Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand for Convenience and Instant Gratification

The surge in demand for rapid delivery services among urban consumers is a key growth driver for India’s quick commerce sector. With busy lifestyles, especially among millennials and Gen Z, speed and convenience are paramount when purchasing everyday items. Traditional e-commerce delivery models, which often take one to two days, are increasingly being replaced by platforms offering 10-20-minute delivery of groceries, snacks, and personal care essentials. The success of food delivery apps like Swiggy and Zomato has normalized expectations for fast service, creating a favorable environment for quick commerce models.High population density, digital adoption, and rising disposable incomes in metro cities further support this trend. In 2023, India’s per capita disposable income rose to USD 2.54 thousand from USD 2.11 thousand in 2019. Additionally, nuclear families and working professionals often rely on these platforms for urgent or last-minute purchases, reinforcing the importance of speed and convenience in everyday consumption habits. Mobile apps and digital payment systems have also made the ordering process seamless, fueling the rapid rise of quick commerce in India's top urban centers.

Key Market Challenges

Profitability and High Operational Costs

Achieving profitability remains one of the most significant challenges in India’s quick commerce sector. The promise of deliveries within 10-15 minutes necessitates a dense web of dark stores, a reliable delivery workforce, and advanced logistics systems, all of which incur substantial costs. Compounding this is the relatively low average order value in the Indian market, which makes balancing revenue and operational expenses difficult.To attract customers in a highly competitive environment, companies often resort to deep discounts, low delivery charges, and promotional campaigns, further straining margins. Operating in Tier 2 and Tier 3 cities poses additional cost challenges due to lower order densities and underdeveloped infrastructure. Last-mile delivery, which constitutes the bulk of logistics expenditure, becomes cost-inefficient in areas with sparse demand or longer distances. Despite efforts to introduce private label goods and advertising revenue streams, quick commerce platforms continue to face a difficult path toward sustainable unit economics and long-term profitability.

Key Market Trends

Assortment Diversifies Far Beyond Groceries Toward Premium, High-Value and Occasion-Based SKUs

Quick commerce platforms in India are expanding their product mix beyond groceries and daily essentials to include high-value, premium, and occasion-specific items. From electronics and personal gadgets to festive gifts, toys, and lifestyle products, the range of offerings is growing to meet evolving consumer needs. This strategic diversification aims to enhance average order values while aligning with consumer demand for convenience across various categories. Festive periods, birthdays, and last-minute gifting occasions have emerged as key use-cases for these services.In response, platforms are redesigning their dark stores, optimizing inventory for broader SKUs, and upgrading delivery capabilities to manage a mix of bulky and sensitive products. The move also helps redefine consumer perception of quick commerce - from a platform for emergency essentials to a dependable solution for everyday and specialty shopping. As urban consumers continue to seek speed and variety, this trend is expected to drive deeper engagement and higher order frequency across the platform landscape.

Key Market Players

- Blink Commerce Private Limited

- Swiggy Limited

- Zepto Marketplace Private Limited

- bigbasket.com (Supermarket Grocery Supplies Pvt Ltd)

- Amazon Fresh

- Flipkart Minutes

- JioMart (Reliance Retail Ltd.)

- Milkbasket

- Nature's Basket

- Licious (Delightful Gourmet Pvt Ltd.)

Report Scope:

In this report, the India Quick Commerce Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Quick Commerce Market, By Product Type:

- Grocery and Staples

- Fresh Produce and Dairy

- Others

India Quick Commerce Market, By Delivery Time:

- Less than 10 Minutes

- 11-30 Minutes

- 31-60 Minutes

India Quick Commerce Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Quick Commerce Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Blink Commerce Private Limited

- Swiggy Limited

- Zepto Marketplace Private Limited

- bigbasket.com (Supermarket Grocery Supplies Pvt Ltd)

- Amazon' Fresh

- Flipkart Minutes

- JioMart (Reliance Retail Ltd.)

- Milkbasket

- Nature's Basket

- Licious (Delightful Gourmet Pvt Ltd.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | July 2025 |

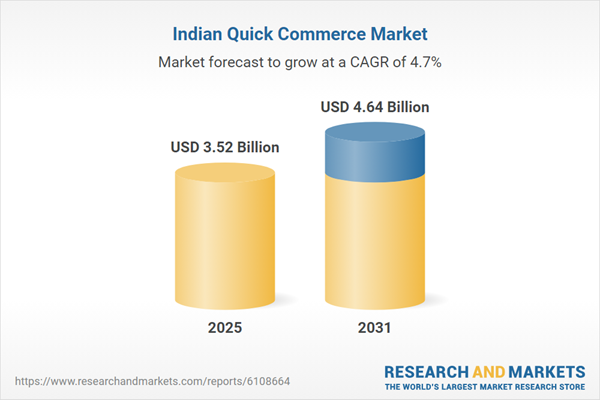

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.52 Billion |

| Forecasted Market Value ( USD | $ 4.64 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |