas mixing. The widespread impact of respiratory pandemics, including COVID-19, has underscored the necessity of high-performance respiratory equipment, prompting urgent procurement of gas blenders in both developed and developing regions. Fourth, the trend toward outpatient care and home-based medical services is expanding the use of portable and user-friendly blenders outside traditional hospital environments. Continuous technological innovations are making gas blenders more accessible and efficient, with improvements in digital interfaces, automation, and maintenance-free operation. Also, stricter regulatory requirements around oxygen therapy safety and clinical guidelines for respiratory care are encouraging healthcare providers to invest in advanced, compliant blending systems. Further, the expansion of healthcare infrastructure, particularly in emerging markets, is driving new installations in hospitals, emergency rooms, and mobile clinics. Lastly, growing awareness among clinicians regarding the benefits of precise gas blending in improving patient outcomes is contributing to increased adoption. Together, these drivers are shaping a dynamic and rapidly expanding market that plays a vital role in the global healthcare system's ability to deliver high-quality, patient-tailored respiratory care.Report Scope

The report analyzes the Medical Gas Blenders market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Dual Flow Gas Blenders, Tube Flow Gas Blenders); End-Use (Hospitals End-Use, Ambulatory Surgery Centers End-Use, Pharmaceuticals End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Dual Flow Gas Blenders segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 5%. The Tube Flow Gas Blenders segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $536.4 Million in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $518.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Medical Gas Blenders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Medical Gas Blenders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Medical Gas Blenders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Allscripts Healthcare Solutions, Babylon Health, Cerner Corporation (Oracle Health), Change Healthcare (Optum/UnitedHealth), Clinical Decision Support LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Medical Gas Blenders market report include:

- Acare Technology Co., Ltd.

- Armstrong Medical Ltd.

- BeaconMedaes (Atlas Copco)

- Bio-Med Devices, Inc.

- Dameca A/S

- EKU Elektronik GmbH

- Flow-Meter S.p.A.

- Genstar Technologies Co. Inc.

- Great Group Medical Co., Ltd.

- HERSILL S.L.

- Heyer Medical AG

- Inspiration Healthcare Group

- Maxtec (a Halma Company)

- MEC Medical Ltd.

- Ohio Medical Corporation

- Precision Medical, Inc.

- Penlon Ltd.

- Sechrist Industries, Inc.

- SLE Ltd.

- WIKA Alexander Wiegand SE & Co. KG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acare Technology Co., Ltd.

- Armstrong Medical Ltd.

- BeaconMedaes (Atlas Copco)

- Bio-Med Devices, Inc.

- Dameca A/S

- EKU Elektronik GmbH

- Flow-Meter S.p.A.

- Genstar Technologies Co. Inc.

- Great Group Medical Co., Ltd.

- HERSILL S.L.

- Heyer Medical AG

- Inspiration Healthcare Group

- Maxtec (a Halma Company)

- MEC Medical Ltd.

- Ohio Medical Corporation

- Precision Medical, Inc.

- Penlon Ltd.

- Sechrist Industries, Inc.

- SLE Ltd.

- WIKA Alexander Wiegand SE & Co. KG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

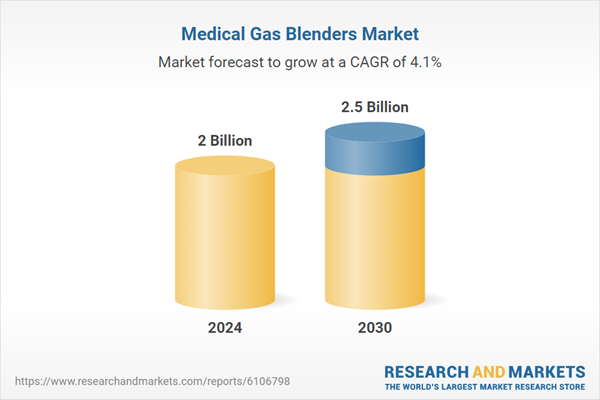

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |