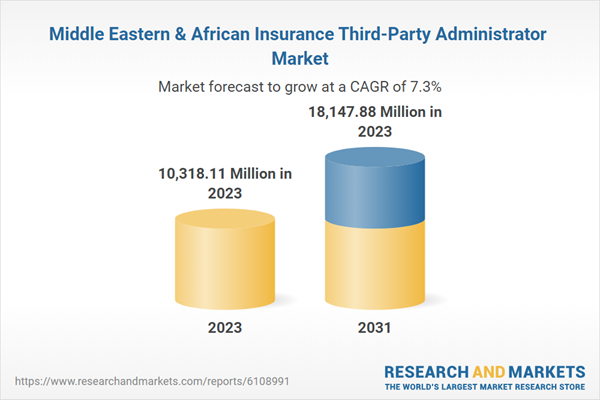

Digital Third-Party Administrators Bolster Middle East & Africa Insurance Third-Party Administrator Market

Digital third-party administrators are transforming the insurance third-party administrator business by harnessing the capabilities of AI and machine learning, which can allow the scanning of massive volumes of data to detect fraudulent claims and predict future hazards. The advanced data management capabilities lower costs for insurers and allow them to make more educated underwriting and risk management decisions. Digital third-party administrators provide self-service portals for policyholders to file claims, track their progress, and access policy papers. This promotes transparency and convenience, resulting in a more positive consumer experience. In October 2023, LIDP partnered with Sutherland, a global digital-first business process as a service (BPaaS) provider, to introduce innovative, comprehensive solutions. Digital tools and AI drive middle-office and back-office digitization customer experience (CX) and provide more precise insights into insurance carrier businesses. Their unique approach empowers carriers to fast-track life insurance and annuity product launches, enhance distribution, and improve customer experience. In September 2021, Xceedance (an insurance consultancy firm) introduced a new digital claims third-party administrator with enhanced and intelligent automation. The new solution offers full-service claims operation services to global insurers with the goal of closing claims faster and providing more visibility into claim handling and status. The new third-party administrator takes advantage of Xceedance's broad range of insurance, technical, and operational capabilities. Thus, the digital third-party administrator is setting a new trend in the insurance third-party administrator market.Middle East & Africa Insurance Third-Party Administrator Market Overview

The insurance companies in the country partner with top-class TPAs to deliver high-quality, consistent services and process related to voluminous health insurance claims. In September 2022, Dubai National Insurance (DNI), one of the leading insurance companies in the UAE, tied up with Al Madallah Healthcare Management, one of the fastest-growing TPA in the country, offering innovative medical claims management services. Through the agreement, Al Madallah administers DNI health insurance plans as a TPA, and the partnership reinforces both entities' commitment to providing superior customer service. Thus, focusing on serving the extensive customer base more effectively, the insurance companies approach TPAs, which fosters the UAE insurance third-party administrator market growth.Middle East & Africa Insurance Third-Party Administrator Market Segmentation

The Middle East & Africa insurance third-party administrator market is segmented based on insurance type, end users, and country. Based on insurance type, the Middle East & Africa insurance third-party administrator market is segmented into healthcare, retirement plans, commercial general liability insurers, and other insurance types. The healthcare segment held the largest market share in 2023.In terms of end users, the Middle East & Africa insurance third-party administrator market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2023.

Based on country, the Middle East & Africa insurance third-party administrator market is segmented into Saudi Arabia, the UAE, South Africa, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa insurance third-party administrator market share in 2023.

Crawford and Company; Charles Taylor Limited; ExlService Holdings, Inc; Arthur J Gallagher & Co; and Chubb Ltd are some of the leading players operating in the Middle East & Africa insurance third-party administrator market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa Insurance Third-Party Administrator Market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa Insurance Third-Party Administrator Market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa Insurance Third-Party Administrator Market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Middle East & Africa Insurance Third-Party Administrator Market include:- Crawford and Company

- Charles Taylor Limited

- ExlService Holdings, Inc

- Arthur J Gallagher & Co

- Chubb Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 93 |

| Published | April 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value in 2023 | 10318.11 Million in 2023 |

| Forecasted Market Value by 2031 | 18147.88 Million by 2031 |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 5 |