Global Memory and Processors for Military and Aerospace Market - Key Trends & Drivers Summarized

Why Are Advanced Memory and Processor Technologies Critical for Military and Aerospace Missions?

Memory and processor technologies serve as the foundational computing backbone for modern military and aerospace systems, enabling the operation of complex platforms that demand real-time responsiveness, high data integrity, and fault-tolerant performance. These components are embedded in a wide range of mission-critical systems, including navigation units, avionics, unmanned aerial vehicles, missile guidance systems, surveillance satellites, and radar arrays. In high-stakes defense environments, the ability to process vast streams of sensor data rapidly and reliably is essential for mission success and troop safety. Unlike consumer-grade electronics, military and aerospace applications require processors and memory modules that function flawlessly under extreme temperatures, high radiation exposure, shock, and vibration. The increasing deployment of autonomous platforms, AI-enabled surveillance, and digital battlefield technologies has amplified the need for computing systems with higher throughput, lower latency, and resilient error-correcting capabilities. Additionally, secure memory and processors play a pivotal role in safeguarding sensitive information and ensuring operational integrity in adversarial conditions. Encryption capabilities, anti-tamper features, and real-time data verification are often built into these components to prevent compromise during cyberattacks or electronic warfare. With the growing complexity of defense systems, there is a rising emphasis on modular and scalable architectures that allow for easy upgrades without compromising mission continuity. Thus, high-performance, ruggedized memory and processors are no longer optional but a strategic necessity across all modern military and aerospace operations.How Are Technological Innovations Enhancing the Capabilities of Memory and Processors for Defense Systems?

Technological advances are transforming the capabilities of memory and processor components in the military and aerospace sectors, addressing the ever-expanding requirements for speed, durability, and security. One of the key developments is the integration of radiation-hardened (rad-hard) technology, which ensures components can operate reliably in high-radiation environments such as outer space or nuclear combat zones. Advances in non-volatile memory types like MRAM and FRAM are being adopted for their fast read-write cycles, low power consumption, and exceptional endurance. For processing units, the shift toward multi-core and heterogeneous architectures is enabling simultaneous execution of diverse computational tasks, from AI-driven target recognition to real-time flight path correction. System-on-chip (SoC) designs are being favored for their ability to consolidate multiple functions into a single unit, reducing weight and energy consumption, which is critical in space-constrained aerospace systems. Moreover, machine learning accelerators and GPU-based processors are finding increased use in satellite data analysis, drone imaging, and electronic warfare simulations. Embedded memory technologies with built-in error correction, low latency, and encryption support are further strengthening data reliability and security. Thermal management innovations and new packaging methods are also making it possible for components to endure extreme operational conditions for extended periods. These innovations are not only improving the performance of current platforms but are also making it feasible to deploy next-generation technologies such as hypersonic systems, high-altitude intelligence platforms, and autonomous combat vehicles, all of which rely heavily on computational precision and resilience.How Do Defense Requirements and Aerospace Constraints Shape Component Design and Selection?

The stringent requirements of defense and aerospace sectors deeply influence the design and selection of memory and processor components, pushing manufacturers to go far beyond the standards set by commercial industries. These systems often need to operate in remote, inaccessible, or hostile environments where failure is not an option, making reliability the single most important selection criterion. Components must meet military-grade certifications such as MIL-STD-810 and DO-254, which test for performance under extreme stress, including wide temperature ranges, radiation exposure, mechanical shock, and humidity. In aerospace applications, size, weight, and power consumption are also critical factors, especially for satellites, UAVs, and fighter aircraft where every gram and watt matters. Designers prioritize low-profile, high-efficiency solutions that do not sacrifice performance or durability. Moreover, defense systems often have long operational lifespans, sometimes exceeding 20 years, which demands long-term availability of parts and backward compatibility with legacy systems. Secure supply chains are another consideration, with preference given to domestically sourced or ITAR-compliant vendors to minimize the risk of component tampering or geopolitical disruption. The importance of secure boot capabilities, hardware-based encryption, and trusted platform modules has increased significantly with the rising threat of cyber warfare. Additionally, modular open systems architectures (MOSA) are being promoted by defense agencies to allow interoperability and easy integration across multiple platforms. These diverse and high-stakes design criteria ensure that every processor and memory component in a military or aerospace system must meet a unique combination of robustness, security, and performance under the most demanding conditions.What Key Drivers Are Fueling Growth in the Military and Aerospace Memory and Processor Market?

The growth in the memory and processors market for military and aerospace applications is driven by a multitude of interconnected factors spanning technology, security, and global defense priorities. First, the rapid modernization of defense infrastructure globally is creating demand for computing systems that can power advanced platforms such as next-generation aircraft, missile defense systems, and autonomous military vehicles. Second, the increasing reliance on AI, machine learning, and real-time analytics in battlefield management and space surveillance is elevating the need for high-speed, reliable, and secure computing components. Third, the expansion of satellite constellations for communication, Earth observation, and reconnaissance is boosting demand for radiation-hardened memory and processors capable of long-term operation in orbit. Fourth, rising geopolitical tensions and national security concerns are pushing governments to enhance their electronic warfare and cybersecurity capabilities, both of which depend on advanced signal processing and secure memory architectures. Fifth, the convergence of commercial and military aerospace technologies is opening up new design opportunities and accelerating innovation cycles, particularly in dual-use applications. Sixth, defense budget increases in major economies such as the United States, China, and India are enabling large-scale procurement and upgrades of computational infrastructure across all military branches. Seventh, industry initiatives focused on open architecture and modular integration are encouraging the adoption of scalable and interoperable components that simplify long-term maintenance and system evolution. Lastly, the shift toward edge computing in defense operations is creating new requirements for compact, high-performance processors and memory modules that can deliver mission-critical performance without reliance on centralized data centers. These drivers collectively highlight the strategic importance of advanced memory and processors in shaping the future of defense readiness and aerospace innovation.Report Scope

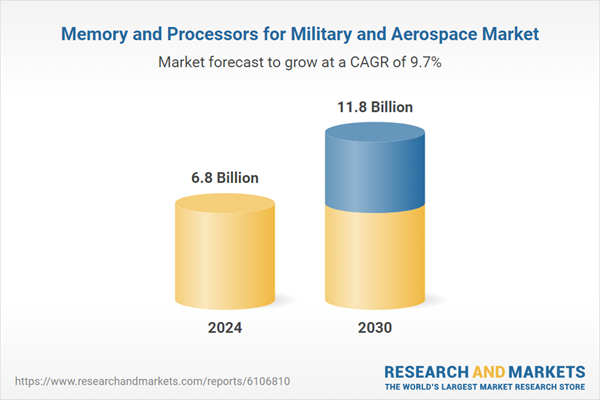

The report analyzes the Memory and Processors for Military and Aerospace market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Memory Type, Processor Type); End-Use (Military End-Use, Aerospace End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Memory segment, which is expected to reach US$7.8 Billion by 2030 with a CAGR of a 8.5%. The Processor segment is also set to grow at 12.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.8 Billion in 2024, and China, forecasted to grow at an impressive 13.1% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Memory and Processors for Military and Aerospace Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Memory and Processors for Military and Aerospace Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Memory and Processors for Military and Aerospace Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AstraZeneca PLC, Bayer AG, BeOne Medicines, Blueprint Medicines, Crinetics Pharmaceuticals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Memory and Processors for Military and Aerospace market report include:

- Advanced Micro Devices, Inc.

- Analog Devices Inc.

- BAE Systems plc

- Broadcom Inc.

- Cadence Design Systems Inc.

- Curtiss-Wright Corporation

- Elma Electronic AG

- Honeywell International Inc. (Aerospace)

- Infineon Technologies AG

- Intel Corporation

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Micron Technology, Inc.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Teledyne Technologies Incorporated

- RTX Corporation (formerly Raytheon)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Micro Devices, Inc.

- Analog Devices Inc.

- BAE Systems plc

- Broadcom Inc.

- Cadence Design Systems Inc.

- Curtiss-Wright Corporation

- Elma Electronic AG

- Honeywell International Inc. (Aerospace)

- Infineon Technologies AG

- Intel Corporation

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Micron Technology, Inc.

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Teledyne Technologies Incorporated

- RTX Corporation (formerly Raytheon)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 11.8 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |