Global Volatile Organic Compound (VOC) Recovery and Abatement Market - Key Trends & Drivers Summarized

How Are VOC Recovery and Abatement Solutions Gaining Momentum Amid Rising Environmental Concerns?

Volatile organic compound (VOC) recovery and abatement technologies are gaining significant traction as environmental regulations tighten and industries face increasing pressure to reduce harmful emissions. VOCs, which are emitted as gases from certain solids or liquids, play a critical role in the formation of ground-level ozone and smog, contributing to air pollution and posing severe health risks to both humans and ecosystems. As a result, governments and environmental agencies across the globe have implemented stringent emission standards that require industrial facilities to control and minimize their VOC output. This has led to a surge in demand for effective recovery and abatement systems, especially in sectors such as petrochemicals, pharmaceuticals, paints and coatings, automotive, and food processing. These systems are designed to capture VOCs before they are released into the atmosphere and either destroy them using thermal oxidation technologies or recover them for reuse through adsorption, condensation, or membrane separation techniques. Increasing awareness of the long-term impact of air pollutants on public health has further strengthened the regulatory push for cleaner industrial operations. Moreover, companies are recognizing the economic and reputational benefits of adopting sustainable practices. VOC recovery allows for the reuse of valuable compounds, reducing material costs and improving process efficiency. As environmental sustainability becomes a core component of corporate strategy, VOC control technologies are no longer viewed as mere compliance tools but as integral elements of responsible and future-focused industrial operations.What Are the Key Technological Advancements Driving Efficiency in VOC Control Systems?

Technological innovation is playing a vital role in enhancing the efficiency, cost-effectiveness, and versatility of VOC recovery and abatement solutions. Among the most widely adopted methods are regenerative thermal oxidizers (RTOs), which utilize heat recovery processes to destroy VOCs at high temperatures while minimizing energy consumption. Continuous improvements in RTO design, such as advanced heat exchange materials and optimized airflow configurations, are increasing destruction efficiency and lowering operational costs. Catalytic oxidation technologies offer another approach by using catalysts to accelerate the breakdown of VOCs at lower temperatures, resulting in energy savings and reduced greenhouse gas emissions. On the recovery side, adsorption systems using activated carbon or zeolites are becoming more sophisticated, with innovations in regeneration techniques that extend media life and improve capture efficiency. Condensation systems, which involve cooling VOC-laden air to condense the compounds, are increasingly being equipped with automation and control sensors to enhance performance under variable conditions. Emerging technologies such as membrane separation and cryogenic condensation are being explored for applications requiring high selectivity and low-temperature operation. Integration with smart monitoring systems and IoT devices is enabling real-time tracking of emissions and system performance, allowing operators to fine-tune processes and ensure compliance. Additionally, modular system designs are making VOC control solutions more adaptable to different facility layouts and production scales. These advancements are not only improving environmental outcomes but also helping industries reduce costs, increase uptime, and operate with greater flexibility in dynamic regulatory and market environments.Why Are Industries Prioritizing VOC Management as Part of Their Sustainability and Compliance Strategies?

Industries across the spectrum are increasingly prioritizing VOC recovery and abatement technologies as part of their broader sustainability and compliance strategies due to a growing focus on environmental responsibility and risk mitigation. Compliance with local, regional, and international environmental regulations is no longer optional, with agencies such as the U.S. Environmental Protection Agency (EPA), the European Environment Agency (EEA), and national regulatory bodies enforcing strict VOC emission limits. Non-compliance can result in substantial fines, legal action, and reputational damage, compelling companies to invest proactively in emissions control infrastructure. Beyond regulatory compliance, there is a heightened awareness among stakeholders, investors, and consumers about the importance of environmental performance. Companies that demonstrate a commitment to reducing their environmental footprint often gain competitive advantage, improved brand perception, and greater access to environmentally conscious markets and investment opportunities. VOC recovery systems also support the principles of circular economy by capturing usable solvents and chemicals for reintegration into manufacturing processes, reducing raw material consumption and waste generation. In sectors where product purity and air quality are critical, such as pharmaceuticals and electronics, VOC management ensures adherence to quality standards and operational safety. Additionally, incorporating VOC abatement into environmental, social and governance (ESG) frameworks helps companies in reporting quantifiable progress toward climate goals and sustainability targets. As a result, VOC control is being viewed not merely as a regulatory necessity but as a strategic enabler of operational resilience, resource efficiency, and long-term environmental stewardship.What Market Dynamics and Emerging Trends Are Driving the Expansion of the VOC Recovery and Abatement Sector?

The growth in the volatile organic compound (VOC) recovery and abatement market is driven by a combination of regulatory momentum, technological evolution, industrial expansion, and increasing global awareness of air quality issues. One of the primary market dynamics is the global push for cleaner air and climate action, which has led to the implementation of comprehensive emission control standards across industrialized and emerging economies. As nations commit to reducing greenhouse gas emissions and improving urban air quality, the demand for VOC mitigation solutions is intensifying across multiple sectors. Industrial growth in developing countries, particularly in Asia and Latin America, is generating new opportunities for the deployment of VOC control systems as manufacturing facilities expand. At the same time, the rise of sustainable manufacturing practices is encouraging companies to adopt recovery-based systems that support circular economy models. Technological progress, especially in automation, remote monitoring, and data analytics, is making VOC systems more user-friendly, measurable, and responsive. Additionally, the increasing adoption of low-VOC materials in products such as paints, coatings, and adhesives is complementing these abatement efforts by reducing VOC generation at the source. Industry collaborations and public-private partnerships are supporting research, standardization, and awareness, further accelerating market maturity. Financial incentives and green financing mechanisms are also emerging to support investments in emission control infrastructure. Together, these trends are shaping a robust and diversified VOC recovery and abatement market, one that aligns with the world's shifting priorities toward environmental health, regulatory accountability, and industrial sustainability.Scope Of Study:

The report analyzes the Volatile Organic Compound (VOC) Recovery and Abatement market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Type (Thermal Oxidation Type, Catalytic Oxidation Type, Adsorption Type, Condensation Type, Biofiltration Type); Application (Petroleum & Petrochemical Application, Coating & Inks Application, Pharmaceuticals Application, Food & Beverages Application, Electronics Application, Packaging & Printing Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Thermal Oxidation Type segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 12.5%. The Catalytic Oxidation Type segment is also set to grow at 14.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $508.5 Million in 2024, and China, forecasted to grow at an impressive 18.1% CAGR to reach $851.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Volatile Organic Compound (VOC) Recovery and Abatement Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Volatile Organic Compound (VOC) Recovery and Abatement Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Volatile Organic Compound (VOC) Recovery and Abatement Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AAF International, Anguil Environmental Systems Inc., CECO Environmental Corp., Condorchem Envitech, Dürr AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Volatile Organic Compound (VOC) Recovery and Abatement market report include:

- AAF International

- Anguil Environmental Systems Inc.

- CECO Environmental Corp.

- Condorchem Envitech

- Dürr AG

- EBARA Environmental Plant Co., Ltd.

- Environmental C&C Co., Ltd.

- Eisenmann GmbH

- Fives Group

- John Zink Hamworthy Combustion (Koch Industries)

- Lianhua Technology Inc.

- Munters Group AB

- Polaris s.r.l.

- Praxair (now part of Linde plc)

- Pure Air Solutions BV

- Taikisha Ltd.

- TANN Corporation

- Thermoxidizer (a division of Catalytic Products International)

- Wärtsilä Corporation

- Zhejiang Kaidi Environmental Protection Co., Ltd.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAF International

- Anguil Environmental Systems Inc.

- CECO Environmental Corp.

- Condorchem Envitech

- Dürr AG

- EBARA Environmental Plant Co., Ltd.

- Environmental C&C Co., Ltd.

- Eisenmann GmbH

- Fives Group

- John Zink Hamworthy Combustion (Koch Industries)

- Lianhua Technology Inc.

- Munters Group AB

- Polaris s.r.l.

- Praxair (now part of Linde plc)

- Pure Air Solutions BV

- Taikisha Ltd.

- TANN Corporation

- Thermoxidizer (a division of Catalytic Products International)

- Wärtsilä Corporation

- Zhejiang Kaidi Environmental Protection Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 297 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

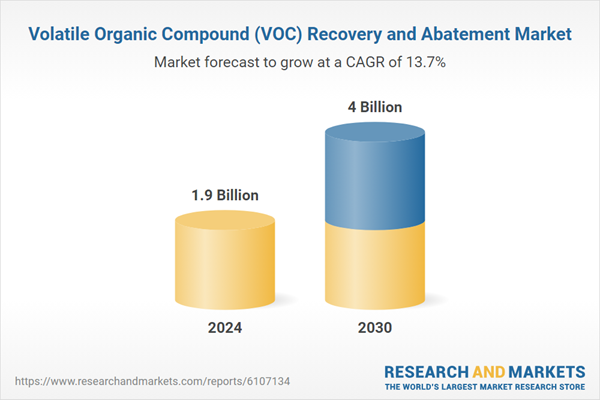

| Estimated Market Value in 2024 | 1.9 Billion |

| Forecasted Market Value by 2030 | 4 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |