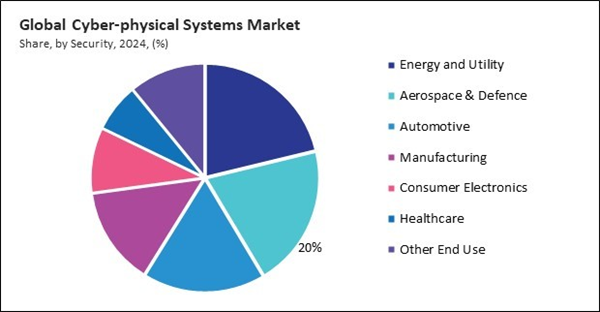

These systems enable real-time data analysis, predictive maintenance, and load balancing, which are essential for improving energy efficiency and operational reliability. As utilities increasingly transition to renewable energy sources and decentralized power generation, the need for CPS to manage and optimize complex infrastructure has grown substantially. Additionally, rising concerns over cybersecurity and grid stability have further driven investments in advanced cyber-physical solutions in this sector. Thus, the energy & utility segment procured 21% revenue share in the cyber-physical systems market in 2024. This dominance is largely attributed to the widespread adoption of smart grids, automated energy distribution networks, and intelligent monitoring systems that rely heavily on CPS technologies.

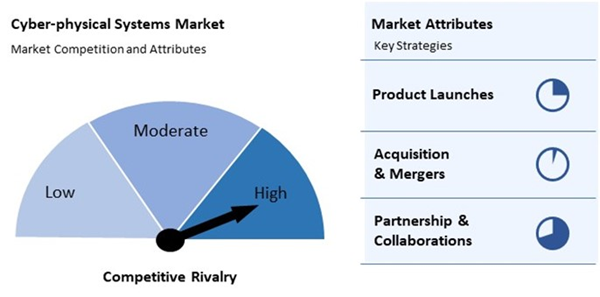

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2025, ABB and Red Hat expanded their collaboration to develop secure, modular process automation systems using open-source platforms. This integration enhances operational stability, cybersecurity, and incremental innovation, bridging IT and OT environments to support digital transformation and advanced industrial automation in process industries. Additionally, In October, 2024, Honeywell and Google Cloud partner to enhance industrial autonomous operations using AI agents. Integrating Honeywell Forge IoT data with Google’s AI, they aim to boost productivity, reduce maintenance costs, and upskill workers, driving smarter, safer cyber-physical system management.

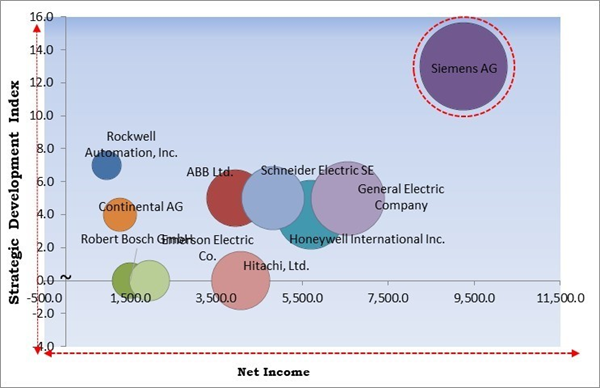

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Siemens AG is the forerunners in the Cyber-physical Systems Market. Companies such as General Electric Company, Honeywell International Inc., and Schneider Electric SE are some of the key innovators in Cyber-physical Systems Market. In October, 2023, Siemens AG expanded its partnership with Tenable to integrate Tenable OT Security into its Omnivise OT Security offering, enhancing cybersecurity for energy sector cyber-physical systems through asset discovery, intrusion detection, anomaly detection, and vulnerability management.

COVID-19 Impact Analysis

The COVID-19 pandemic had a notably adverse impact on the cyber-physical systems market, particularly during the initial phases of global lockdowns and economic disruption. Manufacturing plants, logistics facilities, and construction sites - major adopters of CPS - faced prolonged shutdowns or operated at reduced capacities. As a result, the deployment and implementation of new CPS infrastructure were either delayed or canceled altogether, severely affecting market momentum. As a consequence, many CPS initiatives failed to meet their planned deadlines or had to be re-scoped entirely. Thus, the COVID-19 pandemic had a negative impact on the market.Driving and Restraining Factors

Drivers

- Increasing Adoption of Industry 4.0 and Smart Manufacturing

- Rapid Expansion of Internet of Things (IoT) and Sensor Technologies

- Growing Demand for Automation and Real-Time Control in Critical Infrastructure

- Advances in Artificial Intelligence and Machine Learning Integration

Restraints

- Security and Privacy Concerns in Cyber-Physical Systems

- High Implementation Costs and Complex Integration Processes

- Lack of Standardization and Regulatory Frameworks

Opportunities

- Expansion of Smart Cities and Urban Infrastructure Development

- Integration with Autonomous Systems and Robotics

- Advancement and Deployment of Digital Twins Across Industries

Challenges

- Complexity of System Integration and Interoperability

- Managing Real-Time Data Processing and Latency Constraints

- Ensuring Cybersecurity and Privacy in Highly Connected Environments

Market Growth Factors

The evolution of Industry 4.0 has been a major catalyst for the growth of cyber-physical systems. Industry 4.0, often termed the fourth industrial revolution, revolves around the integration of advanced digital technologies such as IoT, AI, robotics, and data analytics with traditional manufacturing processes to create smart, interconnected factories. Cyber-physical systems are fundamental to this transformation, serving as the bridge that connects physical machinery, sensors, and devices with digital control systems and software. Overall, the integration of cyber-physical systems within Industry 4.0 frameworks offers a powerful value proposition: enhanced productivity, improved quality, agility in manufacturing, and sustainability.Additionally, the increasing complexity and criticality of infrastructure systems worldwide are driving the demand for cyber-physical systems to enable greater automation, monitoring, and control. Critical infrastructure sectors - including energy grids, transportation networks, water supply, and healthcare systems - require robust, real-time management to ensure safety, reliability, and resilience. CPS offer a unique ability to integrate physical components with computational intelligence, enabling automated decision-making and immediate responses to dynamic conditions. The combination of technological advances and increasing infrastructure modernization projects ensures that CPS remain indispensable for managing complex, interdependent physical systems.

Market Restraining Factors

However, one of the most significant restraints on the growth of the cyber-physical systems market is the mounting challenge of security and privacy risks inherent in the integration of physical and digital systems. Cyber-physical systems by design connect critical infrastructure, industrial equipment, transportation networks, healthcare devices, and other sensitive systems to digital control units and communication networks. Thus, until the industry develops mature, scalable security solutions that address the unique requirements of cyber-physical environments, these concerns will continue to restrain market growth.Value Chain Analysis

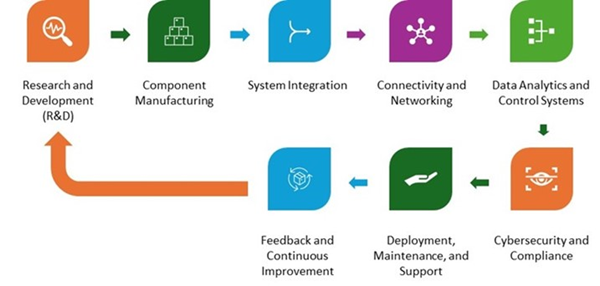

The Cyber-physical Systems (CPS) Market operates through a robust value chain beginning with Research and Development (R&D), where new technologies and intelligent systems are conceptualized. This is followed by Component Manufacturing, where physical hardware like sensors, actuators, and embedded systems are produced. These components are then brought together through System Integration, enabling seamless interaction between digital and physical environments. The next step, Connectivity and Networking, ensures real-time communication among devices, while Data Analytics and Control Systems process and optimize operations. Cybersecurity and Compliance play a crucial role in safeguarding sensitive data and ensuring regulatory adherence. Finally, the systems undergo Deployment, Maintenance, and Support, with a loop back to Feedback and Continuous Improvement, ensuring the system evolves based on operational insights.

Market Share Analysis

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Component Outlook

Based on component, the cyber-physical systems market is characterized into hardware, software, and services. The services segment held 25% revenue share in the cyber-physical systems market in 2024. As organizations across various sectors integrate CPS into their operations, there is a growing demand for services such as consulting, system integration, customization, training, technical support, and maintenance. These services are essential for ensuring the seamless functioning of both hardware and software components and for achieving desired outcomes from CPS deployments.Type Outlook

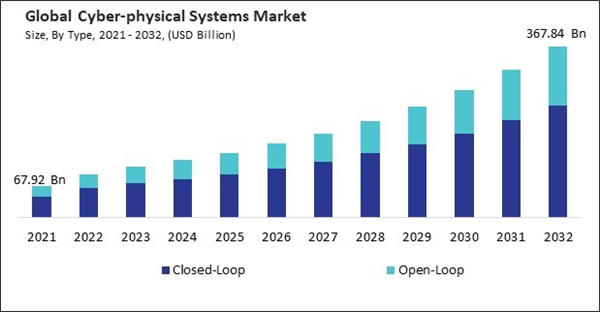

On the basis of type, the cyber-physical systems market is classified into open-loop and closed-loop. The open-loop segment acquired 32% revenue share in the cyber-physical systems market in 2024. This growth can be attributed to the simplicity, cost-effectiveness, and widespread use of open-loop systems in various industrial and commercial applications where feedback is not essential for system performance. Open-loop CPS operate based on predefined instructions without real-time data feedback, making them ideal for processes where consistent input leads to predictable outcomes.Security Outlook

By security, the cyber-physical systems market is divided into embedded security, industrial control systems (ICS) security, robotic security, internet of things (IoT) security, and others. The internet of things (IoT) security segment procured 32% revenue share in the cyber-physical systems market in 2024. With the explosion of connected devices forming the backbone of CPS ecosystems, the security of IoT nodes has become a crucial concern. IoT security addresses vulnerabilities such as weak authentication, unsecured communications, and device spoofing.End Use Outlook

Based on end use, the market is segmented into aerospace & defence, automotive, energy & utility, healthcare, manufacturing, consumer electronics, and others. The automotive segment attained 17% revenue share in the cyber-physical systems market in 2024. This is driven by the rapid integration of CPS into modern vehicle platforms. These systems form the backbone of critical automotive technologies such as advanced driver-assistance systems (ADAS), autonomous driving, infotainment, and real-time diagnostics. CPS allows vehicles to perceive their surroundings, process data, and respond to dynamic driving conditions with minimal human input.Regional Outlook

Region-wise, the cyber-physical systems market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 34% revenue share in the cyber-physical systems market in 2024. This dominance is driven by the strong presence of advanced technology infrastructure, significant investments in automation, and the widespread adoption of CPS in industries such as aerospace, defense, healthcare, and manufacturing. The United States, in particular, has been at the forefront of implementing CPS in smart factories, autonomous vehicles, and digital healthcare systems. Moreover, supportive government initiatives and research funding have further accelerated innovation and deployment of CPS technologies across the region.Market Competition and Attributes

The Cyber-physical Systems (CPS) market experiences intense competition due to rapid technological advancements and increasing demand for integrated, intelligent solutions. Companies strive to differentiate through innovation in real-time processing, edge computing, and secure communication protocols. High R&D investments, compliance with global standards, and system scalability are key competitive factors. Market players also compete on system reliability, ease of integration, and lifecycle support. Strategic collaborations and vertical-specific customizations further intensify the competitive landscape, especially across industries like manufacturing, energy, healthcare, and transportation.

Recent Strategies Deployed in the Market

- May-2025: ABB launched a Battery Energy Storage Systems-as-a-Service model, offering hardware, software, and lifecycle support with no upfront cost. Partnering with GridBeyond, it uses AI-driven optimization for energy efficiency, shifting costs from capital to operational expenditures, supporting sustainable energy management.

- Apr-2025: Schneider Electric launched EcoConsult for Data Centers, offering consulting to optimize infrastructure efficiency, maximize uptime, and extend asset life. Leveraging a global expert network, the service focuses on power and cooling system modernization to boost reliability and reduce operational costs.

- Apr-2025: Rockwell Automation launched a 24/7 Security Monitoring and Response service for operational technology, offering real-time thrseat detection, expert incident response, and continuous monitoring to enhance industrial cybersecurity, address talent shortages, and strengthen resilience in cyber-physical system environments.

- Jan-2025: General Electric Company and Accenture partner on grid modernization, leveraging the GridOS platform to integrate IT and OT, enabling scalable, flexible digital grid orchestration. This collaboration supports the transition to renewable energy through advanced cyber-physical systems and ecosystem-driven solutions.

- Jan-2025: Siemens AG launched the "Siemens for Startups" program to empower engineering and manufacturing startups with access to Siemens Xcelerator tools. In collaboration with AWS, the initiative accelerates innovation and scaling of cyber-physical systems through cloud, AI, and industrial software support.

- Oct-2024: Siemens AG acquired Altair Engineering to enhance its industrial software and AI capabilities. This acquisition strengthens Siemens’ digital twin and simulation portfolio, accelerating innovation in cyber-physical systems through AI, high-performance computing, and comprehensive design-to-operation integration.

List of Key Companies Profiled

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- Schneider Electric SE

- Continental AG

- General Electric Company

- Hitachi, Ltd.

- Robert Bosch GmbH

- Emerson Electric Co.

Market Report Segmentation

By Type

- Closed-Loop

- Open-Loop

By Security

- Internet of Things (IoT) Security

- Embedded Security

- Industrial Control Systems (ICS) Security

- Robotic Security

- Other Security

By Component

- Hardware

- Software

- Services

By End Use

- Energy and Utility

- Aerospace & Defence

- Automotive

- Manufacturing

- Consumer Electronics

- Healthcare

- Other End Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Siemens AG

- Honeywell International Inc.

- Rockwell Automation, Inc.

- ABB Ltd.

- Schneider Electric SE

- Continental AG

- General Electric Company

- Hitachi, Ltd.

- Robert Bosch GmbH

- Emerson Electric Co.