Global Space-Based Network Market - Key Trends & Drivers Summarized

Satellites at the Core: How Space-Based Networks Are Reshaping Global Communications and Infrastructure ResilienceWhat Are Space-Based Networks and Why Are They Redefining Global Connectivity Infrastructure?

Space-based networks refer to integrated systems of communication, navigation, and data relay satellites operating in Earth-s orbit to provide wide-area coverage and resilient services across commercial, defense, and scientific domains. These networks are not limited to traditional geostationary satellites; they now include Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and hybrid constellations designed for low-latency broadband, secure communications, and global reach. The surge in demand for global internet access, disaster-resilient communication frameworks, and real-time data exchange has transformed space-based networks from niche assets into mission-critical infrastructure.LEO satellite constellations, such as SpaceX-s Starlink, OneWeb, and Amazon-s Kuiper, are reshaping the economics and architecture of the sector. These systems aim to provide high-throughput, low-latency internet access to remote, underserved, or politically restricted areas. Unlike GEO satellites that suffer from high latency due to their 36,000 km altitude, LEO systems (operating between 500-1,500 km) offer response times comparable to terrestrial fiber optics. Moreover, with mesh-based routing and phased-array antennas, these networks ensure dynamic bandwidth allocation and fault tolerance, critical for real-time applications like autonomous vehicles, maritime navigation, and emergency response.

Which Applications Are Accelerating the Expansion of Space-Based Networks Worldwide?

Commercial telecommunications is the most prominent driver of space-based network expansion. As terrestrial infrastructure faces limitations in reach and resilience-especially in mountainous regions, oceans, deserts, and polar zones-space-based connectivity provides an efficient alternative. LEO satellite internet is being adopted by aviation, maritime, and logistics sectors to ensure seamless tracking, safety, and operations. In mobile backhaul and 5G densification, space-based networks support rural coverage and redundancy for high-availability services.Defense and strategic communications represent another critical use case. Governments are increasingly reliant on secure space-based communication channels for battlefield connectivity, surveillance data relay, and command coordination. Encrypted satellite links are essential for high-assurance applications such as drone operations, ballistic missile defense, and naval fleet coordination. Militaries are also investing in hardened satellite architectures that can withstand jamming, cyberattacks, and space weather disruptions.

Scientific and environmental monitoring uses are also expanding. Space-based networks support Earth observation satellites that relay meteorological, geospatial, and climate data. Real-time connectivity enables quicker responses to natural disasters, forest fires, and crop failures. Moreover, space-based IoT networks are linking thousands of sensors deployed in agriculture, mining, smart cities, and oil and gas exploration. These networks enable low-bandwidth, high-reliability data transmission over massive areas with minimal energy consumption.

Which Countries and Companies Are Leading Global Deployment of Satellite Network Infrastructure?

The United States is at the forefront of commercial and government space-based network initiatives. SpaceX-s Starlink is the most expansive LEO constellation, with over 6,000 satellites in orbit and growing. Amazon-s Project Kuiper is following suit, while Iridium and Globalstar offer established voice and IoT services from MEO and LEO orbits. The U.S. Department of Defense continues to fund resilient communication satellites under programs such as AEHF (Advanced Extremely High Frequency) and the new PWSA (Proliferated Warfighter Space Architecture) by the Space Development Agency.China-s “Guowang” satellite network and Beidou navigation system signify its ambition to match or surpass Western capabilities in space-based services. The China Aerospace Science and Technology Corporation (CASC) is developing broadband constellations for both domestic use and Belt and Road partner nations. Europe, through the EU-backed IRIS2 and Galileo programs, is establishing sovereign satellite infrastructures for navigation and secure communications. The UK-s OneWeb, after its acquisition by a government consortium, has resumed constellation deployment with global coverage ambitions.

In parallel, smaller players like Canada-s Telesat (with Lightspeed), South Korea-s Hanwha Systems, and India-s Bharti Group (a stakeholder in OneWeb) are entering the market with tailored regional solutions. Cross-sector partnerships are increasing, involving telecom providers, data centers, ground segment integrators, and space agencies. As orbital real estate becomes more crowded, space traffic management and spectrum regulation will be critical to sustaining long-term functionality of space-based networks.

What Is Driving Market Growth and How Is Innovation Shaping the Future of Satellite Networking?

The growth in the global space-based network market is driven by several factors including rising global internet penetration demands, critical infrastructure digitization, and geopolitical focus on space sovereignty. Hybrid network models-where terrestrial, airborne, and satellite systems converge-are enabling seamless coverage and uninterrupted service in both urban and remote zones. Space-based networks are also becoming foundational to autonomous systems, global logistics, and AI-powered analytics that rely on persistent high-speed data access.Innovation is accelerating across multiple domains. Electronically steered antennas (ESAs), optical inter-satellite links (OISLs), and software-defined payloads are being deployed to enhance bandwidth agility and network programmability. AI-based network orchestration allows autonomous routing, congestion mitigation, and dynamic prioritization of traffic. Ground segment innovations, such as virtualized satellite gateways and cloud-based network management, are making it easier for enterprises to integrate satellite capacity into their IT ecosystems.

Future trajectories include quantum communication satellites, laser-based data downlinks, and satellite-as-a-service platforms that offer modular, subscription-based connectivity. As constellations scale, edge computing in space, swarm satellite architecture, and AI-assisted mission planning will redefine what-s possible from orbit. The result is a resilient, globally distributed information infrastructure-one that will underpin future economies, military operations, and digital societies across Earth and beyond.

Scope Of Study:

The report analyzes the Space-based Network market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Component (Satellite Component, Gateways & Antenna Dish Component, Modem Component); Orbit (Low Earth Orbit, Medium Earth Orbit, Geostationary Earth Orbit); Application (Agriculture Application, Maritime Application, Aviation Application, Enterprise Application, Data & Telecommunication Application, Logistics & Transportation Application, Other Applications); End-Use (Defense & Government End-Use, Commercial End-Use, Individual End- Users End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Satellite Component segment, which is expected to reach US$22.8 Billion by 2030 with a CAGR of a 19.6%. The Gateways & Antenna Dish Component segment is also set to grow at 22.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 19.2% CAGR to reach $5.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Space-based Network Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Space-based Network Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Space-based Network Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon (Project Kuiper), AST SpaceMobile, Astrocast, China State-Owned Constellations (ChinaSat, G60), Eutelsat / OneWeb and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Space-based Network market report include:

- Amazon (Project Kuiper)

- AST SpaceMobile

- Astrocast

- China State-Owned Constellations (ChinaSat, G60)

- Eutelsat / OneWeb

- Gilat Satellite Networks

- Globalstar, Inc.

- Hughes Network Systems

- Inmarsat

- Iridium Satellite LLC

- Kacific Broadband Satellites

- Lynk Global

- Project Loon (subsidiary of Alphabet - defunct)

- SES S.A.

- SpaceX (Starlink)

- Telesat

- Thales Alenia Space

- T-Mobile (via Starlink-powered T-Satellite)

- Viasat, Inc.

- ViaSat-Mobile / EchoStar Mobile

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon (Project Kuiper)

- AST SpaceMobile

- Astrocast

- China State-Owned Constellations (ChinaSat, G60)

- Eutelsat / OneWeb

- Gilat Satellite Networks

- Globalstar, Inc.

- Hughes Network Systems

- Inmarsat

- Iridium Satellite LLC

- Kacific Broadband Satellites

- Lynk Global

- Project Loon (subsidiary of Alphabet - defunct)

- SES S.A.

- SpaceX (Starlink)

- Telesat

- Thales Alenia Space

- T-Mobile (via Starlink-powered T-Satellite)

- Viasat, Inc.

- ViaSat-Mobile / EchoStar Mobile

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 204 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

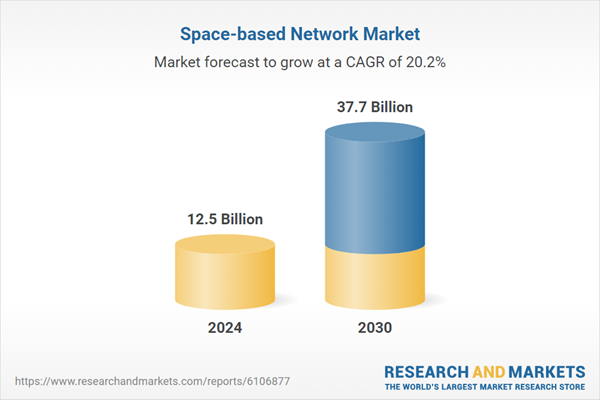

| Estimated Market Value in 2024 | 12.5 Billion |

| Forecasted Market Value by 2030 | 37.7 Billion |

| Compound Annual Growth Rate | 20.2% |

| Regions Covered | Global |