Global Military Airborne Lasers Market - Key Trends & Drivers Summarized

How Are Military Airborne Lasers Redefining Precision and Threat Neutralization Capabilities?

Military airborne lasers are rapidly transforming the battlefield by offering a high-precision, speed-of-light solution for neutralizing threats in real time. Mounted on aircraft, drones, or helicopters, these directed-energy weapons are capable of disabling or destroying targets such as missiles, drones, and artillery shells before they reach their intended destinations. Unlike conventional kinetic weapons, airborne lasers provide silent, stealthy, and highly targeted strikes without the need for explosive ordnance or ammunition resupply. This capability allows for repeated use during missions without logistical strain, making them ideal for high-tempo combat scenarios. The lasers offer pinpoint accuracy with minimal collateral damage, a critical advantage in modern asymmetric warfare and urban combat zones where civilian safety is paramount. As military forces seek new ways to counter fast-evolving aerial threats, including hypersonic missiles and drone swarms, airborne lasers offer a proactive defense mechanism that intercepts threats at the speed of light. They can also complement existing missile defense systems, filling coverage gaps and reducing overall response time. Technological advancements in beam control, thermal management, and power generation are making these systems more compact, efficient, and reliable, thus enabling their integration into a wider variety of airframes. In addition to their defensive applications, some laser systems are being designed for offensive operations such as disabling enemy sensors or communication systems. These capabilities collectively position airborne lasers as a critical asset in the future of air superiority and force protection strategies.Why Are Advancements in Directed-Energy Technology Accelerating the Deployment of Airborne Lasers?

Recent breakthroughs in directed-energy technology are playing a key role in accelerating the deployment and operational readiness of military airborne lasers. Historically, one of the main challenges in laser weapon development has been generating and managing sufficient power to create a destructive beam while keeping the system compact and lightweight enough for airborne use. However, advances in solid-state lasers, fiber-optic lasers, and coherent beam combining have enabled the creation of systems that deliver high energy levels without excessive bulk or cooling requirements. These improvements are making it feasible to integrate laser systems onto a variety of airborne platforms, including fighter jets, transport aircraft, and unmanned aerial vehicles. Enhanced thermal management systems and adaptive optics are also helping stabilize beam focus and improve accuracy in dynamic flight conditions. Another critical advancement is the integration of laser systems with sophisticated tracking and targeting technologies, such as infrared sensors, radar, and artificial intelligence, to ensure precise engagement of fast-moving or evasive threats. These integrated systems are capable of autonomously detecting, tracking, and neutralizing targets with minimal operator input. In parallel, modular system architectures are being developed to allow for easy upgrades and platform interoperability, which is particularly important for international coalition operations. As the global arms race increasingly focuses on non-kinetic capabilities, the deployment of reliable, air-based laser weapons is becoming a strategic priority for leading defense forces. These technological leaps are not only improving system performance but also reducing acquisition and lifecycle costs, making airborne lasers a more attractive option for widespread military adoption.How Are Evolving Aerial Threats and Asymmetric Warfare Scenarios Driving Demand for Laser Systems?

The rapid evolution of aerial threats and the growing prevalence of asymmetric warfare scenarios are major factors driving demand for military airborne laser systems. Traditional defense systems are often not fast or flexible enough to deal with the high speed, low altitude, and erratic flight paths of modern threats such as drones, loitering munitions, and hypersonic missiles. In response, military planners are turning to airborne lasers for their ability to engage these threats almost instantaneously and with great precision. In asymmetric warfare, where adversaries may deploy low-cost, mass-produced drones or stealthy infiltration aircraft, airborne lasers provide a cost-effective and scalable solution. Instead of expending expensive missile interceptors or dealing with slow-reacting gun systems, a laser weapon can continuously engage multiple targets without the need to reload or reposition. This is particularly useful in protecting forward-operating bases, high-value assets, and mobile units that are frequently under threat from unpredictable attacks. Airborne lasers also offer the advantage of rapid redeployment and high-altitude operation, giving forces the ability to patrol and defend large areas quickly. These systems are increasingly being integrated into layered air defense strategies, working in concert with ground-based and space-based sensors to provide comprehensive coverage. The global proliferation of drone technology and the increasing sophistication of aerial strike platforms have made it essential for militaries to invest in future-proof defense solutions. Military airborne lasers, with their flexibility and rapid response capabilities, are uniquely positioned to address these challenges and provide a decisive edge in modern combat environments.What Are the Main Drivers Behind the Global Growth of the Military Airborne Lasers Market?

The growth in the military airborne lasers market is being propelled by a combination of strategic defense priorities, technological readiness, and shifting threat dynamics. One of the leading drivers is the increased emphasis on next-generation air defense systems that are capable of countering a broad spectrum of threats with minimal collateral impact. As nations modernize their military capabilities, they are placing a high premium on technologies that deliver precision, speed, and cost-efficiency. Airborne lasers meet these criteria while offering additional benefits such as multi-mission capability and operational scalability. Geopolitical tensions and regional conflicts are also accelerating investment in advanced defense platforms, including directed-energy weapons. Countries in regions like North America, the Middle East, and Asia-Pacific are actively pursuing airborne laser programs to strengthen their deterrence posture and protect against both state and non-state actors. Joint military initiatives and defense collaborations among allied nations are further expanding the scope and funding available for airborne laser development. Budget allocations are increasingly being directed toward research and procurement of laser systems as part of broader efforts to gain technological superiority. Moreover, the push for lighter, more portable, and energy-efficient systems is resulting in new design concepts and manufacturing techniques that make airborne lasers more viable and affordable for broader adoption. The convergence of these factors is generating sustained demand and spurring new opportunities for defense contractors, research institutions, and aerospace integrators. As military doctrines evolve to incorporate more non-kinetic and energy-based weapons, the role of airborne lasers is expected to grow significantly, making them a central component of 21st-century warfare strategies.Report Scope

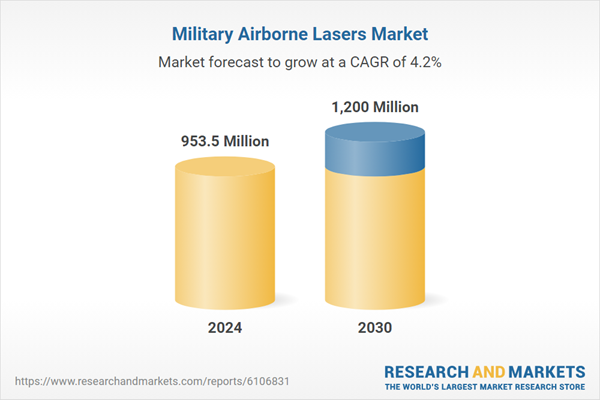

The report analyzes the Military Airborne Lasers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (LIDAR, 3D Scanning, Laser Weapon, Laser Range Finder, Laser Altimeter); Technology (Fiber-Optic Technology, Solid-State Technology, Other Technologies); Platform Type (Fixed Wing Platform, Rotary Wing Platform).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the LIDAR segment, which is expected to reach US$475.3 Million by 2030 with a CAGR of a 4.9%. The 3D Scanning segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $259.8 Million in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $250.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Military Airborne Lasers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Military Airborne Lasers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Military Airborne Lasers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., AC Immune SA, Alzheon, Inc., Alector, Inc., Anavex Life Sciences Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Military Airborne Lasers market report include:

- Airbus Defence and Space

- BAE Systems plc

- Bharat Electronics Limited (BEL)

- Boeing Defense, Space & Security

- Coherent Corp.

- Directed Energy Solutions

- Elbit Systems Ltd.

- Epsilor-Electric Fuel Ltd.

- General Atomics Electromagnetic Systems

- Hensoldt AG

- Hindustan Aeronautics Ltd (HAL)

- Israel Aerospace Industries (IAI)

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA Group

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Textron Systems Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus Defence and Space

- BAE Systems plc

- Bharat Electronics Limited (BEL)

- Boeing Defense, Space & Security

- Coherent Corp.

- Directed Energy Solutions

- Elbit Systems Ltd.

- Epsilor-Electric Fuel Ltd.

- General Atomics Electromagnetic Systems

- Hensoldt AG

- Hindustan Aeronautics Ltd (HAL)

- Israel Aerospace Industries (IAI)

- L3Harris Technologies Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- MBDA Group

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Rheinmetall AG

- Textron Systems Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 953.5 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |