Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

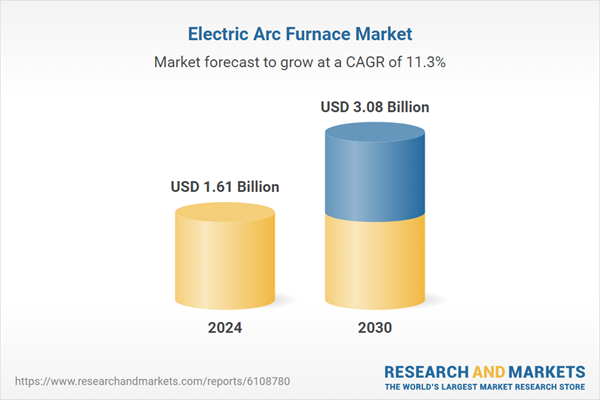

EAFs are increasingly adopted in the steelmaking industry due to their efficiency in recycling scrap steel and producing high-quality specialty steels and alloys. They offer a more sustainable and energy-efficient alternative to traditional blast furnaces and are available in various configurations, including AC, DC, and UHP variants, tailored to diverse production requirements. The market is gaining momentum as global steel demand rises, scrap metal availability improves, and industries intensify their efforts to decarbonize production processes.

Key Market Drivers

Rising Demand for Scrap-Based Steel Production to Drive Electric Arc Furnace Adoption

The shift toward environmentally conscious steel manufacturing is significantly boosting the adoption of electric arc furnaces. EAFs use recycled scrap steel as their primary raw material, which aligns with global goals to reduce carbon emissions and implement circular economy models. Urbanization, industrial demolition, and the recycling of end-of-life vehicles are increasing scrap steel availability, enhancing the feasibility of EAF operations. EAFs emit considerably fewer greenhouse gases than traditional blast furnaces, making them a preferred choice for low-carbon steelmaking. Their flexibility in handling different scrap grades and ability to deliver high-quality steel with reduced energy usage supports their growing adoption among manufacturers looking to reduce operational costs while meeting environmental targets.Key Market Challenges

High Energy Consumption and Volatility in Electricity Prices

A key challenge facing the Electric Arc Furnace Market is the high and often unpredictable cost of electricity, which is the primary energy source for EAFs. Unlike blast furnaces that rely on coke, EAFs require large amounts of power to melt scrap or DRI (Direct Reduced Iron). Fluctuations in electricity pricing - caused by regulatory shifts, energy supply instability, and grid limitations - directly impact production costs and profit margins. In regions with underdeveloped power infrastructure or expensive energy tariffs, operational planning becomes complex, with peak-hour surcharges further inflating costs per ton of steel produced. This pricing volatility makes long-term forecasting difficult and challenges EAF operators to balance cost-efficiency with production reliability.Key Market Trends

Shift Toward Sustainable Steel Production Driving Demand for Electric Arc Furnaces

The global movement toward sustainable manufacturing is accelerating the adoption of electric arc furnaces as a cleaner alternative to carbon-intensive blast furnaces. EAFs, which primarily use electricity and recycled steel, produce significantly less CO₂, making them well-suited for companies aiming to meet tightening environmental regulations. The rising implementation of carbon taxes and emissions trading schemes in developed economies is making blast furnace operations more expensive, further supporting the shift to EAFs.Steel producers are increasingly aligning with ESG goals, integrating low-carbon technologies, and investing in EAF facilities powered by renewable energy sources like wind, solar, or hydro. Government incentives for green steel production and funding support for low-emission technologies are reinforcing this trend. As green construction, auto manufacturing, and infrastructure projects demand sustainable inputs, EAFs are becoming the preferred option for steelmakers seeking long-term environmental and economic viability.

Key Market Players

- Danieli & C. Officine Meccaniche S.p.A.

- Primetals Technologies Limited

- SMS group GmbH

- Tenova S.p.A.

- Electrotherm (India) Ltd.

- Steel Plantech Co., Ltd.

- Inductotherm Corp.

- IHI Corporation

- Lindarc Systems Ltd.

- Doshi Technologies Pvt. Ltd.

Report Scope:

In this report, the Global Electric Arc Furnace Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Electric Arc Furnace Market, By Type:

- DC Arc Furnace

- AC Arc Furnace

Electric Arc Furnace Market, By Capacity:

- Up to 100 Tons

- 100-300 Tons

- Above 300 Tons

Electric Arc Furnace Market, By Application:

- Ferrous Metals

- Non-Ferrous Metals

Electric Arc Furnace Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electric Arc Furnace Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Danieli & C. Officine Meccaniche S.p.A.

- Primetals Technologies Limited

- SMS group GmbH

- Tenova S.p.A.

- Electrotherm (India) Ltd.

- Steel Plantech Co., Ltd.

- Inductotherm Corp.

- IHI Corporation

- Lindarc Systems Ltd.

- Doshi Technologies Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.61 Billion |

| Forecasted Market Value ( USD | $ 3.08 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |