Global Menstrual Health Apps Market - Key Trends & Drivers Summarized

Why Are Menstrual Health Apps Becoming Integral to Women's Health Management?

Menstrual health apps have emerged as vital tools in the realm of personal healthcare, offering users the ability to track, understand, and manage their menstrual cycles with unprecedented ease and accuracy. These digital platforms empower women to monitor key health indicators such as period dates, ovulation windows, flow intensity, pain levels, mood shifts, and other hormonal symptoms. The growing adoption of smartphones and wearable devices, coupled with increasing health awareness among women, has transformed period tracking from a niche interest into a daily routine for millions globally. These apps not only provide convenience but also offer predictive insights that assist in fertility planning, contraceptive management, and symptom tracking for conditions like PCOS or endometriosis. By gathering and analyzing user data over time, they can alert users to irregular patterns that may indicate underlying health concerns, prompting earlier medical consultations. Many also integrate with broader wellness platforms, linking menstrual cycles with fitness, sleep, and dietary habits to create a holistic picture of health. The growing acceptance and normalization of discussions around menstruation have encouraged more women to use digital solutions openly and confidently. Moreover, healthcare providers are beginning to view these apps as useful adjunct tools that can enhance patient-doctor communication and improve diagnostic accuracy. As a result, menstrual health apps are transitioning from simple trackers to comprehensive health management systems that reflect a broader shift toward personalized, data-driven, and user-empowered healthcare.How Is Technology Driving Innovation and Personalization in Menstrual Health Apps?

Technology is revolutionizing the capabilities of menstrual health apps, pushing them beyond basic calendar functions into sophisticated health platforms that leverage data science, artificial intelligence, and machine learning. These technologies allow apps to provide more accurate predictions by learning from individual user patterns and adjusting algorithms based on lifestyle changes, health inputs, and hormonal fluctuations. AI-enabled platforms are now capable of offering personalized health tips, symptom forecasts, and even mental health insights based on mood and behavior patterns during different phases of the cycle. Integration with wearable technology such as fitness trackers and smartwatches allows real-time synchronization of biometrics like heart rate, body temperature, and sleep cycles, enriching the app's understanding of the user's hormonal rhythm. Advanced apps are also experimenting with predictive analytics to detect cycle irregularities, flag early signs of reproductive disorders, or guide fertility treatments more precisely. Some platforms are using anonymized user data to contribute to clinical research and public health studies, thereby advancing the scientific understanding of menstrual health. Voice assistants, chatbot-based support, and multilingual interfaces are being introduced to make the apps more inclusive and user-friendly across different populations and age groups. Additionally, privacy and data security have become major focal points, with leading apps now offering end-to-end encryption, customizable privacy settings, and transparent data usage policies. These technological enhancements are making menstrual health apps not only smarter and more responsive but also more attuned to the nuanced needs of diverse users around the world.How Do Social Trends and Health Awareness Impact the Adoption of Menstrual Health Apps?

The rapid rise in the adoption of menstrual health apps is closely tied to evolving social attitudes, increasing health consciousness, and the empowerment of women to take charge of their reproductive health. As menstruation becomes a more openly discussed topic, particularly among younger generations, digital tools that support cycle awareness are gaining popularity. In many societies, particularly where traditional taboos have historically restricted conversations about menstruation, these apps are acting as private, stigma-free spaces for education and self-monitoring. Millennials and Gen Z users, who are highly tech-savvy and value wellness-oriented lifestyles, are the primary drivers of this trend. Simultaneously, the global women's health movement has highlighted menstrual equity and access to care, prompting demand for tools that offer insights and autonomy in managing menstruation-related issues. School programs, online influencers, and health-focused content platforms are all playing a role in encouraging the use of menstrual health apps. In clinical contexts, patients are increasingly sharing app-generated data with their healthcare providers, using digital records to support diagnosis and treatment discussions. Apps are also gaining traction in family planning and fertility contexts, helping users track ovulation and improve the timing of conception or contraceptive use. However, adoption patterns can vary by region, influenced by digital literacy, smartphone penetration, and cultural openness. Despite these variances, the general trajectory is clear: as global awareness of menstrual health grows, and as women increasingly seek tools that provide personalized, accessible, and real-time insights, the adoption of menstrual health apps will continue to accelerate across all age groups and geographies.What Are the Main Drivers Fueling the Growth of the Menstrual Health Apps Market?

The growth in the menstrual health apps market is driven by several compelling factors tied to user behavior, healthcare evolution, and digital innovation. First, the increasing global awareness of menstrual and reproductive health issues is leading women to seek tools that offer better self-monitoring and cycle management. Second, the rise of digital health ecosystems is enabling seamless integration of menstrual apps with fitness platforms, telehealth services, and wearable devices, which enhances their value as everyday health tools. Third, the demand for non-invasive, user-controlled health solutions is favoring apps that offer privacy, convenience, and actionable insights without requiring clinical intervention. Fourth, growing investment from venture capital firms and health-tech companies is accelerating app development, leading to more competitive and feature-rich platforms. Fifth, regulatory encouragement for digital health solutions, especially in countries focused on expanding women's health services, is creating an enabling environment for app adoption and innovation. Sixth, the proliferation of smartphones and increasing internet access, particularly in emerging markets, is expanding the user base dramatically. Seventh, broader social movements centered around body positivity, menstrual education, and healthcare equity are normalizing the use of period-tracking apps and other reproductive health technologies. Lastly, the shift toward preventive and personalized medicine is positioning menstrual health apps as valuable tools in managing not only reproductive health but also broader wellness indicators such as mental health, metabolic function, and hormonal balance. Collectively, these drivers are transforming menstrual health apps from niche digital products into powerful, mainstream healthcare tools poised for continued global expansion.Report Scope

The report analyzes the Menstrual Health Apps market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Platform (Android Platform, iOS Platform, Other Platforms); Application (Period Cycle Tracking Application, Fertility & Ovulation Management Application, Menstrual Health Management Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Android Platform segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 10%. The iOS Platform segment is also set to grow at 7.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $326.5 Million in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $444.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Menstrual Health Apps Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Menstrual Health Apps Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Menstrual Health Apps Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abercrombie & Fitch Co., Adidas AG, American Eagle Outfitters, ASOS plc, Benetton Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Menstrual Health Apps market report include:

- Apple Inc. (Health App)

- Bayer AG (Clue partnership)

- BioWink GmbH (Clue)

- Bloomlife Inc.

- Cycle Technologies (CycleBeads)

- DayaMed Inc.

- Eve by Glow Inc.

- FemTec Health (Awesome Woman)

- Fitbit (Owned by Google)

- Flo Health Inc.

- Grace Health

- GP International LLC (Maya)

- HelloBaby Inc. (Hello Baby App)

- Kindara Inc.

- LADYTIMER GmbH

- Natural Cycles Nordic AB

- Ovia Health (by Labcorp)

- Period Tracker by GP Apps

- Premom (Easy Healthcare Corp.)

- Spot On by Planned Parenthood

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apple Inc. (Health App)

- Bayer AG (Clue partnership)

- BioWink GmbH (Clue)

- Bloomlife Inc.

- Cycle Technologies (CycleBeads)

- DayaMed Inc.

- Eve by Glow Inc.

- FemTec Health (Awesome Woman)

- Fitbit (Owned by Google)

- Flo Health Inc.

- Grace Health

- GP International LLC (Maya)

- HelloBaby Inc. (Hello Baby App)

- Kindara Inc.

- LADYTIMER GmbH

- Natural Cycles Nordic AB

- Ovia Health (by Labcorp)

- Period Tracker by GP Apps

- Premom (Easy Healthcare Corp.)

- Spot On by Planned Parenthood

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 270 |

| Published | February 2026 |

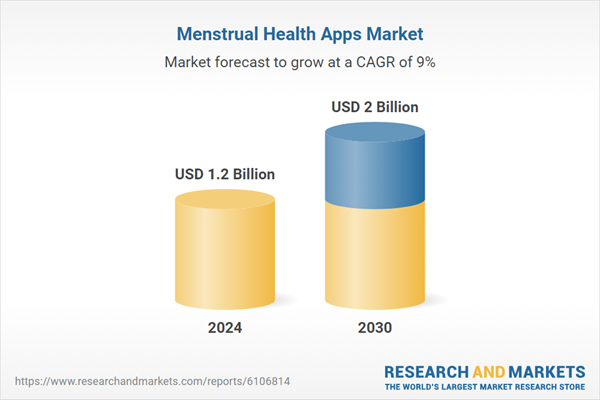

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 9.0% |

| Regions Covered | Global |