A notable market trend within this segment is the integration of artificial intelligence and machine learning algorithms, which empower platforms with self-healing capabilities and predictive analytics. Cloud-native and hybrid automation solutions are also gaining traction, particularly among enterprises pursuing agile infrastructure models and cost-efficient deployments.

The major strategies followed by the market participants are partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2025, SAP SE teamed up with Google, an IT company to advance enterprise AI by contributing to the Agent2Agent (A2A) interoperability protocol. This collaboration focuses on enabling AI agents to seamlessly interact across platforms, improving automation and business outcomes. SAP also expands access to Google’s AI models for more flexibility in enterprise solutions. Additionally, In September, 2024, IBM Corporation teamed up with Salesforce, a software company to provide AI-driven autonomous agents for improving sales and service processes, particularly in regulated industries. By integrating Salesforce Data Cloud with IBM's Watson, businesses can leverage mainframe and Db2 data to automate tasks, enhance productivity, and ensure compliance. The collaboration supports customizable AI agents for various business challenges.

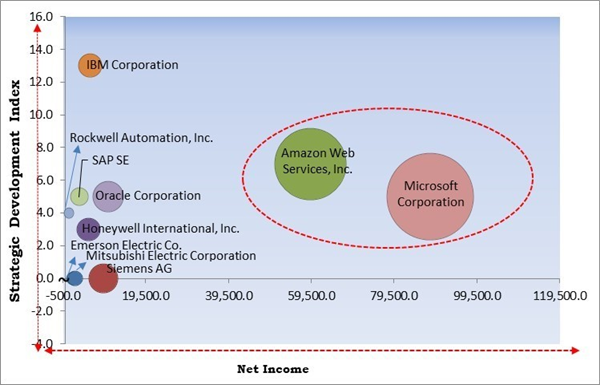

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Amazon Web Services, Inc. are the forerunners in this Market. In September, 2024, Amazon Web Services, Inc. announced the partnership with Oracle, a computer software company to offer Oracle Database services within the AWS cloud. The service, Oracle Database@AWS, integrates Oracle Autonomous Database and Exadata on AWS infrastructure, providing unified billing, support, and seamless integration with AWS tools, aiming for multi-cloud solutions and low-latency performance. Companies such as Oracle Corporation, Siemens AG, and IBM Corporation are some of the key innovators in this Market.

Driving and Restraining Factors

Drivers

- Exponential Growth of Data Volumes

- Increasing Complexity of Database Environments

- Enhanced Data Security and Compliance

- Demand for Operational Efficiency and Cost Reduction

Restraints

- High Implementation Costs and Integration Complexities

- Data Security and Compliance Concerns

- Resistance to Change and Skill Gaps

Opportunities

- Integration of AI and Machine Learning in Database Automation

- Rising Adoption of Multi-Cloud and Hybrid Cloud Environments

- Demand for Real-Time Analytics and Autonomous Operations

Challenges

- Skills Gap in Managing Automated and Autonomous Database Systems

- Interoperability Challenges Across Diverse Technology Stacks

- Data Governance and Ethical Automation Concerns

Market Growth Factors

In the digital era, the volume of data generated by organizations has been increasing at an unprecedented rate. This surge is driven by various factors, including the proliferation of internet-connected devices, social media interactions, e-commerce transactions, and the adoption of technologies like the Internet of Things (IoT). As a result, businesses are inundated with vast amounts of structured and unstructured data that need to be stored, managed, and analyzed effectively. In conclusion, as data continues to grow exponentially, adopting database automation is no longer just beneficial - it has become essential for organizations aiming to fully leverage their data assets.Additionally, Modern organizations often operate in complex IT environments that encompass a mix of on-premises systems, cloud services, and hybrid infrastructures. This diversity arises from the need to leverage the benefits of different platforms, such as the scalability of cloud services and the control offered by on-premises systems. Additionally, businesses may utilize various types of databases, including relational, NoSQL, and in-memory databases, each serving specific application requirements. Hence, as IT environments grow more complex, database automation plays an increasingly vital role in maintaining seamless and reliable operations.

Market Restraining Factors

However, one of the primary barriers to adopting database automation solutions is the substantial initial investment required. Implementing automation tools often necessitates significant financial resources, not only for the procurement of software but also for the associated infrastructure upgrades and training. For small and medium-sized enterprises (SMEs), these costs can be prohibitive, leading to reluctance in transitioning from traditional database management methods. Therefore, organizations must carefully evaluate both the initial and ongoing costs, as well as integration challenges, to make informed decisions about adopting database automation solutions.Value Chain Analysis

The value chain for this market begins with Raw Material Sourcing, such as computing infrastructure and data tools. This is followed by Software Development, where core automation functionalities are built. Component Integration ensures various modules and systems work cohesively. Testing and Quality Assurance validate system performance and reliability. Once tested, solutions move through Marketing and Sales, and into Distribution and Deployment to reach end-users. Post-Sales Support handles customer needs and technical issues. Insights gathered via the Feedback Loop inform Product Innovation and Updates, driving improvements that loop back into sourcing and development - ensuring continuous enhancement of solutions.

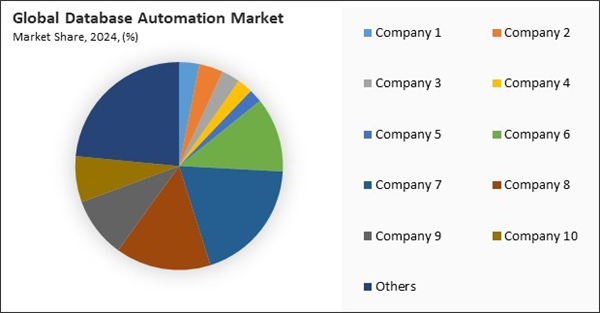

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Application Outlook

Based on Application, the market is segmented into Provisioning, Backup, and Security & Compliance. The Backup segment acquired 30.80 % revenue share in the market in 2024. Backup automation addresses the critical need for data protection, recovery assurance, and business continuity. Organizations across industries are implementing automated backup solutions to ensure regular, reliable backups without manual scheduling. Modern backup automation tools integrate with monitoring systems to validate the integrity of backups and automatically trigger recovery protocols in case of failures or anomalies.End-use Outlook

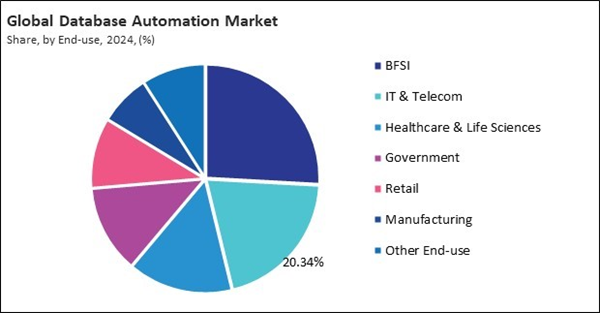

Based on End-use, the market is segmented into BFSI, IT & Telecom, Healthcare & Life Sciences, Government, Retail, Manufacturing, and Other End-use. The segment witnessed 20.34 % revenue share in the market in 2024. The IT & Telecom industry relies on database automation to support massive user bases, high data throughput, and continuous service availability. Automation enhances database provisioning, load balancing, and system monitoring - enabling telecom operators and IT service providers to deliver uninterrupted connectivity and support rapid service deployments.Component Outlook

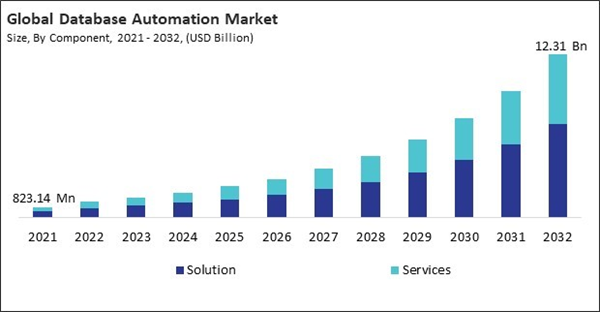

Based on Component, the market is segmented into Solution, and Services. The Services segment garnered 40.46 % revenue share in the market in 2024. The Services segment includes consulting, deployment, training, and managed services that support organizations in adopting and optimizing database automation solutions. These services are essential for ensuring smooth migration from legacy systems, addressing deployment complexities, and achieving operational excellence.Regional Outlook

Based on the Region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment gained the largest market share of 36.2% in 2024, in Global Quantum Processing Unit Market followed by Europe and Asia Pacific. North America leads the market due to its robust digital infrastructure and early adoption of AI-driven technologies. Dominated by the U.S. and Canada, the region is home to major cloud and software vendors. Enterprises in sectors like finance and healthcare are leveraging automation to improve performance and ensure compliance.Market Competition and Attributes

This market remains highly competitive with numerous emerging vendors and startups driving innovation. These players focus on niche solutions, cost-effective services, and AI-driven automation to attract small to mid-sized enterprises. The market sees rapid technological advancements, fostering agility and customization, while partnerships and cloud-native solutions help these companies gain market traction and differentiate offerings.

Recent Strategies Deployed in the Market

- May-2025: IBM Corporation unveiled new AI and hybrid cloud tools to advance enterprise adoption of AI agents. Highlights include Watsonx Orchestrate for rapid agent creation, and enhanced unstructured data handling via Watsonx. Data, hybrid integration automation, and open, secure AI infrastructure - marking a shift from experimentation to measurable outcomes.

- Feb-2025: IBM Corporation acquired HashiCorp, a Software company, enhancing its hybrid cloud platform. The move strengthens IBM’s capabilities in IT automation, infrastructure lifecycle management, and security. HashiCorp's tools like Terraform and Vault will integrate with IBM offerings, supporting scalable, automated multi-cloud and hybrid cloud operations for enterprise clients.

- Feb-2025: SAP SE unveiled the Business Data Cloud (BDC) to integrate structured and unstructured data across its platform, with support from Databricks. This platform enhances AI-driven automation and decision-making, leveraging AI agents like Joule for various business processes. The partnership aims to simplify data integration, improve governance, and enable enterprise-wide analytics.

- Dec-2024: Amazon Web Services, Inc. unveiled Aurora DSQL, a new serverless, distributed SQL database with high availability, PostgreSQL compatibility, and faster performance than competitors like Google Spanner. It offers independent scaling of reads and writes, strong consistency, and active-active architecture, ensuring continuous availability. Aurora DSQL uses precise time synchronization for global consistency.

- Oct-2024: Microsoft Corporation unveiled Drasi, an open-source system for real-time event processing and automation. Drasi simplifies detecting critical events in complex infrastructures by offering real-time monitoring, continuous queries, and automated responses. It integrates with platforms like PostgreSQL, Microsoft Dataverse, and Azure Event Grid, providing developers with flexible and adaptable solutions.

List of Key Companies Profiled

- Honeywell International, Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Siemens AG

- Rockwell Automation, Inc.

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- SAP SE

Market Report Segmentation

By Component

- Solution

- Services

By Application

- Provisioning

- Backup

- Security & Compliance

By End-use

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Government

- Retail

- Manufacturing

- Other End-use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Honeywell International, Inc.

- Emerson Electric Co.

- Mitsubishi Electric Corporation

- Siemens AG

- Rockwell Automation, Inc.

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- SAP SE