Global Wet Glue for Labelling Market - Key Trends & Drivers Summarized

Why Is Wet Glue Still Widely Used in Labelling Despite the Rise of Pressure-Sensitive Alternatives?

Wet glue continues to maintain a significant presence in the global labelling industry, especially across beverage, food, pharmaceutical, and industrial product segments. Despite the rise of pressure-sensitive adhesives and self-adhesive labels, wet glue remains a preferred choice for many manufacturers due to its cost-effectiveness, versatility, and strong bonding capability with a wide range of substrates. The adhesive is applied in liquid form during the labelling process and offers an excellent solution for high-speed automatic labelling lines, where efficiency and volume are critical. Wet glue is particularly dominant in the glass bottle labelling market, commonly used for beer, spirits, sauces, and non-carbonated drinks. Its suitability for returnable bottles, where labels must be easily removed during cleaning without leaving residue, further reinforces its value in circular packaging systems. Moreover, it allows for the use of paper labels, which are biodegradable and often preferred for sustainable packaging initiatives. In many developing regions, where packaging budgets are tight and the infrastructure for self-adhesive labels is limited, wet glue remains the default solution due to its affordability and wide availability. Manufacturers also favor wet glue for its low waste generation and long shelf life, which simplify logistics and storage. With a broad application range and enduring relevance in both premium and mass-market packaging, wet glue continues to serve as a reliable, scalable, and environmentally conscious labelling method for industries that rely on high-speed, cost-efficient production lines.How Are Formulation Advancements Enhancing the Performance and Sustainability of Wet Glue Adhesives?

Ongoing advancements in adhesive chemistry and formulation are significantly enhancing the performance, usability, and sustainability of wet glue used in labelling applications. Modern formulations have evolved to offer stronger initial tack, faster setting times, and improved adhesion on difficult surfaces such as wet glass, coated paper, and plastic. These performance enhancements are particularly beneficial for high-speed bottling lines and chilled or moist product conditions, where traditional wet glue adhesives might struggle. The development of water-based, solvent-free, and biodegradable glue options is also addressing growing environmental and safety concerns. Manufacturers are now creating wet glue products with lower volatile organic compound (VOC) emissions, meeting stricter regulatory standards while improving workplace safety. Additionally, enhanced resistance to humidity and temperature fluctuations ensures that labels remain securely in place throughout the product's lifecycle, from production and shipping to retail display and end-user handling. Innovations in raw materials, including the use of natural polymers and bio-based resins, are helping companies reduce reliance on petroleum-derived components and improve the overall sustainability profile of their labelling processes. Easy-clean formulations that reduce machine downtime and improve changeover efficiency are also becoming standard features in modern wet glue systems. These technological developments are enabling wet glue to stay competitive with newer adhesive technologies while offering significant environmental and operational advantages. As the labelling industry becomes more focused on performance, compliance, and sustainability, enhanced wet glue formulations are meeting these needs without sacrificing reliability or cost-efficiency.What Industry Applications and Regional Trends Are Driving Wet Glue Adhesive Demand?

The demand for wet glue adhesives in labelling is strongly influenced by industry-specific needs, product types, and regional manufacturing trends. The beverage sector continues to be the largest consumer, especially in the labelling of beer, wine, spirits, and soft drinks, where glass bottles are commonly used. Wet glue adhesives provide strong bonding on curved and smooth glass surfaces, and their compatibility with high-speed labelling machines ensures minimal disruptions in large-scale operations. In the food industry, wet glue is used for labelling jars, tins, and cartons where paper labels are applied to both glass and metal containers. Pharmaceutical and chemical sectors also utilize wet glue for secure labelling that meets stringent regulatory and safety requirements. From a regional perspective, Asia-Pacific and Latin America represent significant markets due to the dominance of glass packaging and the cost sensitivity of local producers. Many manufacturers in these regions continue to favor wet glue for its low application cost and widespread infrastructure support. In Europe, where there is a strong focus on sustainability and recycling, wet glue remains in use for returnable bottle systems and environmentally friendly packaging lines. Eastern Europe and parts of Africa also maintain high usage levels due to economic considerations and the maturity of traditional labelling technologies. As market dynamics evolve, wet glue's adaptability to different regulatory environments, packaging materials, and operational models makes it a resilient solution that continues to fulfill a wide variety of regional and industry-specific labelling demands.What Is Driving the Global Growth of the Wet Glue for Labelling Market?

The growth in the wet glue for labelling market is being driven by a combination of economic, operational, and environmental factors that continue to reinforce its relevance across packaging industries. One of the most significant growth drivers is the cost efficiency of wet glue systems, especially for high-volume production lines in beverage and food sectors. As consumer demand for packaged goods rises globally, particularly in emerging markets, the need for reliable, scalable, and affordable labelling solutions becomes even more critical. Wet glue meets these needs by offering lower material costs and reduced adhesive consumption per label, which are essential for producers aiming to maintain competitive pricing. Additionally, the resurgence of returnable and recyclable glass packaging, particularly in environmentally conscious regions, is creating new opportunities for wet glue labels that can be easily washed off during bottle cleaning cycles. The increased automation of labelling lines, coupled with innovations in glue application systems, is also contributing to higher adoption by improving precision, speed, and overall line efficiency. Growth in private label and craft product segments is further fueling demand, as producers seek flexible labelling options that can be used on a wide range of container shapes and sizes without complex machinery adjustments. Environmental regulations and consumer preferences are encouraging the use of recyclable and biodegradable label materials, which pair well with water-based wet glues. These market dynamics, along with ongoing advancements in adhesive technology and packaging trends, are collectively driving the expansion of the wet glue for labelling market and reinforcing its position as a practical and adaptable solution in the global packaging ecosystem.Scope Of Study:

The report analyzes the Wet Glue for Labelling market in terms of units by the following Segments, and Geographic Regions/Countries:Segments: Glue Type (Starch-based Glue, Protein-based Glue, Synthetic Glue, Hybrid Glue, Other Glue Types); Material (Paper Labels Material, Film Labels Material, Foil Labels Material, Other Material Types); Application (Brewery Labels Application, Mineral Water Labels Application, Soft Drink Labels Application, Wine & Spirits Labels Application, Pharmaceuticals Labels Application, Personal Care & Cosmetics Labels Application, Food Labels Application, Other Applications)

Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Starch-based Glue segment, which is expected to reach US$4.0 Billion by 2030 with a CAGR of a 6.7%. The Protein-based Glue segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, estimated at $2.0 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $2.0 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Wet Glue for Labelling Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Wet Glue for Labelling Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Wet Glue for Labelling Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Chemline Global, Optimum Group, Ahlstrom-Munksjö, Alfa Aesar, All4Labels Global Packaging Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Wet Glue for Labelling market report include:

- Chemline Global

- Optimum Group

- Ahlstrom-Munksjö

- Alfa Aesar

- All4Labels Global Packaging Group

- Arjobex America, Inc.

- Avery Dennison Corporation

- BASF SE

- Bostik

- CCL Industries Inc.

- Chemence

- Fedrigoni Special Papers

- Gallus Holding AG

- Henkel (Loctite/Tesa adhesives)

- Kemin Industries Inc.

- Merck KGaA

- Minakem

- Paramelt

- Royal Sens

- Sappi

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chemline Global

- Optimum Group

- Ahlstrom-Munksjö

- Alfa Aesar

- All4Labels Global Packaging Group

- Arjobex America, Inc.

- Avery Dennison Corporation

- BASF SE

- Bostik

- CCL Industries Inc.

- Chemence

- Fedrigoni Special Papers

- Gallus Holding AG

- Henkel (Loctite/Tesa adhesives)

- Kemin Industries Inc.

- Merck KGaA

- Minakem

- Paramelt

- Royal Sens

- Sappi

Table Information

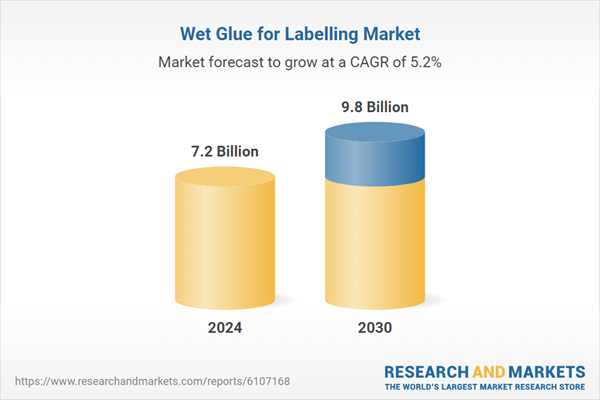

| Report Attribute | Details |

|---|---|

| No. of Pages | 396 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value in 2024 | 7.2 Billion |

| Forecasted Market Value by 2030 | 9.8 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |