The Germany market dominated the Europe Software Licensing Management Market by country in 2024, and is expected to continue to be a dominant market till 2032; thereby, achieving a market value of $540.3 million by 2032. The UK market is exhibiting a CAGR of 14.3% during 2025-2032. Additionally, the France market is expected to experience a CAGR of 16.3% during 2025-2032.

The importance of software license management stems from the growing reliance on software as a core driver of business operations. With the proliferation of software applications, organizations face the challenge of managing a complex portfolio of licenses, each governed by different terms, conditions, and pricing models. SLM solutions provide a centralized approach to managing these licenses, enabling businesses to gain insight into their software usage, avoid non-compliance penalties, and optimize their software spending.

The market is driven by the need to streamline operations, reduce unnecessary costs, and align software usage with business objectives. As digital transformation accelerates, organizations are adopting SLM solutions to ensure they can effectively manage their software assets while staying agile in a rapidly evolving technological landscape. The rise of cloud computing, Software as a Service (SaaS) models, and hybrid work environments has further amplified the demand for robust SLM solutions, as businesses seek to maintain control over their software assets in dynamic and distributed environments.

In Germany, the sustained growth of the IT sector - rising from USD 76.4 billion in 2007 to USD 141.6 billion in 2023 - is a testament to the sector’s resilience and digital maturity. With IT services generating USD 45.3 billion and software contributing USD 34.1 billion in 2022 alone, German enterprises are heavily dependent on a range of licensed software solutions. This widespread software usage across industries, including automotive, manufacturing, and finance, necessitates advanced Software Licensing Management tools. Furthermore, in the United Kingdom, the thriving edtech industry - home to over 1,000 companies with a GVA between £3.7 billion and £4.0 billion in 2021 - illustrates the digital transformation of the education sector. Many of these companies operate on SaaS and cloud-based delivery models, involving complex software licensing structures. Additionally, with UK manufacturing product sales reaching £429.8 billion in 2022 - led by food manufacturing - manufacturers also rely on enterprise resource planning (ERP), automation, and supply chain management software. In conclusion, the robust expansion of the IT sector in Germany, the dual rise of edtech and manufacturing in the UK, and the flourishing e-commerce sector in Italy are collectively fuelling the growth of the market.

List of Key Companies Profiled

- DXC Technology Company- BMC Software, Inc. (KKR & Co., Inc.)

- HP Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- ServiceNow, Inc.

- Accenture PLC

- Thales Group S.A.

- Broadcom, Inc.

- Flexera Software LLC

Market Report Segmentation

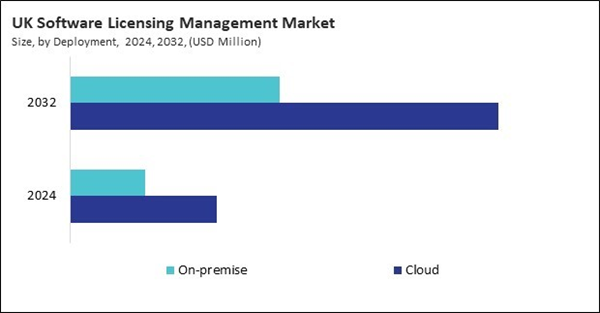

By Deployment

- Cloud

- On-premise

By Enterprise Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Licensing Type

- Subscription-Based

- User-Based

- Usage-Based

- Other Licensing Type

By End-use

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Government & Public Sector

- Retail & E-commerce

- Education

- Other End-use

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

- DXC Technology Company

- BMC Software, Inc. (KKR & Co., Inc.)

- HP Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- ServiceNow, Inc.

- Accenture PLC

- Thales Group S.A.

- Broadcom, Inc.

- Flexera Software LLC