Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growth in Processed and Packaged Food Consumption

The surge in processed and packaged food consumption is a major factor propelling the India Food Additives Market. Urbanization, rising numbers of dual-income households, and busier lifestyles are prompting a preference for convenient food formats such as ready-to-eat and ready-to-cook options. Food additives play a crucial role in enhancing shelf life, maintaining taste and texture, and preserving nutritional quality.Younger consumers in particular are demanding food that balances convenience with flavor and quality, further driving the use of additives like emulsifiers, stabilizers, preservatives, and flavoring agents. The growing availability of processed foods through modern retail formats and e-commerce platforms has extended reach beyond metro cities into semi-urban markets. In addition, the Indian ready-to-eat food segment is expected to exceed USD 1 billion by 2025, reinforcing the strong outlook for food additive demand in the evolving processed food landscape.

Key Market Challenges

Lack of Technological Infrastructure

The India Food Additives Market faces challenges due to inadequate technological infrastructure, particularly among small and medium-sized enterprises (SMEs). Many such firms continue to use outdated equipment and lack automation, restricting their ability to develop and produce advanced food additives that meet modern consumer and regulatory expectations.High-end food additive production often requires technologies like spray drying, precision blending, microencapsulation, and stringent quality control systems - investments that are financially and technically demanding. Limited access to skilled personnel and capital further compounds these constraints, affecting consistency, innovation, and product safety. This technological gap creates barriers to competitiveness, particularly in export markets and among health-conscious consumer segments.

Key Market Trends

Functional and Health-Focused Additives

Functional and health-oriented additives are gaining prominence in the India Food Additives Market, as consumers increasingly seek products that support wellness, immunity, and nutrition. Ingredients such as probiotics, prebiotics, antioxidants, omega-3 fatty acids, plant sterols, and dietary fibers are being incorporated into everyday food and beverage products, offering added health benefits like improved digestion, heart health, and weight management. In parallel, urbanization and rising health awareness are fueling demand for fortified foods, particularly in combating micronutrient deficiencies. Staples like milk, edible oil, and flour are being enriched with vitamins and minerals such as iron, calcium, vitamin D, and B12. This dual influence of consumer demand and public health policy is shaping a more health-centric food ecosystem supported by advanced additive formulations.Key Market Players

- Kerry Ingredients India Private Limited

- DDS-TPM Flavors Pvt. Ltd.

- Firmenich Aromatics India Pvt. Ltd.

- Mane India Pvt. Ltd.

- Symrise Private Limited

- Flavors & Fragrances India Pvt. Ltd.

- Estelle Chemicals Pvt. Ltd.

- Merisant Company

- Herboveda India Pvt. Ltd.

- ADM Agro Industries India Pvt. Ltd.

Report Scope:

In this report, the India Food Additives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Food Additives Market, By Type:

- Preservatives

- Sweeteners

- Sugar Substitutes

- Emulsifier

- Anti-Caking Agents

- Enzymes

- Hydrocolloids

- Food Flavors and Enhancers

- Food Colorants

- Acidulants

India Food Additives Market, By Application:

- Dairy & Frozen

- Bakery

- Meat & Sea Food

- Beverages

- Confectionery

- Other Applications

India Food Additives Market, By Region:

- North India

- East India

- West India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Food Additives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kerry Ingredients India Private Limited

- DDS-TPM Flavors Pvt. Ltd.

- Firmenich Aromatics India Pvt. Ltd.

- Mane India Pvt. Ltd.

- Symrise Private Limited

- Flavors & Fragrances India Pvt. Ltd.

- Estelle Chemicals Pvt. Ltd.

- Merisant Company

- Herboveda India Pvt. Ltd.

- ADM Agro Industries India Pvt. Ltd.

Table Information

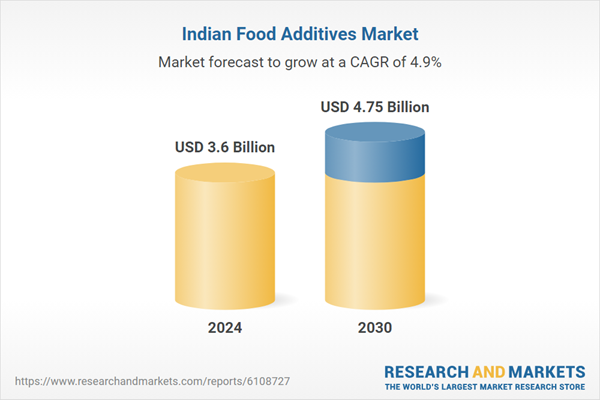

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 4.75 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |