Global Subsea Production and Processing Market - Key Trends & Drivers Summarized

What's Fueling the Demand for Subsea Production and Processing Systems?

Subsea production and processing systems include subsea trees, manifolds, separators, and compression modules that extract, condition, and transport hydrocarbons directly on the seabed. These systems are increasingly vital in deepwater and ultra-deepwater fields, enabling operators to reduce surface infrastructure, improve reservoir recovery, and access previously unreachable reserves. Their importance has soared as offshore developments move into deeper waters, the cost of floating platforms rises, and decommissioning pressures increase. Operators benefit from compact, modular subsea hubs that allow phased tie-backs and reduced topside complexity.Are Technologies Enabling Smarter, More Efficient Subsea Systems?

Yes. Integration of subsea compression-both electric and hydraulic-is enhancing reservoir performance by maintaining production rates and stabilizing flowlines. Subsea boosting and separation systems remove water and gas offshore, optimizing export pipeline economics. Additionally, digitalization via subsea control modules, fiber-optic sensing, and digital twin models enables real-time anomaly detection, leakage monitoring, and flow optimization. These smart features reduce the need for surface intervention and lower OPEX.Why Are Operators Embracing Subsea Innovation?

Oil and gas firms are prioritizing subsea solutions to lower field development costs, extend asset life, and minimize environmental footprints. Mature fields benefit from redeployment of subsea compression or processing modules to revitalize declining wells. The shift toward low-carbon operations also encourages decentralized subsea hubs that reduce surface emissions and logistical complexity. Subsea modularity supports flexible, hybrid schemes-hydrocarbons, offshore wind, carbon capture-on shared seabeds.What's Powering the Growth in Subsea Production and Processing?

Key growth drivers include increasing exploration in deepwater basins, demand for shorter time-to-first oil via tie-backs, and tighter OPEX control under volatile oil prices. Integration of digital control systems and remote architecture enhances uptime and reduces vessel dependency. Rising decommissioning obligations also elevate interest in retrofitting subsea assets for reuse. Lastly, future-proofing via multi-purpose modules (e.g., processing + CO2 handling) is lifting the subsea value proposition.Scope Of Study:

The report analyzes the Subsea Production and Processing market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Application (Shallow Water Application, Deepwater Application, Ultra-Deepwater Application)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Shallow Water Application segment, which is expected to reach US$18.6 Billion by 2030 with a CAGR of a 4.1%. The Deepwater Application segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $6.8 Billion in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $5.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Subsea Production and Processing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Subsea Production and Processing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Subsea Production and Processing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aker Solutions ASA, Akastor ASA, Baker Hughes Company, Cameron (SLB subsidiary), Dril-Quip, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Subsea Production and Processing market report include:

- Aker Solutions ASA

- Akastor ASA

- Baker Hughes Company

- Cameron (SLB subsidiary)

- Dril-Quip, Inc.

- Framo AS

- Halliburton Co.

- InterMoor

- MODEC, Inc.

- National Oilwell Varco (NOV) Inc.

- Oceaneering International, Inc.

- OneSubsea (SLB joint venture)

- Saipem S.p.A.

- Schlumberger Ltd.

- Subsea 7 SA

- TechnipFMC plc

- Transocean Ltd.

- TWI Technology Centre (Wales)

- Wärtsilä Corporation

- WesternGeco (SLB subsidiary)

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aker Solutions ASA

- Akastor ASA

- Baker Hughes Company

- Cameron (SLB subsidiary)

- Dril-Quip, Inc.

- Framo AS

- Halliburton Co.

- InterMoor

- MODEC, Inc.

- National Oilwell Varco (NOV) Inc.

- Oceaneering International, Inc.

- OneSubsea (SLB joint venture)

- Saipem S.p.A.

- Schlumberger Ltd.

- Subsea 7 SA

- TechnipFMC plc

- Transocean Ltd.

- TWI Technology Centre (Wales)

- Wärtsilä Corporation

- WesternGeco (SLB subsidiary)

Table Information

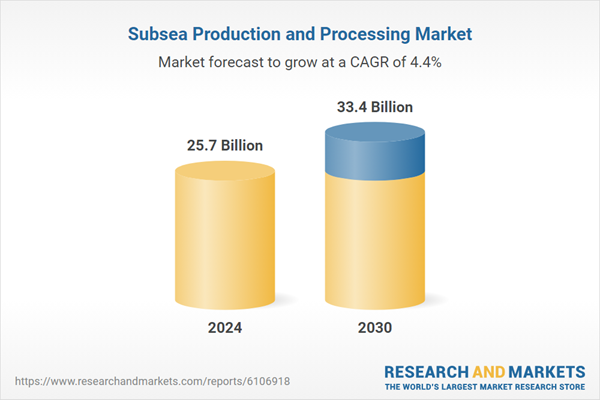

| Report Attribute | Details |

|---|---|

| No. of Pages | 129 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 25.7 Billion |

| Forecasted Market Value by 2030 | 33.4 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |