Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Birth Rates and Growing Infant Population

The steady increase in India’s birth rate is a key driver of the diaper market. India continues to rank among the countries with the highest birth rates globally, which sustains demand for baby care products such as diapers. In 2024, the birth rate stood at 16.75 - up 3.74% from the previous year - resulting in a larger consumer base for baby diapers. Families, especially in urban and semi-urban areas, are becoming more reliant on disposable diapers due to time constraints and changing work patterns. As both parents in nuclear families increasingly participate in the workforce, the convenience of diapers helps reduce the time and effort involved in traditional cloth washing. This shift in parenting behavior, coupled with a large and growing infant population, continues to provide a strong foundation for diaper market expansion across India.Key Market Challenges

Environmental Concerns and Waste Management Issues

A key challenge facing the India diaper market is the environmental impact of disposable diapers. These products are typically made from non-biodegradable materials like plastics, synthetic fibers, and absorbent gels, contributing significantly to landfill waste. With millions of diapers discarded daily, the strain on India's already limited waste management infrastructure is increasing. Concerns about environmental degradation are influencing consumer preferences, especially among eco-conscious buyers. The lack of effective large-scale recycling or composting options adds to the challenge. While biodegradable alternatives exist, their higher price points hinder mass adoption. Additionally, future regulatory action around plastic usage or landfill restrictions could create further obstacles for manufacturers, making it imperative for companies to explore more sustainable and scalable waste management solutions for continued market growth.Key Market Trends

Shift Towards Eco-Friendly and Biodegradable Diapers

An emerging trend in the India diaper market is the growing demand for environmentally sustainable diaper products. As consumer awareness around plastic waste and sustainability increases, many parents are actively seeking alternatives to conventional disposable diapers. In response, several companies are launching biodegradable options made from bamboo fibers, plant-based polymers, and other eco-friendly materials.These products are marketed as skin-safe and environmentally responsible, appealing to a segment of urban consumers prioritizing sustainability. According to the 2024 Voice of the Consumer Survey, Indian consumers are willing to pay a 9.7% premium for sustainably sourced products, reflecting a shift in purchasing behavior. The trend is further supported by eco-parenting communities, digital influencers, and government advocacy of green products. Although pricing remains a barrier, demand for biodegradable diapers is growing among middle- and upper-income households, indicating a shift in market preferences toward sustainable hygiene solutions.

Key Market Players

- The Procter & Gamble Company

- Unicharm India Pvt. Ltd

- Kimberly-Clark India Pvt. Ltd

- Nobel Hygiene Pvt. Ltd.

- Pan Healthcare Pvt. Ltd. (PHPL)

- Swara Baby Products Pvt. Ltd.

- Millennium Baby Care Pvt. Ltd.

- Uniclan Healthcare Pvt. Ltd.

- Luzon Healthcare LLP

- RGI Meditech Pvt. Ltd.

Report Scope:

In this report, the India Diaper Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Diaper Market, By Product Type:

- Baby Diapers

- Adult Diapers

India Diaper Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Pharmacy/Drug Stores

- Online

- Others

India Diaper Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Diaper Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- The Procter & Gamble Company

- Unicharm India Pvt. Ltd

- Kimberly-Clark India Pvt. Ltd

- Nobel Hygiene Pvt. Ltd.

- Pan Healthcare Pvt. Ltd. (PHPL)

- Swara Baby Products Pvt. Ltd.

- Millennium Baby Care Pvt. Ltd.

- Uniclan Healthcare Pvt. Ltd.

- Luzon Healthcare LLP

- RGI Meditech Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | July 2025 |

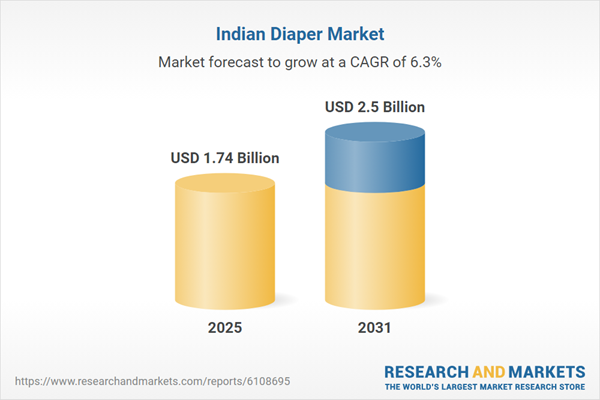

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.74 Billion |

| Forecasted Market Value ( USD | $ 2.5 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |