Global Video Shopping Market - Key Trends & Drivers Summarized

How Is Video Shopping Revolutionizing the E-Commerce Experience for Digital Consumers?

Video shopping has emerged as a powerful force reshaping the way consumers engage with products online. As e-commerce continues to replace traditional retail in both volume and value, video shopping adds a vital layer of interactivity and trust to digital purchasing behavior. Unlike static images or text descriptions, live and pre-recorded product videos offer a more authentic representation of merchandise, demonstrating fit, usage, texture, and even real-time feedback from hosts or influencers. Consumers are increasingly turning to platforms that allow them to view products in action before committing to a purchase. This shift is evident across demographics but is particularly pronounced among younger generations such as Millennials and Gen Z, who demand immersive, entertaining, and social shopping experiences. Retailers have responded by integrating video content into product pages, launching livestream events hosted by brand ambassadors, and partnering with creators who build trust through direct engagement. These video formats not only improve conversion rates but also reduce returns by helping buyers make more informed decisions. Moreover, the integration of real-time chat, reactions, polls, and live Q&A sessions during broadcasts turns passive viewers into active participants. Brands are increasingly viewing video shopping not just as a sales tool but as a strategic marketing avenue that enhances brand storytelling, community building, and long-term customer loyalty. As a result, video shopping is becoming a defining feature of the next generation of digital commerce.What Role Do Technology Platforms and Infrastructure Play in Scaling Video Shopping?

The rapid adoption of video shopping is being underpinned by significant advances in supporting technologies and infrastructure. Retailers and marketplaces are relying on robust content delivery networks, real-time streaming protocols, and cloud-based video platforms to ensure seamless playback and high-quality experiences for viewers across devices and geographies. With millions of users tuning into livestreams or viewing on-demand content simultaneously, latency, buffering, and uptime are critical factors. This has led to a sharp rise in the use of scalable cloud video solutions, edge computing, and adaptive bitrate streaming. Many brands are integrating video shopping functionality directly into their websites or apps, bypassing third-party platforms to retain user data and control over branding. Sophisticated analytics tools are also playing a key role, enabling retailers to track viewer behavior, engagement metrics, and conversion patterns in real time. These insights allow brands to fine-tune their content, optimize show timings, and personalize offers for different audience segments. At the same time, advancements in interactive technologies such as clickable product overlays, one-click purchases, augmented reality try-ons, and AI-powered recommendations are transforming passive viewership into dynamic shopping journeys. Even payment systems are evolving to accommodate impulse buying behaviors during live events, with integrations that allow seamless checkout without leaving the video stream. As these technologies become more accessible and cost-effective, businesses of all sizes are jumping into the video shopping arena, driving its rapid global expansion.Why Is Consumer Psychology Driving the Shift Toward Video-Centric Retail Experiences?

Consumer behavior has undergone a marked transformation in recent years, and video shopping taps into many of the psychological triggers that influence purchasing decisions in the digital age. Visual storytelling, real-time interaction, and social proof all combine to make video a persuasive medium that bridges the sensory gap in online shopping. Shoppers feel more confident buying products they can see in action, especially when demonstrations come from relatable hosts or trusted influencers. This form of peer validation enhances trust and fosters a sense of community around the brand. The emotional resonance of live video, especially during limited-time events or exclusive drops, also stimulates urgency and excitement, encouraging spontaneous purchases. Additionally, the format mirrors social media behavior, making it more familiar and engaging for users who already consume video content on platforms like TikTok, Instagram, and YouTube. Consumers are no longer passive observers but want to participate in the conversation, ask questions, and see authentic reactions to products. This has led to an increase in user-generated content and community-driven commerce, where audiences contribute reviews, livestreams, and discussions that add depth to the shopping experience. The convenience of watching and buying in the same interface reduces friction and makes the path to purchase more intuitive. For time-starved consumers, video shopping offers an efficient, engaging, and enjoyable way to discover and buy products, blending entertainment with utility in a uniquely modern shopping format.What Forces Are Propelling the Growth of the Global Video Shopping Market?

The growth in the video shopping market is driven by several factors rooted in shifting consumer expectations, digital infrastructure readiness, and industry-wide adoption strategies. One of the most prominent drivers is the rise of mobile-first behavior, especially in regions with younger, tech-savvy populations. Consumers are spending more time on their smartphones watching short-form videos, participating in livestreams, and browsing through curated content feeds. Retailers have recognized this shift and are optimizing their video shopping experiences for mobile screens, incorporating responsive design, vertical video formats, and touch-enabled features. Another key driver is the growing influence of social commerce, where platforms like Instagram, YouTube, TikTok, and Facebook have embedded shopping functionality directly into their video content. This convergence of content and commerce is reducing the gap between discovery and purchase. Brands are also investing heavily in creator partnerships, recognizing that influencers bring credibility and reach to live video formats. Meanwhile, improvements in bandwidth, 5G connectivity, and edge delivery are enabling smooth video experiences even in high-traffic scenarios. In parallel, the analytics capabilities of video shopping platforms are allowing businesses to personalize content, target audiences more accurately, and improve return on ad spend. The retail industry's push for experiential commerce is another catalyst, as brands look to differentiate themselves in crowded digital marketplaces through more engaging formats. Additionally, consumer fatigue with traditional advertising and static e-commerce interfaces is driving preference for richer, more interactive formats. Combined, these trends are positioning video shopping not just as a temporary trend but as a foundational pillar of future online retail ecosystems.Scope Of Study:

The report analyzes the Video Shopping market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Product (Shoppable Videos, Livestream Shopping); Product (Apparel & Accessories, Health & Personal Care Products, Consumer Electronic Products, Home Furnishing Products, Food & Beverage Products, Other Products); Payment Method (Online Payment Method, Pay On Delivery Payment Method)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Shoppable Videos segment, which is expected to reach US$953.7 Million by 2030 with a CAGR of a 27.4%. The Livestream Shopping segment is also set to grow at 27.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $213.7 Million in 2024, and China, forecasted to grow at an impressive 32.8% CAGR to reach $721.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Video Shopping Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Video Shopping Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Video Shopping Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amazon Live, Bambuser, Buywith, Channelize.io, Clicktivated and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Video Shopping market report include:

- Amazon Live

- Bambuser

- Buywith

- Channelize.io

- Clicktivated

- CommentSold

- Firework

- Giosg

- Livescale

- MikMak

- Moast.io

- NTWRK

- QVC Live

- ReelUp

- Shoploop

- Smartzer

- Talkshop.live

- TikTok Shop

- Vidjet

- Vimeo

- Whatnot

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amazon Live

- Bambuser

- Buywith

- Channelize.io

- Clicktivated

- CommentSold

- Firework

- Giosg

- Livescale

- MikMak

- Moast.io

- NTWRK

- QVC Live

- ReelUp

- Shoploop

- Smartzer

- Talkshop.live

- TikTok Shop

- Vidjet

- Vimeo

- Whatnot

Table Information

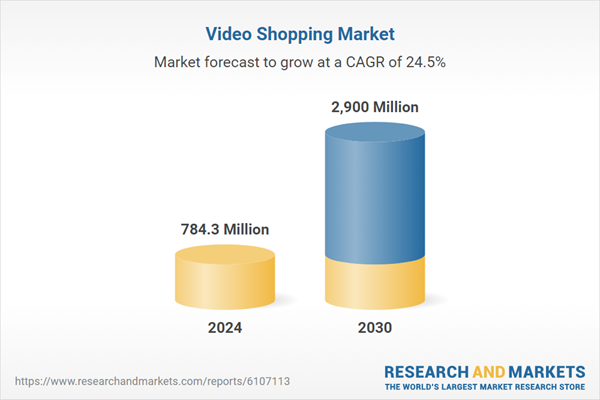

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 784.3 Million |

| Forecasted Market Value by 2030 | 2900 Million |

| Compound Annual Growth Rate | 24.5% |

| Regions Covered | Global |