Global Microbiology Analyzers Market - Key Trends & Drivers Summarized

How Are Microbiology Analyzers Revolutionizing Clinical and Diagnostic Microbiology?

Microbiology analyzers are transforming the way laboratories detect, identify, and monitor microorganisms responsible for infectious diseases, food contamination, and environmental hazards. These automated systems offer rapid, accurate, and high-throughput analysis of bacteria, viruses, fungi, and parasites, reducing the turnaround time that was traditionally required for culture-based methods. In clinical settings, microbiology analyzers play a vital role in diagnosing bloodstream infections, respiratory diseases, urinary tract infections, and hospital-acquired infections by enabling faster pathogen detection and antibiotic susceptibility testing. Advanced analyzers incorporate techniques such as MALDI-TOF mass spectrometry, nucleic acid amplification, and real-time polymerase chain reaction (PCR), which allow laboratories to move beyond basic identification and into genetic characterization of microorganisms. Integration with laboratory information systems (LIS) supports seamless data management, traceability, and reporting, further enhancing operational efficiency. These systems also reduce manual labor and minimize the risk of human error, which is especially critical in high-volume laboratories and outbreak scenarios. Additionally, microbiology analyzers are being increasingly adapted for use in decentralized settings such as clinics, mobile labs, and point-of-care units due to their compact designs and user-friendly interfaces. As antimicrobial resistance (AMR) continues to rise, rapid diagnostic tools like these are becoming indispensable in guiding appropriate therapy and infection control measures. Food safety and pharmaceutical companies are also relying on these systems to meet stringent quality assurance standards by detecting contaminants in raw materials and finished products. With expanding applications and ongoing technological improvements, microbiology analyzers are emerging as a cornerstone in modern diagnostics and public health surveillance.Why Is the Demand for Automation Driving Innovations in Microbiology Analyzers?

The growing demand for laboratory automation is a major force driving innovation and investment in microbiology analyzers. As laboratories face rising sample volumes, limited staffing, and the need for faster results, automated systems are offering solutions that can process hundreds of samples daily with minimal human intervention. Automation addresses key bottlenecks in traditional microbiology workflows, such as specimen plating, incubation, colony counting, and identification. Sophisticated robotic systems integrated with artificial intelligence and machine learning algorithms now enable real-time image analysis of microbial growth, automatic interpretation of test results, and even predictive analytics for outbreak monitoring. These advancements significantly shorten diagnostic cycles and improve decision-making in critical care scenarios. Fully automated systems not only increase throughput but also ensure consistency and reproducibility, which are vital for clinical accreditation and regulatory compliance. Moreover, next-generation analyzers are designed with modular and scalable features, allowing laboratories to expand capabilities without overhauling existing infrastructure. The standardization of diagnostic processes through automation also helps reduce cross-contamination and improves biosafety in clinical environments. Automation is particularly impactful in resource-constrained settings, where it helps compensate for workforce shortages and improves access to high-quality diagnostics. As hospitals and diagnostic labs adopt lean management principles to optimize efficiency and reduce operational costs, the role of automated microbiology analyzers becomes even more central. The convergence of automation with cloud-based data management and digital connectivity also supports integrated diagnostics and remote result sharing. These developments are not only reshaping laboratory workflows but also creating a new era of rapid, accurate, and data-driven microbial diagnostics.How Are Emerging Infectious Threats and Global Health Priorities Boosting Market Demand?

The emergence of new infectious diseases and the resurgence of previously controlled pathogens are accelerating global demand for microbiology analyzers. The COVID-19 pandemic underscored the importance of having scalable, reliable, and rapid diagnostic systems that can be deployed in diverse settings. Microbiology analyzers capable of handling molecular and culture-based assays were critical in testing strategies, highlighting their utility in both routine diagnostics and emergency response scenarios. As health systems strengthen surveillance infrastructure to better prepare for future outbreaks, investments in advanced microbiology analyzers have increased across public health laboratories, private clinics, and border control facilities. Diseases such as tuberculosis, influenza, and sexually transmitted infections continue to pose significant health burdens, especially in low- and middle-income countries, where fast and accurate diagnostics are key to reducing transmission. The spread of antimicrobial-resistant organisms is another pressing concern that reinforces the need for analyzers capable of performing susceptibility testing and resistance gene detection. Global initiatives by organizations like the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) have highlighted diagnostic capability as a critical pillar in combating infectious diseases. In agriculture and food production, concerns over zoonotic disease transmission are also driving the adoption of microbiology analyzers for pathogen screening in animal health and food supply chains. Environmental monitoring applications, including water quality testing and bioterrorism preparedness, further expand the use cases for these systems. With disease patterns becoming increasingly complex due to climate change, global mobility, and urbanization, microbiology analyzers offer the analytical precision needed to monitor, respond to, and contain infectious threats efficiently and effectively.What Factors Are Propelling the Global Growth of the Microbiology Analyzers Market?

The growth in the microbiology analyzers market is driven by a combination of healthcare trends, technological innovation, public health initiatives, and regulatory evolution. A key driver is the global increase in infectious disease incidence, which is straining laboratory resources and heightening the need for rapid diagnostic tools. As healthcare systems prioritize early detection, real-time monitoring, and personalized treatment, microbiology analyzers provide the necessary speed and precision to support these objectives. Advances in biotechnology and microfluidics have led to the development of compact, multi-functional analyzers capable of performing a broad range of tests from a single sample, improving diagnostic yield and reducing sample processing time. In the pharmaceutical and biotechnology sectors, stringent quality control regulations are driving demand for analyzers that support microbial contamination testing, sterility assurance, and bioburden assessments. Furthermore, government funding and public-private partnerships are expanding diagnostic capacity in both high-income and developing nations, facilitating market penetration of sophisticated analyzer systems. The trend toward decentralized and point-of-care testing is also fostering innovation in portable and user-friendly devices that retain laboratory-grade accuracy. As healthcare access improves globally, particularly in Asia-Pacific, Latin America, and the Middle East, there is growing investment in diagnostic infrastructure and equipment procurement, fueling further market expansion. Additionally, the emphasis on value-based care and operational efficiency is encouraging healthcare providers to adopt automated systems that deliver reliable results while reducing overall diagnostic costs. Strategic acquisitions and partnerships among diagnostic companies are accelerating the rollout of integrated solutions, while continued R&D is expected to expand test menus and improve cost-effectiveness. Collectively, these factors are driving robust and sustained growth in the global microbiology analyzers market.Report Scope

The report analyzes the Microbiology Analyzers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Automated Analyzers, Clinical Analyzers, Molecular Analyzers, Fully Automated Analyzers); Application (Microbial Infection Application, Antibiotic Susceptibility Application, Urine Screening Application, Blood Culture Application, Other Applications); End-Use (Hospitals & Diagnostic Centers End-Use, Custom Lab Service Providers End-Use, Academic & Research Institutes End-Use).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automated Analyzers segment, which is expected to reach US$558.6 Million by 2030 with a CAGR of a 3.6%. The Clinical Analyzers segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $259.7 Million in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $238 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Microbiology Analyzers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Microbiology Analyzers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Microbiology Analyzers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Baker Hughes, BP plc, Chemiphase Ltd., ConocoPhillips, CNPC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Microbiology Analyzers market report include:

- Abbott Laboratories

- Accelerate Diagnostics

- Alifax S.r.l.

- Autobio Diagnostics

- Beckman Coulter

- BD (Becton, Dickinson and Co.)

- bioMérieux

- Bio-Rad Laboratories

- Bruker Corporation

- Copan Diagnostics

- Danaher Corporation

- ELITechGroup

- Eurofins Scientific

- Hologic, Inc.

- Liofilchem S.r.l.

- Meridian Bioscience

- Qiagen N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific

- TSI Incorporated

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Accelerate Diagnostics

- Alifax S.r.l.

- Autobio Diagnostics

- Beckman Coulter

- BD (Becton, Dickinson and Co.)

- bioMérieux

- Bio-Rad Laboratories

- Bruker Corporation

- Copan Diagnostics

- Danaher Corporation

- ELITechGroup

- Eurofins Scientific

- Hologic, Inc.

- Liofilchem S.r.l.

- Meridian Bioscience

- Qiagen N.V.

- Shimadzu Corporation

- Thermo Fisher Scientific

- TSI Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | February 2026 |

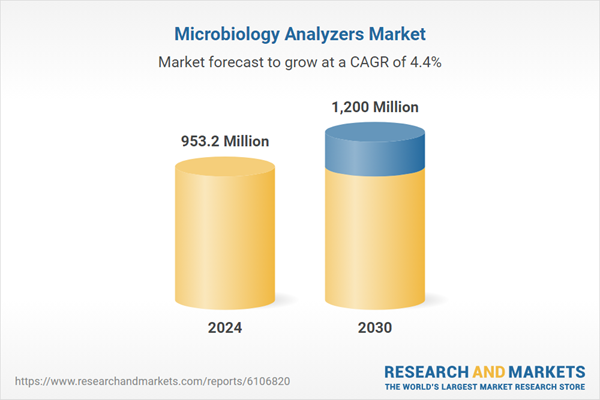

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 953.2 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

![Clinical Microbiology Market by Product (Instrument (Incubators), Analyzer (Microscope), Reagent, Kits, Media], Disease Area (Respiratory, Gastrointestinal, STD, UTI), End User (Hospitals, Diagnostic Center, Research Institutes) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/11979/11979906_60px_jpg/clinical_microbiology_market.jpg)