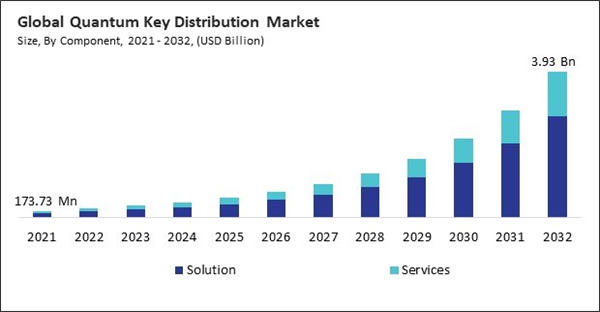

Market trends indicate a shift toward scalable and hybrid systems that combine QKD with post-quantum cryptography to strengthen cybersecurity frameworks. Furthermore, government-backed quantum communication programs and expanding 5G and IoT networks are accelerating solution deployment globally. Vendors are increasingly focusing on product integration and interoperability with existing telecom infrastructures to drive adoption.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November, 2024, NEC Corporation and Quantinuum, Mitsui have partnered to successfully deliver quantum tokens across a 10km fibre-optic network using commercial Quantum Key Distribution (QKD) devices. This collaboration advances digital asset security, transaction speed, and privacy, paving the way for quantum-enhanced financial systems. Moreover, In March, 2025, QuintessenceLabs Pty Ltd. and Fortinet have partnered to provide a quantum-enhanced cybersecurity solution, combining advanced network security with quantum-safe cryptography. This integration helps protect against emerging quantum threats, ensuring data security and business continuity by strengthening encryption and generating quantum-resistant keys.

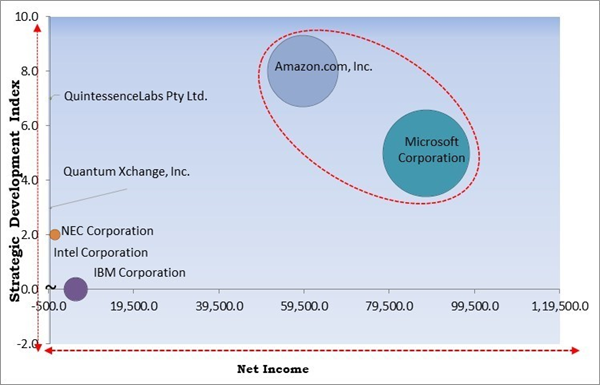

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Amazon.com, Inc. are the forerunners in the Quantum Key Distribution Market. In November, 2024, Microsoft Corporation and Atom Computing have partnered to advance reliable quantum computing by entangling logical qubits and implementing error correction. This collaboration supports the development of secure quantum communication technologies like Quantum Key Distribution (QKD), crucial for secure key exchange in the quantum era. Companies such as IBM Corporation and NEC Corporation are some of the key innovators in Quantum Key Distribution Market.

COVID-19 Impact Analysis

During the COVID-19 pandemic, the Quantum Key Distribution market experienced significant setbacks due to widespread disruptions in global supply chains. Manufacturing delays, shortages of critical components like single-photon detectors and quantum-compatible optical fibers, and international trade restrictions hindered production and deployment of QKD systems. Companies dependent on a global network of suppliers found it difficult to maintain inventory levels or initiate new projects, which delayed ongoing deployments and R&D initiatives across the industry. Thus, the COVID-19 pandemic had a negative impact on the market.Driving and Restraining Factors

Drivers

- Escalating Cybersecurity Threats And The Imperative For Quantum-Resistant Encryption

- Government Initiatives And Strategic Investments In Quantum Technologies

- Advancements In Satellite-Based QKD For Global Secure Communication

- Integration Of QKD Into Existing Communication Infrastructure

Restraints

- High Implementation Costs

- Integration Challenges With Existing Infrastructure

- Limited Transmission Distance And Scalability

Opportunities

- Integration Of QKD With 5G And Iot Networks

- Advancements In Satellite-Based QKD For Global Secure Communication

- Standardization And Interoperability Efforts Driving Market Expansion

Challenges

- Vulnerabilities In Practical Implementations

- Regulatory And Standardization Challenges

- Limited Awareness And Skilled Workforce

Market Growth Factors

In today's digital landscape, the proliferation of sophisticated cyber threats has underscored the limitations of classical encryption methods. The advent of quantum computing poses a significant challenge, as it has the potential to break widely used encryption algorithms like RSA and ECC. This looming threat has intensified the demand for quantum-resistant encryption solutions. QKD emerges as a robust response, leveraging the principles of quantum mechanics to enable secure key exchange that is theoretically immune to interception. By detecting any eavesdropping attempts during the key distribution process, QKD ensures the integrity and confidentiality of sensitive data. Consequently, the pressing need for enhanced cybersecurity in the quantum era is a primary driver for the QKD market's expansion.Additionally, Governments worldwide recognize the strategic importance of quantum technologies and are investing heavily in their development. National initiatives, such as the United States' National Quantum Initiative Act and India's National Quantum Mission, exemplify this commitment. These programs aim to advance quantum research, develop a skilled workforce, and establish quantum infrastructure, including QKD networks. Such governmental support not only accelerates technological advancements but also fosters public-private partnerships, encouraging private sector participation in quantum projects. Thus, national security and economic competitiveness become increasingly intertwined with technological prowess, government-backed quantum programs are pivotal in driving the growth and adoption of QKD solutions globally.

Market Restraining Factors

The deployment of QKD systems entails substantial financial investment, primarily due to the necessity for specialized hardware components such as single-photon detectors, quantum random number generators, and quantum repeaters. These components are not only expensive but also require precise manufacturing and calibration, contributing to the overall cost. Additionally, the integration of QKD into existing communication infrastructures often demands significant modifications or upgrades, further escalating expenses. For instance, establishing a QKD link over a metropolitan area network may necessitate the installation of dedicated optical fibers or the adaptation of current networks to accommodate quantum signals, both of which incur additional costs. Consequently, the high implementation costs remain a significant restraint on the global proliferation of QKD technology.Value Chain Analysis

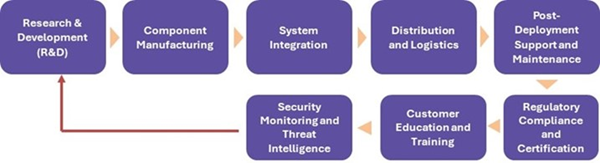

The Quantum Key Distribution (QKD) Market value chain begins with Research & Development (R&D) to innovate secure communication technologies, followed by Component Manufacturing and System Integration for building quantum-enabled infrastructure. Distribution and Logistics ensure system availability, leading to Post-Deployment Support and Maintenance for sustained performance. Compliance with industry standards is achieved through Regulatory Certification, while Customer Education and Training enhance adoption. Security Monitoring and Threat Intelligence provide real-time defense, with insights feeding back into R&D for continuous technological advancement.

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Component Outlook

Based on the Component, the market is segmented into Solution and Services. The Services segment held 31% revenue share in 2024, and plays a vital role in ensuring the successful implementation and operation of QKD technologies. It includes consulting, integration, system maintenance, and key management support. As QKD systems are complex and resource-intensive to deploy, organizations are turning to service providers for technical expertise and long-term operational support.Application Outlook

Based on the Application, the market is segmented into Secure Communication, Network Security, and Database Encryption. The Network Security segment attained a 35% revenue share in 2024. QKD is increasingly being adopted to safeguard entire communication infrastructures, including internet backbones, data centers, and telecom networks. Enterprises and governments are integrating QKD with conventional encryption to form hybrid security systems that are resilient against quantum attacks. The key drivers here include the demand for uninterrupted service, real-time threat mitigation, and regulatory compliance across sectors like healthcare and banking.Type Outlook

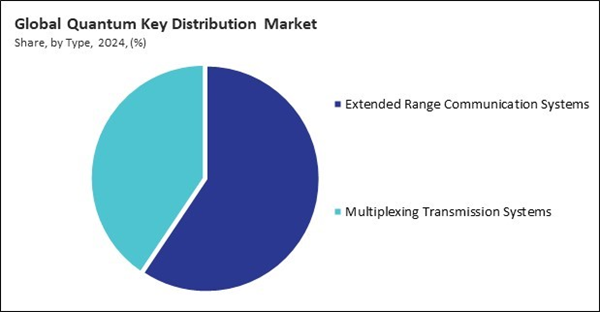

Based on the Type, the market is segmented into Extended Range Communication Systems and Multiplexing Transmission Systems. The Multiplexing Transmission Systems segment acquired 41% revenue share in 2024, offering a cost-effective approach to QKD deployment by combining quantum and classical signals over the same network. These systems utilize existing fiber-optic infrastructure, making them ideal for commercial and enterprise-level communication security in densely connected environments.End Use Outlook

Based on the End Use, the market is segmented into BFSI, Healthcare, Government & Defense, IT & Telecom, Automotive, and Other End Use. The Healthcare segment acquired 22% revenue share in 2024, with QKD is being used to protect sensitive patient records and medical communications. Increasing digitization, telehealth adoption, and strict privacy regulations like HIPAA are driving growth. Public health institutions are piloting QKD for secure data exchange, with cybersecurity vendors integrating quantum encryption into EHR systems.Regional Outlook

Based on the Region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment registered the highest revenue share of 37% in 2024, in Global Quantum Key Distribution Market, followed by Europe and Asia Pacific. The U.S. leads in government investments, research partnerships, and defense-focused QKD deployments. Growth is driven by national cybersecurity priorities, critical infrastructure protection, and rising quantum computing threats.Market Competition and Attributes

The Quantum Key Distribution (QKD) market sees moderate but growing competition among startups, research institutions, and niche technology firms. These players focus on innovation, pilot projects, and regional collaborations to advance secure communication solutions. The market remains fragmented, with varying standards and scalability challenges, offering opportunities for agile firms to shape future developments and gain early mover advantage.

Recent Strategies Deployed in the Market

- Apr-2025: Amazon.com, Inc. has launched support for the ML-KEM hybrid post-quantum key agreement across services like AWS KMS and Secrets Manager, strengthening security against future quantum threats. This innovation aligns with the Quantum Key Distribution (QKD) market by advancing quantum-safe cryptographic solutions.

- Feb-2025: Amazon Web Services (AWS) has launched the Ocelot quantum computing chip, engineered to reduce quantum error correction costs by 90%. This innovation accelerates the development of fault-tolerant quantum computers, supporting advancements in secure communication and the expanding Quantum Key Distribution (QKD) market.

- Jan-2025: Microsoft has launched its Quantum Ready program, designed to help businesses prepare for the quantum computing era. The program focuses on building hybrid applications, investing in quantum safety, and ensuring cryptographic agility, aligning with advancements in Quantum Key Distribution.

- Nov-2024: QuintessenceLabs and Equinix collaborate to enhance cybersecurity by deploying quantum-resilient encryption solutions in Equinix data centers. Their joint effort aims to protect organizations from emerging quantum threats, focusing on post-quantum cryptography and encryption key management, key aspects of the QKD market.

- Jul-2024: Intel Corporation partners with Arqit to integrate its symmetric key agreement platform into Xeon D network cards, providing post-quantum cryptography protection. This collaboration enhances secure data transmission, aligning with the goals of Quantum Key Distribution (QKD) for quantum-resistant communication.

List of Key Companies Profiled

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- D-Wave Systems Inc.

- Amazon.com, Inc.

- NEC Corporation

- Quantum Xchange, Inc.

- QuantumCTek Co., Ltd.

- QuintessenceLabs Pty Ltd.

- MagiQ Technologies, Inc.

- ID Quantique SA

Market Report Segmentation

By Component

- Solution

- Services

By Application

- Secure Communication

- Network Security

- Database Encryption

By Type

- Extended Range Communication Systems

- Multiplexing Transmission Systems

By End Use

- BFSI

- Healthcare

- Government & Defense

- IT & Telecom

- Automotive

- Other End Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- D-Wave Systems Inc.

- Amazon.com, Inc.

- NEC Corporation

- Quantum Xchange, Inc.

- QuantumCTek Co., Ltd.

- QuintessenceLabs Pty Ltd.

- MagiQ Technologies, Inc.

- ID Quantique SA