Global Waterproof Security Cameras Market - Key Trends & Drivers Summarized

Why Are Harsh Environments and Outdoor Threats Reshaping Security Camera Design?

As the demand for comprehensive surveillance increases across residential, commercial, and industrial spaces, waterproof security cameras are becoming indispensable for outdoor deployment. Traditional indoor-only cameras are unable to withstand rain, humidity, dust, snow, and extreme temperatures, creating significant vulnerabilities in perimeter monitoring. This limitation has led to a rapid surge in the adoption of waterproof models, particularly in areas prone to erratic weather patterns or high levels of airborne contaminants. Urban infrastructure projects, smart city initiatives, and critical facilities such as airports, ports, and energy plants now rely heavily on robust camera systems that can deliver uninterrupted performance in open environments. Homeowners, too, are increasingly installing weatherproof surveillance systems to monitor driveways, backyards, gates, and other outdoor zones that are otherwise left exposed. In rural and semi-urban settings, waterproof cameras are being used to secure agricultural land, livestock enclosures, and isolated structures. This widespread need for environmental durability has driven manufacturers to develop IP66, IP67, and IP68-rated devices capable of operating under rainfall, high-pressure water jets, and even submersion. The increasing frequency of natural disasters and climate volatility has only intensified the need for cameras that offer consistent visibility regardless of external conditions. These waterproof security systems are not just passive deterrents; they serve as active tools in remote monitoring, real-time response, and forensic investigation. As physical threats become more unpredictable and infrastructure more decentralized, waterproof security cameras are positioning themselves as vital components in the evolving architecture of global safety and resilience.How Is Advanced Technology Transforming the Capabilities of Waterproof Surveillance?

Technological advancements in imaging, connectivity, and processing are significantly elevating the performance of waterproof security cameras. These cameras now incorporate features that were once reserved for indoor surveillance or high-end specialized equipment. High-definition and ultra-high-definition video capture, including 4K and even 8K resolutions, has become increasingly standard in weatherproof models, ensuring clear and detailed imagery regardless of lighting or environmental interference. Wide dynamic range (WDR), low-light enhancement, and infrared night vision technologies allow these cameras to deliver reliable footage during storms, at dusk, or in complete darkness. Some of the latest models also include thermal imaging, making them highly effective for perimeter security in military zones, correctional facilities, and industrial sites where visibility is often compromised. Artificial intelligence integration is another key advancement, enabling object recognition, facial detection, motion tracking, and behavioral analytics. These AI capabilities reduce false alarms triggered by weather, wildlife, or debris, while also improving real-time threat identification. Cloud-based data storage and real-time remote access have transformed waterproof cameras into smart, connected surveillance tools that can be monitored and managed from anywhere via mobile or desktop platforms. Additionally, the use of edge computing allows for faster local processing and lower bandwidth consumption. Solar-powered waterproof cameras with wireless connectivity are emerging as ideal solutions for off-grid or remote surveillance needs. Battery innovations are enabling longer operational life even in harsh climates. These technological upgrades not only enhance security effectiveness but also reduce operational costs and human oversight, making them ideal for both high-security and consumer markets.What Are Consumers and Businesses Expecting from Outdoor Security Systems Today?

Today's consumers and organizations are expecting far more from waterproof security cameras than just elemental resistance. Whether it`s a homeowner, a retail store manager, or a logistics hub operator, users want intelligent, flexible, and easy-to-manage systems that deliver real-time control and meaningful insights. There is a growing preference for DIY installation and mobile app integration, which has led to a boom in plug-and-play waterproof camera kits tailored for residential and small business use. These systems often include features like motion alerts, two-way audio, smart home compatibility, and event-triggered video storage. For enterprise and municipal users, expectations are even higher. Security teams are looking for networked cameras that integrate with broader security management platforms, offer robust cybersecurity protocols, and allow for rapid incident response. The ability to scale systems without costly infrastructure upgrades is a key demand, especially in expanding urban and suburban areas. Cloud-based monitoring with automated alerts and flexible storage options has become standard in commercial setups. Aesthetics and unobtrusiveness are also becoming important; users prefer compact, sleek devices that blend into surroundings without appearing overly intrusive. Additionally, sustainability concerns are shaping purchasing decisions, with buyers favoring energy-efficient, recyclable, and long-lasting equipment. Security camera providers are now marketing waterproof devices that offer long product lifespans, firmware updates, and sustainable power sources, such as solar panels and energy-efficient batteries. These changing expectations are pushing manufacturers to build waterproof cameras that go beyond durability and become integrated, adaptive tools that respond to individual and enterprise needs in a dynamic, security-conscious world.What Is Driving the Market Growth of Waterproof Security Cameras Across Regions and Sectors?

The growth in the waterproof security cameras market is driven by several factors tied to sectoral demand, climate resilience, regulatory evolution, and changing consumer security behaviors. Rising crime rates, increased concerns about personal safety, and expanding property ownership are propelling adoption in both developed and developing markets. Government initiatives to improve public safety and infrastructure surveillance in cities, transport corridors, and border areas are fueling large-scale procurement of high-performance, weather-resistant cameras. Critical infrastructure sectors such as oil and gas, power generation, mining, and logistics require uninterrupted video monitoring in rugged conditions, making waterproof models an operational necessity. In coastal and flood-prone regions, waterproof cameras are favored due to their resistance to saltwater corrosion and high humidity. Technological diffusion through e-commerce and falling hardware costs have made these systems more accessible to individual consumers and small businesses. There is also a significant rise in gated communities, co-living spaces, and smart home deployments that integrate outdoor surveillance into wider IoT ecosystems. Insurance companies are increasingly offering premium reductions or incentives for properties equipped with robust outdoor surveillance, indirectly encouraging adoption. In the commercial sector, retailers, warehouse operators, and hospitality businesses are installing waterproof security cameras to monitor customer flow, deter theft, and manage outdoor service areas. Moreover, the growing demand for edge AI, real-time analytics, and integrated video management systems is driving innovation and investment. Manufacturers are expanding product portfolios to include hybrid models that combine optical and thermal sensors, mobile-controlled pan-tilt-zoom (PTZ) functionality, and encrypted video transmission. These evolving needs across sectors and geographies are shaping a robust and rapidly growing market, where waterproof security cameras are no longer optional upgrades but essential elements of modern surveillance strategy.Scope Of Study:

The report analyzes the Waterproof Security Cameras market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Camera Type (Bullet Cameras, Dome Cameras, Pan-Tilt-Zoom Cameras, Box Cameras, Other Camera Types); Resolution (High Definition Resolution, Full HD Resolution, Ultra HD Resolution, Other Resolutions); End-Use (Residential End-Use, Commercial End-Use, Industrial End-Use, Government & Public Sector End-Use, Other End-Uses)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bullet Cameras segment, which is expected to reach US$1.0 Billion by 2030 with a CAGR of a 5.1%. The Dome Cameras segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $635.0 Million in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $633.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Waterproof Security Cameras Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Waterproof Security Cameras Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Waterproof Security Cameras Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADT Inc., Amcrest Technologies, Arlo Technologies, Inc., Axis Communications, Bosch Security Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Waterproof Security Cameras market report include:

- ADT Inc.

- Amcrest Technologies

- Arlo Technologies, Inc.

- Axis Communications

- Bosch Security Systems

- CP Plus

- Dahua Technology

- Defender USA

- D-Link Corporation

- FLIR Systems (part of Teledyne)

- Foscam Inc.

- Godrej Security Solutions

- Hanwha Vision (formerly Hanwha Techwin)

- Hikvision

- Honeywell International Inc.

- Lorex Technology

- Panasonic i-PRO Sensing Solutions

- Reolink Innovation Ltd.

- Swann Communications

- Zmodo Technology Corporation

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADT Inc.

- Amcrest Technologies

- Arlo Technologies, Inc.

- Axis Communications

- Bosch Security Systems

- CP Plus

- Dahua Technology

- Defender USA

- D-Link Corporation

- FLIR Systems (part of Teledyne)

- Foscam Inc.

- Godrej Security Solutions

- Hanwha Vision (formerly Hanwha Techwin)

- Hikvision

- Honeywell International Inc.

- Lorex Technology

- Panasonic i-PRO Sensing Solutions

- Reolink Innovation Ltd.

- Swann Communications

- Zmodo Technology Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

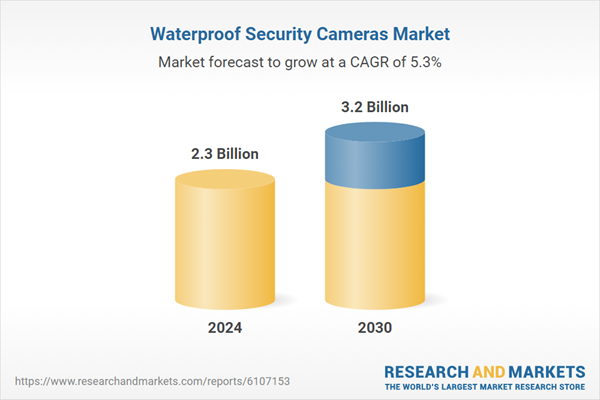

| Estimated Market Value in 2024 | 2.3 Billion |

| Forecasted Market Value by 2030 | 3.2 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |