Global Sub-GHz Modules Market - Key Trends & Drivers Summarized

What's Energizing Growth in Sub-GHz Wireless Modules?

Sub-GHz modules, designed for low-power, long-range wireless communication, are the backbone of many Internet of Things (IoT) applications. Operating within frequency bands like 433 MHz, 868 MHz, and 915 MHz, these modules excel in scenarios where battery life, distance, and signal penetration matter most-such as smart metering, asset tracking, precision agriculture, and building automation. With support for protocols such as LoRa, Sigfox, and proprietary narrowband systems, Sub-GHz modules deliver connectivity where conventional Wi-Fi and Bluetooth fail due to limited range or poor building penetration. Their adoption is particularly strong in both rural and industrial settings that demand resilient, low-data-rate communication.Are Integration and Power Efficiency Leading the Innovation Curve?

Modern Sub-GHz modules are now incorporating ultra-low-power chipsets, advanced sleep modes, and energy harvesting compatibility, enabling devices to operate for years without maintenance. Many modules come embedded with microcontrollers (MCUs), sensor interfaces, and certified network stacks, accelerating development and reducing certification complexity for OEMs. Form factors are becoming increasingly compact, while antenna design and signal range continue to improve. Developers benefit from growing ecosystems of development kits, cloud integration tools, and OTA (over-the-air) firmware update capabilities, which are now considered essential for field deployments.Why Are Manufacturers Turning to Module-Based Designs?

Manufacturers are gravitating toward pre-certified modules to avoid RF compliance headaches and streamline product launches. Modules reduce BOM (bill of materials) complexity, simplify PCB layout, and allow rapid prototyping. They also enable global scalability through regional frequency variants and simplified integration with cloud platforms like AWS IoT and Azure. Use cases in logistics, cold chain management, environmental monitoring, and healthcare are expanding rapidly, making modules a flexible and reliable foundation for IoT product lines.What's Powering the Growth in the Sub-GHz Modules Market?

The growth in the Sub-GHz modules market is driven by several factors related to IoT expansion, energy efficiency, and connectivity diversity. Demand is surging in industries like utilities, agriculture, and logistics for devices that can function in the field for years with minimal servicing. LPWAN (Low-Power Wide-Area Network) deployment is fueling the adoption of LoRa- and Sigfox-based modules. Developers prefer modular, drop-in solutions to shorten design cycles and reduce risk. Finally, the rise of smart infrastructure and sensor networks across public and private sectors continues to generate sustained demand for scalable, low-power wireless communication modules.Scope Of Study:

The report analyzes the Sub-GHz Modules market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Type (Sub-GHz Transceivers, Sub-GHz Transmitters, Sub-GHz Receivers, Sub-GHz LoRa Modules); Application (Remote Metering Application, Smart Home Application, Smart City Application, Smart Agriculture Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sub-GHz Transceivers segment, which is expected to reach US$910.1 Million by 2030 with a CAGR of a 9.8%. The Sub-GHz Transmitters segment is also set to grow at 9.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $298.4 Million in 2024, and China, forecasted to grow at an impressive 14.2% CAGR to reach $407.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sub-GHz Modules Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sub-GHz Modules Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sub-GHz Modules Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAEON, Advantech Co. Ltd., Analog Devices Inc., Anaren Inc., Cavli Wireless and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Sub-GHz Modules market report include:

- AAEON

- Advantech Co. Ltd.

- Analog Devices Inc.

- Anaren Inc.

- Cavli Wireless

- Digi International Inc.

- EMBIT S.R.L.

- EM Microelectronic

- Filtronic

- HOPERF

- Integrated Device Technology

- Jorjin Technologies

- Laird Connectivity

- LITE-ON Technology

- LSR

- Microchip Technology Inc.

- Microsemi

- Murata Manufacturing Co. Ltd.

- Nordic Semiconductor ASA

- Renesas

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAEON

- Advantech Co. Ltd.

- Analog Devices Inc.

- Anaren Inc.

- Cavli Wireless

- Digi International Inc.

- EMBIT S.R.L.

- EM Microelectronic

- Filtronic

- HOPERF

- Integrated Device Technology

- Jorjin Technologies

- Laird Connectivity

- LITE-ON Technology

- LSR

- Microchip Technology Inc.

- Microsemi

- Murata Manufacturing Co. Ltd.

- Nordic Semiconductor ASA

- Renesas

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

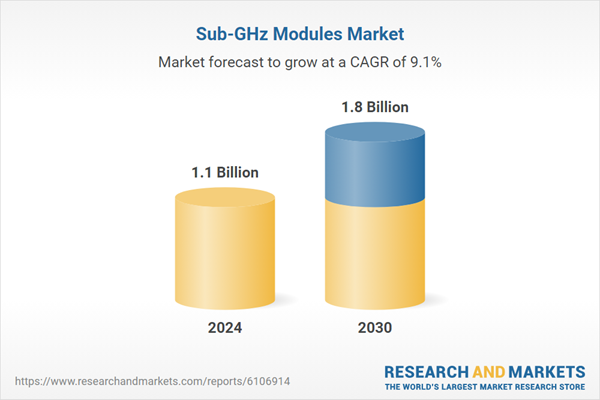

| Estimated Market Value in 2024 | 1.1 Billion |

| Forecasted Market Value by 2030 | 1.8 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |