The use of integrated features such as real-time order tracking, customer reviews, and promotional discounts further enhances the appeal. Restaurants, on the other hand, gain the advantage of reaching new customers and expanding their market presence through these popular online platforms, often without having to invest in their own delivery infrastructure.

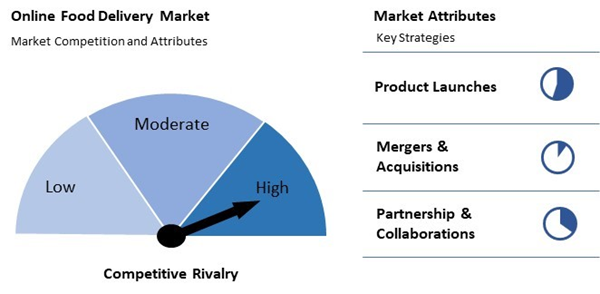

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2025, Zomato Limited unveiled “Zomato Quick,” an in-app service offering food delivery in around 15 minutes in multiple cities. It provides fast food, snacks, desserts, and beverages with a dedicated delivery fleet. This move joins competitors like Swiggy Bolt, Blinkit Bistro, and Zepto Cafe in the quick delivery market. Moreover, In August, 2024, Zomato Limited unveiled a group ordering feature allowing users to add dishes to a shared cart via a link, simplifying group orders. This phased rollout aims to replace passing phones around. Meanwhile, Swiggy increased service fees for some restaurants by charging commissions on gross order value, impacting about 1,000 eateries.

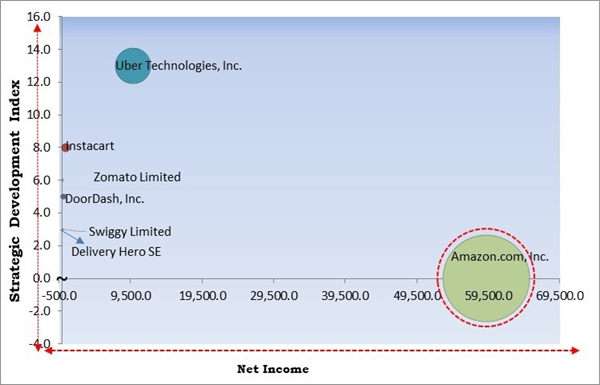

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Amazon.com, Inc. is the forerunner in the Online Food Delivery Market. Companies such as Uber Technologies, Inc., Instacart, and DoorDash, Inc. are some of the key innovators in Online Food Delivery Market. In April, 2025, DoorDash, Inc. unveiled AI-powered tools to help restaurants optimize online menus and enhance customer experience. Features include AI-generated menu descriptions, an AI camera for professional food photos, instant photo approvals, and background enhancements. These tools save time, boost sales, and maintain food authenticity, supporting merchant growth and better customer engagement.

COVID-19 Impact Analysis

During the COVID-19 pandemic, the online food delivery market witnessed an unprecedented surge in demand. With strict lockdowns and social distancing measures in place, consumers increasingly turned to digital platforms to order meals from the safety of their homes. As restaurants and cafes closed their dine-in services, online food delivery became a vital lifeline for both businesses and customers, resulting in a dramatic increase in order volumes across many regions. The pandemic led to a significant expansion of the customer base for online food delivery services. This shift not only boosted the revenues of food delivery companies but also encouraged restaurants to establish or enhance their digital presence. Thus, the COVID-19 pandemic had a positive impact on the market.Driving and Restraining Factors

Drivers

- Urbanization And Busy Lifestyles

- Technology Advancements And App-Based Ecosystems

- Expansion Of Cloud Kitchens And Virtual Restaurants

- Changing Consumer Preferences And Lifestyle Shifts

Restraints

- Logistical And Operational Complexities

- Profitability Challenges Due To High Commission Fees And Price Wars

- Food Quality, Safety, And Customer Trust Concerns

Opportunities

- Penetration Into Tier II, III Cities And Rural Markets

- Integration Of AI And Predictive Analytics For Hyper-Personalization

- Strategic Partnerships And Vertical Integration

Challenges

- Customer Retention And Loyalty In A Hyper-Competitive Landscape

- Balancing Growth With Regulatory Compliance And Labor Issues

- Technology Limitations And Infrastructure Disparity

Market Growth Factors

Urbanization is reshaping the way people live and eat. As more individuals migrate to cities in search of better economic opportunities, the nature of everyday life becomes more accelerated and demanding. In such environments, convenience becomes a high priority, leading to an increased dependence on services that save time - particularly food delivery platforms. The shift from traditional family structures to nuclear and even single-person households has further reinforced this trend. Many working professionals find it cumbersome to cook meals from scratch every day, especially after long work hours or lengthy commutes. In conclusion, the accelerating pace of urban life continues to drive demand for convenient food solutions, making online food delivery a daily essential rather than a luxury.Additionally, Technology has been the backbone of the online food delivery revolution. The integration of GPS, artificial intelligence, and big data analytics has enabled platforms to create hyper-personalized, efficient, and scalable services that appeal to both consumers and service providers. From the customer’s perspective, ordering food is now easier than ever. Food delivery apps have intuitive user interfaces, real-time tracking, and intelligent search functions that help users find exactly what they’re craving. Recommendation engines further enhance user experience by analyzing past behavior to suggest relevant choices. These personalized touches help increase order frequency and brand loyalty. Hence, technology continues to shape and scale the food delivery experience, making it smarter, faster, and increasingly personalized for the digital-first consumer.

Market Restraining Factors

The backbone of any online food delivery service lies in the efficiency and reliability of its logistics and operational framework. Yet, this area is fraught with challenges that can significantly hinder market growth. As consumer demand for faster delivery times and real-time tracking increases, so too does the pressure on delivery platforms to maintain consistent service quality across varied geographies. Ensuring timely deliveries during peak hours, adverse weather conditions, or unexpected traffic scenarios often tests the resilience of the logistics infrastructure. In summary, logistical and operational bottlenecks present a fundamental restraint in the online food delivery market.Value Chain Analysis

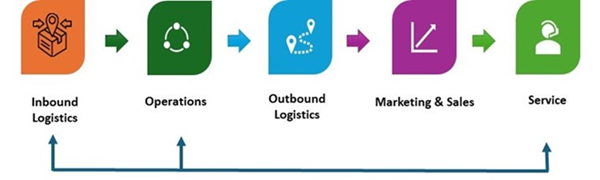

The value chain of the Online Food Delivery Market begins with inbound logistics, which involves sourcing ingredients and ready-made food from restaurants or cloud kitchens. This is followed by operations, where digital platforms process customer orders through apps or websites. Outbound logistics covers the efficient dispatch and delivery of food to consumers using delivery fleets or third-party logistics. Marketing and sales play a vital role in customer acquisition and retention through promotions, loyalty programs, and targeted ads. Finally, service ensures customer satisfaction via real-time support, handling feedback, and resolving issues, feeding into continuous improvement and platform optimization.

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

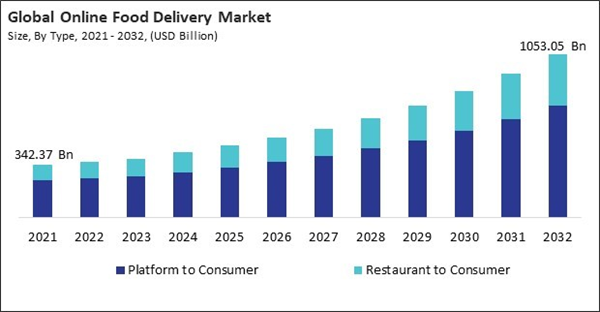

Type Outlook

Based on type, the online food delivery market is characterized into platform to consumer and restaurant to consumer. The restaurant to consumer segment procured 30% revenue share in the online food delivery market in 2024. The restaurant to consumer segment focuses on food delivery services that are directly managed by the restaurants themselves. In this model, customers interact with the restaurant’s own website or app to browse the menu, place their orders, and arrange for delivery. This approach allows restaurants to maintain direct control over every aspect of the customer experience, from food preparation to delivery quality.Product Outlook

On the basis of product, the online food delivery market is classified into meal delivery and grocery delivery. The grocery delivery segment recorded 37% revenue share in the online food delivery market in 2024. The grocery delivery segment focuses on delivering groceries and daily essentials directly to customers. Instead of prepared meals, consumers use online platforms or store apps to order items such as fresh produce, packaged foods, household supplies, and more. The convenience of having groceries delivered to the doorstep, especially for those with limited time or mobility, is a key factor driving this segment’s growth.Payment Method Outlook

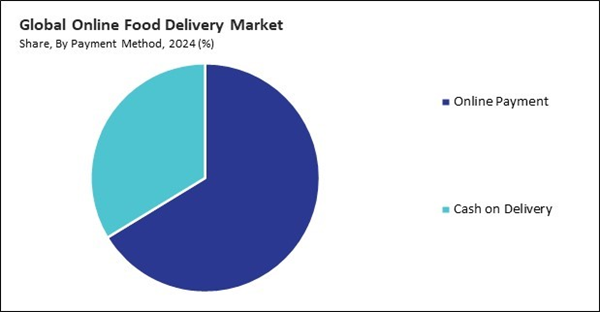

By payment method, the online food delivery market is divided into online payment and cash on delivery. The cash on delivery segment garnered 34% revenue share in the online food delivery market in 2024. The cash on delivery segment allows customers to pay for their orders in cash at the time of delivery, rather than making an advance payment online. This method appeals to consumers who may prefer handling physical currency, have limited access to digital payment options, or are cautious about sharing financial information online.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 39% revenue share in the online food delivery market in 2024. The Asia Pacific region represents a dynamic and rapidly growing segment of the online food delivery market. Factors such as rising urbanization, increasing smartphone usage, and a tech-savvy young population have contributed to strong demand for online food delivery services in this region. The presence of densely populated cities and a growing middle class further support market expansion.Market Competition and Attributes

The online food delivery market remains Highly competitive, driven by regional startups and mid-sized platforms. These companies compete through localized offerings, flexible pricing, and partnerships with local restaurants. Innovation in logistics, user experience, and niche food segments helps differentiate services. The absence of dominant players opens opportunities for new entrants and specialized providers to capture loyal customer bases.

Recent Strategies Deployed in the Market

- Mar-2025: DoorDash, Inc. announced the partnership with Klarna, a Financial services company to offer a "buy now, pay later" option for food delivery orders. Customers can pay in full, split payments into four, or delay payment to align with their paycheck. The move aims to expand flexible spending options amid rising financial caution.

- Mar-2025: Uber Technologies, Inc. announced the partnership with FreshDirect, an online grocery company to offer same-day grocery delivery in New York City. Customers can now order FreshDirect’s fresh produce, meats, and prepared meals through the Uber Eats app, enjoying fast, convenient delivery and exclusive benefits for Uber One members. This expands Uber’s grocery delivery services.

- Dec-2024: Uber Technologies, Inc. announced the partnership with Toast. a financial services company to offer restaurants commission-free delivery through Uber Direct via Toast Delivery Services. This integration helps restaurants reduce delivery costs, extend their delivery range, and provide faster service by leveraging Uber’s delivery network for orders made through Toast’s digital channels and phone.

- May-2024: Uber Technologies, Inc. announced the partnership with Instacart, a retail company to integrate Uber Eats restaurant delivery into the Instacart app. This allows customers to order groceries and restaurant meals in one place, with real-time tracking and $0 delivery for Instacart+ members on orders over $35, enhancing convenience and expanding options nationwide.

- May-2024: Uber Technologies, Inc. took over Delivery Hero’s foodpanda, an online food ordering company in Taiwan, merging their merchant, delivery, and consumer bases into one app. This strategic move aims to enhance service, increase consumer choice, and expand Uber Eats’ presence in Taiwan, pending regulatory approval and closing in early 2025.

List of Key Companies Profiled

- DoorDash, Inc.

- Uber Technologies, Inc. (UberEats)

- Delivery Hero SE

- Instacart

- Zomato Limited

- Just Eat Takeaway.com

- Swiggy Limited

- HelloFresh SE

- Rappi, Inc.

- Amazon.com, Inc. (Amazon Prime Video)

Market Report Segmentation

By Type

- Platform to Consumer

- Restaurant to Consumer

By Product

- Meal Delivery

- Grocery Delivery

By Payment Method

- Online Payment

- Cash on Delivery

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- DoorDash, Inc.

- Uber Technologies, Inc. (UberEats)

- Delivery Hero SE

- Instacart

- Zomato Limited

- Just Eat Takeaway.com

- Swiggy Limited

- HelloFresh SE

- Rappi, Inc.

- Amazon.com, Inc. (Amazon Prime Video)