Global Water and Wastewater Management Market - Key Trends & Drivers Summarized

Why Is Water and Wastewater Management Becoming a Global Priority for Public Health and Sustainability?

Water and wastewater management is emerging as one of the most pressing global challenges due to escalating water demand, pollution, and the impacts of climate change on water availability and quality. As populations grow and urban centers expand, the pressure on freshwater resources is intensifying, making efficient water management essential to ensure adequate supply for domestic, industrial, and agricultural needs. Poorly managed wastewater contributes to the degradation of aquatic ecosystems, spreads waterborne diseases, and endangers food security. In developing countries, where infrastructure is often inadequate or aging, the health risks associated with untreated sewage and contaminated water are especially severe. Effective water and wastewater management ensures that safe water is available for all uses and that pollutants are removed from wastewater before it is released into the environment or reused. This integrated approach supports sustainability by closing the loop between water supply and waste, enabling safe reuse and reducing the need for raw water extraction. Governments, development agencies, and global health organizations are increasingly recognizing water and sanitation services as essential human rights and are working to expand access and infrastructure. The connection between water safety and economic development is also clear, as industries rely on reliable water supplies for operations and communities depend on clean water for well-being. As such, comprehensive water and wastewater management is not just a technical issue but a foundational pillar of public health, environmental stewardship, and long-term socio-economic stability.What Technological Innovations Are Reshaping Modern Water and Wastewater Management Systems?

Technological innovations are transforming how water and wastewater are managed by enabling greater efficiency, precision, and sustainability in every phase of the water cycle. Traditional centralized systems are being complemented by decentralized and modular solutions that offer flexibility and resilience, especially in underserved or remote areas. Smart water management technologies are leveraging the Internet of Things, data analytics, and artificial intelligence to provide real-time monitoring and control of water networks, from detecting leaks and managing pressure to optimizing treatment processes. Advanced treatment technologies such as membrane filtration, UV disinfection, and reverse osmosis are improving water quality while reducing the footprint and energy consumption of treatment plants. Biological treatment processes are being enhanced with techniques like moving bed biofilm reactors and membrane bioreactors, which increase treatment capacity and reliability. Sludge management, a critical yet often overlooked component, is also being modernized through energy recovery, nutrient recovery, and waste-to-resource strategies. Green infrastructure approaches, such as constructed wetlands and rain gardens, are being used to manage stormwater and recharge groundwater naturally. Additionally, water reuse systems are gaining traction in urban planning, allowing treated wastewater to be safely reused for irrigation, industrial processes, or even indirect potable applications. These technological advancements not only enhance the performance of water and wastewater systems but also make them more adaptable to future challenges, including climate variability, urban sprawl, and evolving regulatory demands.Why Are Cities, Industries, and Agriculture Increasingly Investing in Integrated Water and Wastewater Solutions?

Cities, industries, and agricultural sectors are increasingly turning to integrated water and wastewater solutions to manage growing complexity in water demand, quality requirements, and environmental regulations. Urban areas face rising challenges related to population density, aging infrastructure, and climate-induced stress such as flooding and droughts. Integrated water systems that combine supply, wastewater, and stormwater management offer a holistic way to optimize water use and reduce vulnerability. For industries, especially in sectors like chemicals, food and beverage, textiles, and mining, access to reliable and clean water is critical for operations, and compliance with discharge regulations is becoming stricter. Companies are adopting closed-loop systems and zero-liquid discharge strategies that recycle wastewater and minimize environmental footprint. In agriculture, which accounts for the majority of global freshwater use, wastewater reuse is becoming a valuable alternative source of irrigation water, especially in arid regions. This reduces pressure on freshwater sources while addressing the issue of nutrient-rich effluents. Investment in integrated solutions also allows for better financial planning, as capital and operational efficiencies are achieved through coordinated infrastructure development and technology deployment. Additionally, the resilience of these systems helps mitigate risks associated with water scarcity, pollution, and regulatory noncompliance. Public-private partnerships are emerging as a key model for funding and managing such projects, allowing stakeholders to pool resources and expertise. As water becomes a central element of environmental, social, and governance strategies, investment in integrated solutions is becoming a necessity for long-term sustainability and risk management.What Market Dynamics and Strategic Drivers Are Propelling the Growth of the Water and Wastewater Management Industry?

The growth in the water and wastewater management market is driven by a mix of regulatory, economic, technological, and environmental dynamics that are converging to redefine global water stewardship. Stringent water quality and effluent standards are being enforced by governments and international bodies, pushing municipalities and industries to invest in modern treatment infrastructure and pollution control measures. Economic development in emerging markets is fueling urbanization and industrialization, creating new demand for water supply, sanitation, and wastewater treatment services. Climate change is amplifying water-related risks such as scarcity, flooding, and ecosystem degradation, encouraging investments in adaptive infrastructure and resilient systems. Technological innovation is lowering the costs and improving the scalability of solutions, making advanced treatment and smart monitoring systems more accessible to a wider range of users. Furthermore, financial models such as green bonds, blended finance, and public-private partnerships are opening new pathways for funding infrastructure development. On the strategic front, companies are increasingly incorporating water risk assessments into their business continuity plans and sustainability disclosures, recognizing water as both a critical input and a potential vulnerability. Consumers and investors are also applying pressure on corporations and utilities to demonstrate environmental responsibility, further incentivizing improvements in water governance and operational efficiency. Together, these factors are fostering a global shift toward proactive, data-driven, and sustainability-focused water and wastewater management, ensuring that water resources are protected, optimized, and equitably distributed for future generations.Scope Of Study:

The report analyzes the Water and Wastewater Management market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Product (Water Treatment, Wastewater Treatment); Type (Primary Wastewater Treatment, Secondary Wastewater Treatment, Tertiary Wastewater Treatment); Application (Membrane Separation Application, Biological Treatment Application, Disinfection Application, Sludge Treatment Application, Other Applications); End-Use (Municipal End-Use, Industrial End-Use)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Water Treatment segment, which is expected to reach US$5.4 Billion by 2030 with a CAGR of a 4.6%. The Wastewater Treatment segment is also set to grow at 7.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Water and Wastewater Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Water and Wastewater Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Water and Wastewater Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AECOM, Aquatech International, Aris Water Solutions, Beijing Enterprises Water Group, Black & Veatch and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Water and Wastewater Management market report include:

- AECOM

- Aquatech International

- Aris Water Solutions

- Beijing Enterprises Water Group

- Black & Veatch

- DuPont Water Solutions

- Ecolab Inc.

- Evoqua Water Technologies

- Grundfos

- IDE Technologies

- Kurita Water Industries

- Lenntech

- Nalco Water (an Ecolab Company)

- Organo Corporation

- Ovivo Inc.

- Pentair plc

- SUEZ Water Technologies & Solutions

- Tetra Tech

- Veolia Environnement

- Xylem Inc.

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AECOM

- Aquatech International

- Aris Water Solutions

- Beijing Enterprises Water Group

- Black & Veatch

- DuPont Water Solutions

- Ecolab Inc.

- Evoqua Water Technologies

- Grundfos

- IDE Technologies

- Kurita Water Industries

- Lenntech

- Nalco Water (an Ecolab Company)

- Organo Corporation

- Ovivo Inc.

- Pentair plc

- SUEZ Water Technologies & Solutions

- Tetra Tech

- Veolia Environnement

- Xylem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 461 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

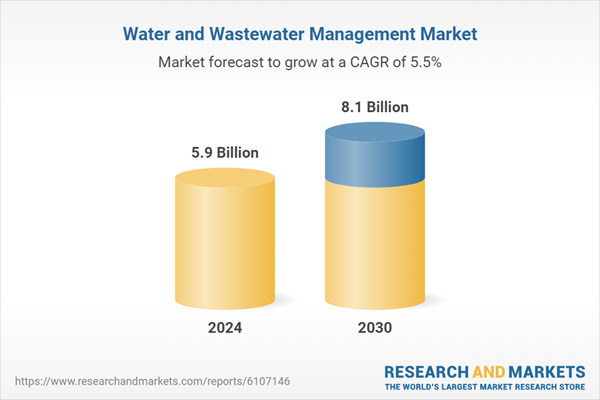

| Estimated Market Value in 2024 | 5.9 Billion |

| Forecasted Market Value by 2030 | 8.1 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |