Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Global Energy Demand and Clean Energy Transition

The increasing global demand for energy - particularly in fast-growing economies - is a key driver of planned LNG infrastructure development. Emerging countries such as China and India are accelerating their shift from coal and oil to cleaner energy sources, with LNG emerging as a preferred option due to its reduced greenhouse gas emissions. As nations aim to meet climate targets and diversify their energy portfolios, LNG is being integrated into national energy strategies for both base load and peak power supply. Government-backed initiatives promoting cleaner fuel adoption are reinforcing this trend, making LNG a central component of the global clean energy transition.Key Market Challenges

High Capital Investment and Long Project Development Timelines

A primary challenge in the planned LNG market lies in the high upfront costs and extended timelines required for project development. LNG terminals - whether for liquefaction or regasification - demand significant capital expenditure and involve intricate engineering, environmental permitting, and construction efforts. Projects often span 5 to 7 years before becoming operational, making them vulnerable to market risks such as energy price volatility, regulatory shifts, and geopolitical uncertainties. These factors can deter investor confidence and delay project execution, especially in regions with less stable economic environments or evolving energy policies.Key Market Trends

Emergence of Floating LNG (FLNG) and Small-Scale LNG Solutions

A transformative trend in the planned LNG market is the increasing deployment of Floating LNG (FLNG) units and Small-Scale LNG (SSLNG) systems. FLNG technology enables offshore extraction, liquefaction, and export of natural gas, eliminating the need for costly onshore infrastructure. This approach offers faster deployment, reduced permitting complexity, and flexibility for remote or deepwater fields. Countries like Mozambique, Nigeria, and Indonesia are adopting FLNG solutions as part of their energy expansion plans. Similarly, SSLNG is gaining momentum for decentralized applications, serving remote communities, islands, and industrial users that are not connected to pipeline networks. These innovations are expanding market access and enhancing the flexibility of LNG supply chains.Key Market Players

- ExxonMobil

- Royal Dutch Shell

- Qatar Petroleum

- Chevron Corporation

- TotalEnergies

- Cheniere Energy

- PetroChina

- Eni S.p.A.

Report Scope:

In this report, the Global Planned LNG Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Planned LNG Market, By Technology:

- Liquefaction

- Regasification

Planned LNG Market, By Application:

- Residential

- Commercial

- Industrial

Planned LNG Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Colombia

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Planned LNG Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ExxonMobil

- Royal Dutch Shell

- Qatar Petroleum

- Chevron Corporation

- TotalEnergies

- Cheniere Energy

- PetroChina

- Eni S.p.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | July 2025 |

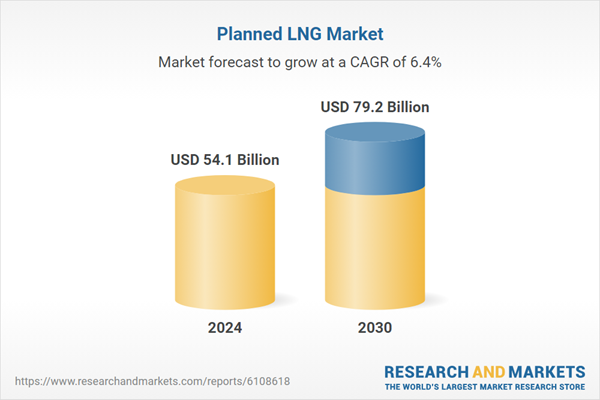

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 54.1 Billion |

| Forecasted Market Value ( USD | $ 79.2 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |