Global Washed Silica Sand Market - Key Trends & Drivers Summarized

Why Is Washed Silica Sand a Critical Raw Material Across Diverse Industrial Sectors?

Washed silica sand holds an indispensable position in numerous industries due to its superior purity, uniform granule size, and enhanced performance characteristics compared to unwashed alternatives. The washing process removes impurities such as clay, dust, silt, and organic matter, thereby improving the physical and chemical properties of the sand and making it suitable for high-precision applications. One of its largest end-use markets is the glass manufacturing industry, where it is a vital component in the production of flat glass, container glass, and specialty glass used in automobiles, electronics, and construction. Its high silica content, typically above 95 percent, and low levels of iron and other contaminants make it ideal for producing clear and colorless glass. In the construction sector, washed silica sand is utilized in ready-mix concrete, mortars, and asphalt blends due to its superior binding properties and ability to provide structural integrity. It is also widely used as a filtration media in municipal and industrial water treatment systems because of its consistent granule structure and high permeability. Furthermore, it serves as a preferred abrasive material in sandblasting operations and as a foundational material in foundry casting processes. The increasing demand for high-performance materials in infrastructure, manufacturing, and environmental remediation has solidified washed silica sand's status as a foundational industrial resource with expanding global relevance.What Processing Innovations Are Improving the Quality and Efficiency of Washed Silica Sand Production?

Innovations in mineral processing technology are significantly enhancing the quality, consistency, and efficiency of washed silica sand production. Traditional washing methods have evolved into multi-stage processes involving hydro-cycloning, attrition scrubbing, and density separation to ensure the removal of ultrafine particles and organic contaminants. These methods are designed to optimize the recovery of usable sand while minimizing water consumption and waste generation. High-frequency dewatering screens and filter presses are now commonly used to reduce moisture content in the final product, improving storage and transport efficiency. Additionally, advances in water recycling systems within washing facilities are addressing environmental concerns by reducing freshwater use and limiting discharge. In terms of equipment, automated washing plants equipped with real-time monitoring and control systems are enabling greater process precision, quality control, and energy efficiency. These digital tools help operators adjust parameters such as feed rate, pH balance, and chemical dosage to maximize output quality and consistency. Specialized techniques such as magnetic separation are being applied in regions with iron-rich deposits to lower iron content further and meet the stringent requirements of the glass and electronics sectors. Manufacturers are also investing in modular and mobile washing units to serve remote mining locations and support agile operations. These innovations are not only improving the economics of silica sand production but are also aligning with sustainability goals by minimizing environmental impact and enhancing resource utilization throughout the value chain.Why Is Demand for Washed Silica Sand Rising Across Key Global Industries?

The demand for washed silica sand is rising steadily across a broad spectrum of industries due to its unique material properties and its role in supporting high-growth sectors such as renewable energy, construction, and electronics. In the solar energy industry, it is a core raw material in the production of photovoltaic glass, which is essential for manufacturing solar panels. As the global push toward clean energy accelerates, the need for pure and consistent silica inputs has surged. In oil and gas exploration, washed silica sand serves as a critical proppant in hydraulic fracturing operations, where its roundness and strength help keep fractures open for the efficient extraction of hydrocarbons. The foundry industry also heavily relies on high-purity silica sand to produce precision molds for automotive and machinery parts. In the electronics sector, washed silica sand is used to manufacture high-purity silicon chips and semiconductors, which are integral to smartphones, computers, and countless other digital devices. Growing urbanization and infrastructure development in emerging economies are fueling the demand for high-quality concrete and glass, both of which require large volumes of washed silica sand. Even in recreational sectors, such as golf courses, sports fields, and playgrounds, the product is used for its uniform texture and drainage properties. As these industries expand globally, they are creating sustained and diversified demand for washed silica sand, making it a critical component of modern economic development.What Market Forces and Strategic Factors Are Driving Growth in the Washed Silica Sand Industry?

The growth in the washed silica sand market is driven by a convergence of industrial demand, technological advancements, regulatory trends, and evolving economic strategies. Rapid urbanization and infrastructure investment, particularly in Asia-Pacific and the Middle East, are increasing the need for glass, concrete, and other construction materials, all of which rely on washed silica sand for optimal performance. Simultaneously, the global energy transition is elevating the material's importance in solar panel production and energy-efficient glass, linking it directly to environmental sustainability goals. Manufacturers are investing in vertically integrated operations to secure a stable supply of high-grade silica sand while also reducing dependence on third-party processors. Strategic partnerships between mining companies and end-use industries are becoming more common, aiming to ensure quality control and reliable delivery. Environmental regulations are also shaping the industry by promoting cleaner production methods, water conservation, and responsible land reclamation. Export-oriented strategies are emerging in resource-rich countries, as global demand continues to outpace local supply in some regions. Furthermore, the rise of circular economy models is encouraging reuse and recycling in the glass and construction industries, indirectly impacting the demand for higher-purity raw materials such as washed silica sand. Logistics and transportation optimization, including investments in bulk shipping and rail networks, are helping to improve cost efficiency and market reach. These forces collectively are establishing a robust and resilient growth trajectory for the washed silica sand industry, aligning material demand with technological progress and sustainable development goals.Scope Of Study:

The report analyzes the Washed Silica Sand market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Method (Wet Washing, Dry Washing, Attrition Scrubbing, Acid Leaching); Application (Glass Manufacturing Application, Foundry Application, Construction Application, Ceramics & Refractories Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wet Washing segment, which is expected to reach US$38.2 Billion by 2030 with a CAGR of a 12.3%. The Dry Washing segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $13.2 Billion in 2024, and China, forecasted to grow at an impressive 14.6% CAGR to reach $18.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Washed Silica Sand Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Washed Silica Sand Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Washed Silica Sand Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adwan Chemical Industries Company, Aggregate Industries, Australian Silica Quartz Group Ltd, Badger Mining Corporation, CDE Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Washed Silica Sand market report include:

- Adwan Chemical Industries Company

- Aggregate Industries

- Australian Silica Quartz Group Ltd

- Badger Mining Corporation

- CDE Group

- Covia Holdings Corporation

- Delmon Group of Companies

- Euroquarz GmbH

- Fineton Industrial Minerals Limited

- G3 Enterprises

- Glenella Quarry Australia

- Hanson Australia

- Kaolin AD

- L.B. Silica Sand Ltd

- Muadinoon Mining Company

- Quarzwerke GmbH

- Sibelco

- Silica Services Inc.

- Tooperang Quarry

- VRX Silica Limited

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adwan Chemical Industries Company

- Aggregate Industries

- Australian Silica Quartz Group Ltd

- Badger Mining Corporation

- CDE Group

- Covia Holdings Corporation

- Delmon Group of Companies

- Euroquarz GmbH

- Fineton Industrial Minerals Limited

- G3 Enterprises

- Glenella Quarry Australia

- Hanson Australia

- Kaolin AD

- L.B. Silica Sand Ltd

- Muadinoon Mining Company

- Quarzwerke GmbH

- Sibelco

- Silica Services Inc.

- Tooperang Quarry

- VRX Silica Limited

Table Information

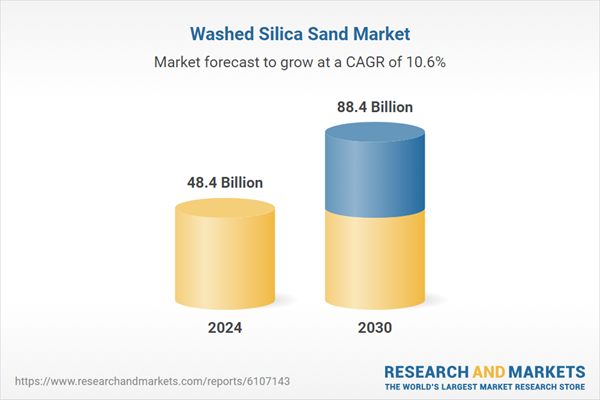

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 48.4 Billion |

| Forecasted Market Value by 2030 | 88.4 Billion |

| Compound Annual Growth Rate | 10.6% |

| Regions Covered | Global |