Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Emerging economies across Latin America, Sub-Saharan Africa, and Southeast Asia are prominent regions for implementing forestry-based initiatives, particularly REDD+ projects aimed at forest conservation and community development. Meanwhile, industrialized nations like those in Europe and North America dominate as primary purchasers of these credits to meet voluntary climate targets or compliance obligations. The market is further supported by the rise of robust verification frameworks such as Verra, Gold Standard, and Plan Vivo, which have enhanced transparency, credibility, and stakeholder confidence. As more governments integrate forestry credits into regulatory frameworks and as corporate climate pledges proliferate, the demand for high-integrity, nature-based carbon offsets is expected to rise steadily.

Key Market Drivers

Corporate Net-Zero Commitments and Sustainability Targets

The increasing number of corporate net-zero pledges is a significant driver of growth in the Forestry and Land Use Carbon Credit Market. A growing share of Fortune 500 companies now allocate a portion of their sustainability budgets to nature-based offsets, with many planning to expand their offset purchases in the coming years. Large corporations are incorporating forestry credits into their carbon strategies, with annual average procurement volumes reaching hundreds of thousands of tons of CO₂e - and in some cases, surpassing two million tons. This surge reflects strong momentum within voluntary carbon markets, where demand for credible, environmentally beneficial offsets is escalating alongside broader ESG commitments.Key Market Challenges

Lack of Standardization and Fragmented Verification Practices

A major challenge in the market is the lack of harmonized standards and verification practices across jurisdictions and frameworks. Although platforms such as Verra and Gold Standard provide structured methodologies, inconsistencies remain in how credits are issued, validated, and tracked. These discrepancies lead to buyer uncertainty and complicate cross-border trading and project comparability. Variations in quality, monitoring procedures, and registry compatibility further inhibit investor confidence, often requiring lengthy due diligence and increasing transaction costs. Without unified global standards, the scalability and long-term trust in forestry and land use carbon credits remain constrained.Key Market Trends

Shift Toward High-Integrity and Co-Benefit-Certified Projects

The market is evolving toward a clear preference for credits that deliver verified carbon reductions alongside social and environmental co-benefits. Buyers are increasingly seeking projects certified under robust standards like Verra’s Climate, Community & Biodiversity (CCB) and the Gold Standard, which emphasize transparency, biodiversity protection, community involvement, and sustainable development. This trend is giving rise to a premium segment within the market, where credits that align with ESG principles and contribute to multiple UN Sustainable Development Goals command higher prices. Project developers are adapting accordingly, embedding elements like indigenous rights, gender inclusion, and habitat conservation into project design to meet rising buyer expectations and regulatory scrutiny.Key Market Players

- South Pole

- The Nature Conservancy

- Wildlife Works

- BioCarbon Partners

- InfiniteEARTH

- Verra

- Climate Focus

- Terra Global Capital

- Finite Carbon

- GreenCollar

Report Scope:

In this report, the Global Forestry and Land Use Carbon Credit Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Forestry and Land Use Carbon Credit Market, By Project Type:

- Afforestation

- Avoided Deforestation

- Agroforestry

- Soil Carbon Sequestration

- Others

Forestry and Land Use Carbon Credit Market, By Credit Type:

- Verified Carbon Units

- Certified Emission Reductions

- Gold Standard Credits

- Others

Forestry and Land Use Carbon Credit Market, By End-User:

- Energy & Utilities

- Manufacturing

- Transport & Logistics

- Agriculture

- Others

Forestry and Land Use Carbon Credit Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Forestry and Land Use Carbon Credit Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- South Pole

- The Nature Conservancy

- Wildlife Works

- BioCarbon Partners

- InfiniteEARTH

- Verra

- Climate Focus

- Terra Global Capital

- Finite Carbon

- GreenCollar

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

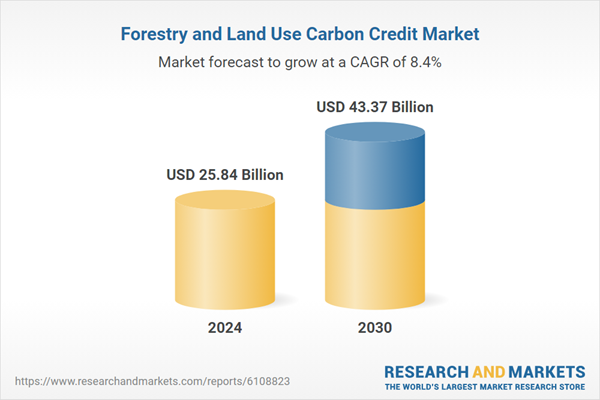

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.84 Billion |

| Forecasted Market Value ( USD | $ 43.37 Billion |

| Compound Annual Growth Rate | 8.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |